On July 16, Federal Reserve Chairman Jerome Powell said that the Fed may not be able to wait until inflation reaches 2% before cutting interest rates; As it stands, Fed officials are hoping for more evidence that inflation is falling and more good data, which the Fed has been getting lately, to boost confidence.

precious metals getting better

Gold prices as a whole continued to rise, spot gold last night to hit $2,439 / ounce, a new high since May 21. Regarding the strong performance of the precious metals market, the market generally believes that with the slowdown of inflation data beyond expectations, combined with the recent dovish speech of the Federal Reserve Chairman, the expectation of interest rate cut in September is further heated, and the price of precious metals such as gold is expected to continue to rise.

(Credit: uSMART)

Bank of America strategists said in a note to clients on Monday that "right now is a good time for the market to rotate toward rate-sensitive cyclical stocks." Inflation is contained, which means the Fed can focus solely on growth, the market expects rate cuts, and companies outside the Big Seven are emerging from an earnings recession. Bank of America focuses on cyclical sectors such as industrials, autos, energy, metals and banks.

Citic Construction Investment Research pointed out that precious metals and non-ferrous commodities with limited supply performed brilliantly in the first half of the year, mainly reflecting three core logic:

Dollar currency overissuance, credit reconstruction: the US interest rate cut cycle is about to open, global geopolitical tensions.Supply constraints: dual-carbon related policy constraints, resource protectionism, and insufficient capital expenditure lead to rigid supply constraints.Demand explosion: The fourth industrial revolution has led to an increase in demand for related metals, especially small metals, and related small metals are ushering in a highlight moment.

Looking ahead to the second half of the year, although the recent weakening of US data has led to market concerns about a recession in trading, even if the weakening of the US economy has limited impact on the direction of global new quality productivity, the above three core logic has not changed, and the long-term trend of precious metals and non-ferrous commodities is still bullish.

Precious metal concept stocks:

Zijin Mining (02899.HK) operates about 30 major mining projects and a number of world-class incremental projects worldwide, with copper resources of 62.77 million tons, gold resources of 233 tons, zinc resources of 9.62 million tons, lithium carbonate equivalent of 7.63 million tons.

On July 16, as of press, Zijin Mining (02899.HK) rose 0.9%.

Chifeng Gold (600988.HK) has gold resources of 5.25 million tons of ore and 43 tons of metal in domestic gold mining enterprises; Overseas Saipan gold copper mine in Laos and Vasa gold mine in Ghana have gold resources of 106.66 million tons of ore and 381.3 million tons of metal.

On July 16, as of press, Chifeng Gold (600988.HK) rose 0.87%.

Lingbao Gold (03330.HK) mine resources are located in Henan, Xinjiang, Jiangxi, Inner Mongolia, Gansu and Kyrgyz Republic of China, It has 35 mining and exploration rights with a total exploration and production area of 216.51 square kilometers and a total gold reserve resource of approximately 137.40 tons (approximately 4,417,346 ounces) as of December 31, 2023.

On July 16, as of press, Lingbao Gold (03330.HK) rose 1.15%.

Zhaojin Mining (01818.HK) The gold mining industry has formed a complete industrial system integrating exploration, mining, cyanide and smelting. At present, the company has more than 1200 tons of gold reserves; The mining scale is 23,000 tons/day, the smelting scale is 3000 tons/day, and the refining scale is 200 tons/year.

On July 16, as of press, Zhaojin Mining (01818.HK) rose 3.94%.

Shandong Gold (01787.HK) currently owns 189 exploration rights and 166 mining rights with a total area of more than 2,997 square kilometers. It has 2,860 tons of gold reserves, silver, copper, lead, zinc, molybdenum and other mineral resources, of which 9,966 tons of silver, about 190,000 tons of copper, 4.24 million tons of lead and zinc, 780,000 tons of molybdenum, 30.23 million tons of iron ore, and the total value of all kinds of mineral resources exceeds one trillion yuan.

