On March 19, Tencent Holdings (00700.HK) released its 2024 financial report, showing total annual revenue of RMB 660.3 billion and operating profit of RMB 237.8 billion, a 24% year-over-year increase, equivalent to a daily profit of RMB 650 million. Following the earnings release, pre-market trading on March 20 saw Tencent’s stock rise 1.48%. However, after the market opened, its share price failed to sustain gains and dropped nearly 4%, in line with the broader market downturn. At the same time, Hong Kong-listed tech stocks also experienced widespread declines. Despite the short-term pressure on its stock, multiple foreign investment banks raised their target prices for Tencent, with Goldman Sachs increasing its target to HKD 590, Morgan Stanley to HKD 630, and Citigroup to HKD 681.

The unexpected drop in Tencent’s stock price reflects both short-term financial concerns and market sentiment toward its strategic transition. Firstly, in Q4 2024, Tencent’s capital expenditures (CapEx) reached RMB 39 billion, marking four consecutive quarters of triple-digit year-over-year growth, making it one of the highest CapEx spenders among global tech firms. However, this aggressive investment led to a sharp drop in free cash flow (FCF) to RMB 4.5 billion, significantly below market expectations of RMB 40–50 billion. Investors are increasingly worried about Tencent’s high-spending approach to growth. Although management has stated that CapEx will be adjusted dynamically based on business needs, uncertainty remains over the long-term returns on its AI-related investments, which could suppress profitability in the short term.

Despite strong profit growth, Tencent’s revenue increased only 8% year-over-year, lower than some investors’ expectations. This has raised concerns about Tencent’s future growth trajectory, with some investors questioning whether its high valuation can be sustained amid slowing revenue expansion. In addition, on a broader scale, global tech stocks have been underperforming, dampening investor confidence. This external pressure contributed to the downtrend in Hong Kong’s tech sector, triggering a market-wide ripple effect.

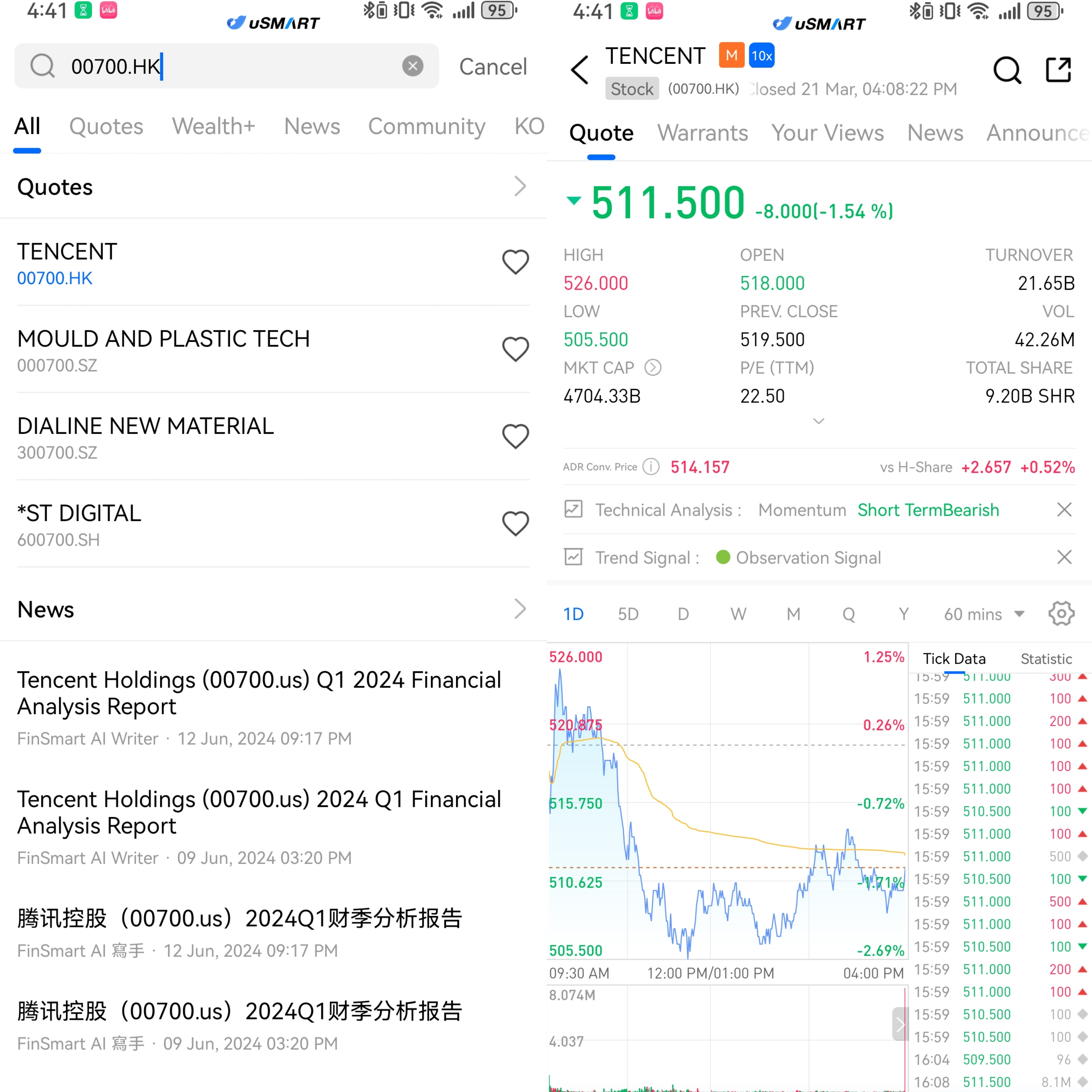

How to purchase Tencent on uSMART

First, log into the uSMART HK app and tap the 'Search' option in the top-right corner of the page. Enter the stock code, such as '00700.HK,' to access the detail page where you can view trading details and historical trends. Next, tap the 'Trade' button in the bottom-right corner and select the 'Buy/Sell' option. Finally, fill in your trading conditions and submit the order.

(Image source: uSMART HK)