2024年Q4拼多多財報發佈,營收遜於預期

uSMART盈立智投 03-21 17:33

2025年3月20日,拼多多(簡稱:PDD)公佈了截至2024年12月31日的第四季度及全年財報。數據顯示,第四季度總營收為1106.101億元,同比增長24%,不及預期的1,160.32億元。2024年全年,拼多多總營收達到3938.361億元,同比增長59%。第四季度營收增長主要得益於線上行銷服務和交易服務收入的增加。其中,線上行銷服務及其他服務的營收為570.111億元,同比增長17%;交易服務的營收為535.990億元,同比增長33%。

值得注意的是,拼多多季度增速有所放緩。此前四個季度,拼多多的營收同比增速分別為131%、86%、44%、24%。對此,有多方面的因素導致這一狀況。其一,拼多多一向偏好高毛利商業模式,即便在發展社區團購和Temu時,其毛利率仍保持在60%以上。下半年以來,Temu受地緣政治逆風影響,調整為部分半託管模式,加大海外倉儲供應鏈投入,並可能由淨額法改為佣金法,導致收入增速放緩、成本激增。

再者,拼多多推出了“百億減免”活動,返還部分佣金和廣告費用,以扶持商家。雖然這有助於優化平台生態,但也在短期內減少了公司的收入。並且還受到宏觀經濟環境影響,中國經濟增速放緩,消費者信心不足,導致整體消費需求疲軟,直接影響了電商平台的銷售表現。第四季度是傳統的電商旺季,拼多多面臨來自阿里巴巴和京東等競爭對手的激烈競爭。在這些競爭對手在財報中均表現出色的狀況下,拼多多面臨著更大的市場壓力。

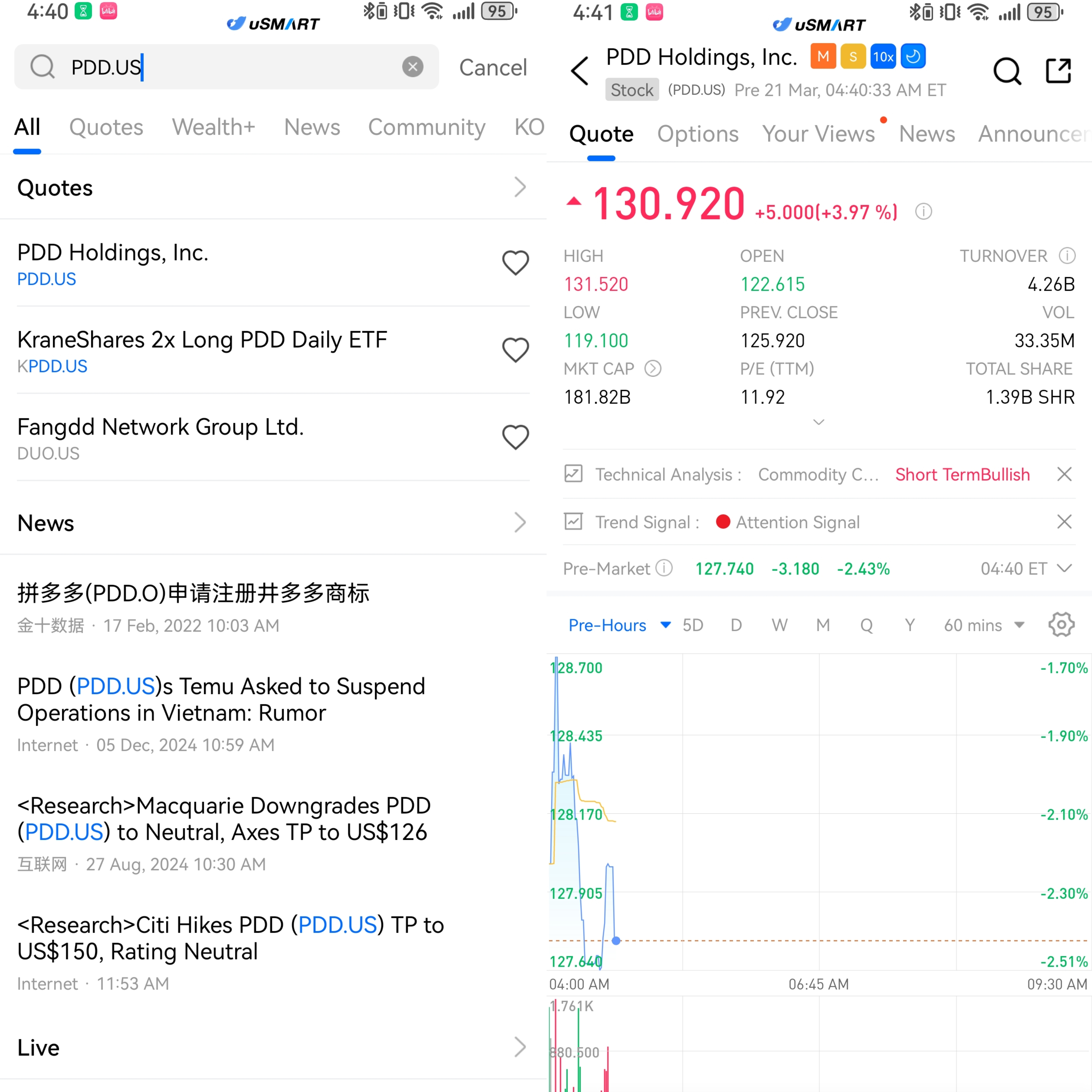

如何在uSMART上購買拼多多

登入uSMART HK APP之後,從頁面最右上方點擊選擇「搜索」,輸入標的代碼,如「PDD.US」,可進入詳情頁瞭解交易詳情和歷史走勢,點擊右下角「交易」,選擇「買入/賣出」功能,最後填寫交易條件後送出訂單即可。

(圖源:uSMART HK)

關注uSMART

在 Facebook, Twitter ,Instagram 和 YouTube 追蹤我們,查閱更多實時財經市場資訊。想和全球志同道合的人交流和發現投資的樂趣?加入 uSMART投資群 並分享您的獨特觀點!立刻掃碼下載uSMART APP!

重要提示及免責聲明

盈立證券有限公司(「盈立」)在撰冩這篇文章時是基於盈立的內部研究和公開第三方信息來源。儘管盈立在準備這篇文章時已經盡力確保內容為準確,但盈立不保證文章信息的準確性、及時性或完整性,並對本文中的任何觀點不承擔責任。觀點、預測和估計反映了盈立在文章發佈日期的評估,並可能發生變化。盈立無義務通知您或任何人有關任何此類變化。您必須對本文中涉及的任何事項做出獨立分析及判斷。盈立及盈立的董事、高級人員、僱員或代理人將不對任何人因依賴本文中的任何陳述或文章內容中的任何遺漏而遭受的任何損失或損害承擔責任。文章內容只供參考,並不構成任何證券、虛擬資產、金融產品或工具的要約、招攬、建議、意見或保證。監管機構可能會限制與虛擬資產相關的交易所買賣基金僅限符合特定資格要求的投資者進行交易。文章內容當中任何計算部分/圖片僅作舉例說明用途。

投資涉及風險,證券的價值和收益可能會上升或下降。往績數字並非預測未來表現的指標。請審慎考慮個人風險承受能力,如有需要請諮詢獨立專業意見。