On July 16, as of press, Shandong Gold (01787.HK) rose 4.61%

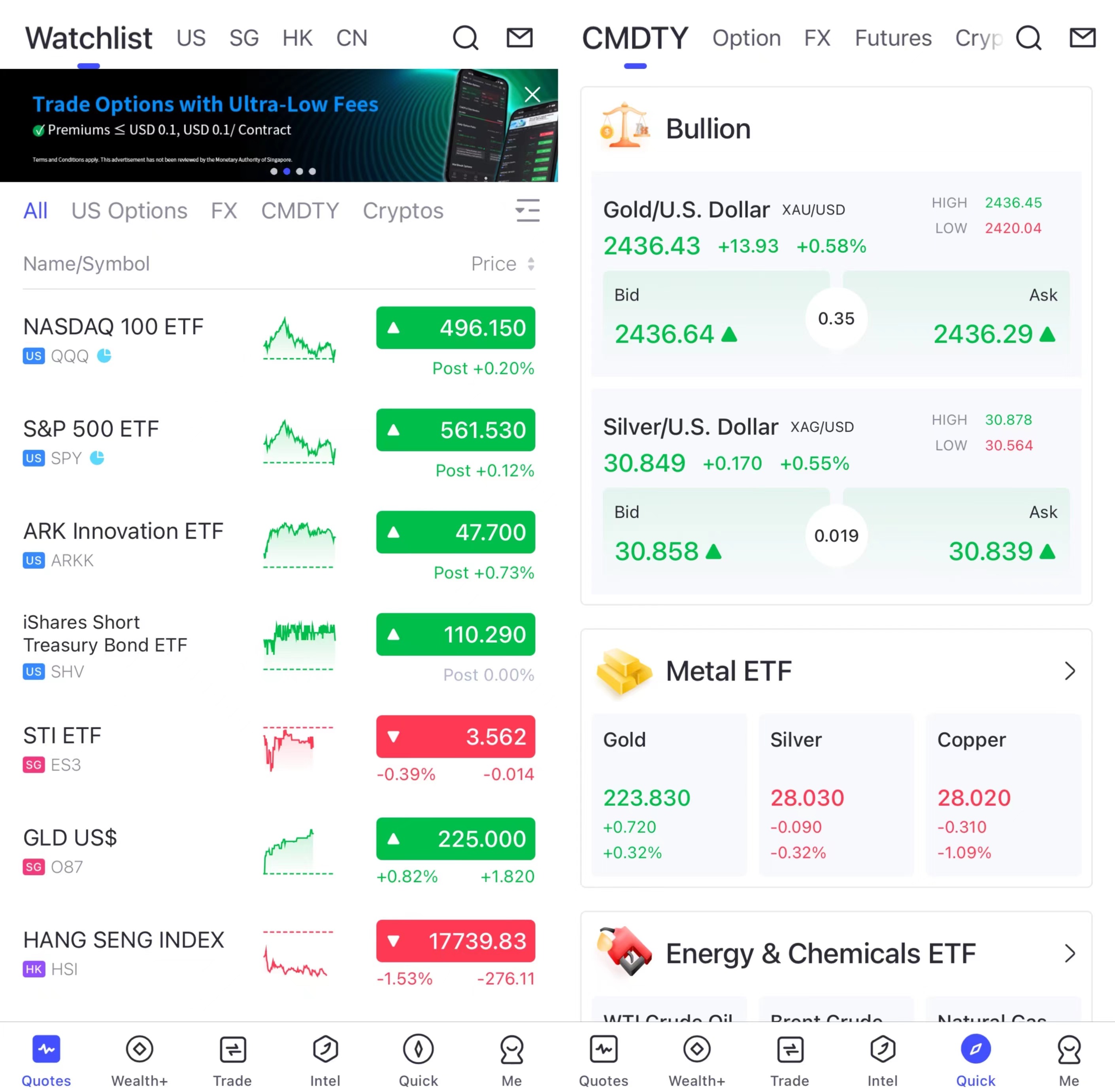

How to buy gold ETF on the uSMART APP?

- After opening the APP, select the [Quotes] page in the lower left corner

- Select [Watchlist] at the top of the page, then select [Commodities] below the image, and click [Gold/U.S] to trad