Cinda Securities Macro team

The January-February economic data were so strong that they were overwhelmingly higher than expected. This is in line with our forecast of 6 per cent GDP growth in the first quarter, but many people's first reaction is not to believe or even doubt whether the data will match. We put forward four understandings about this economic data.

Core point of view

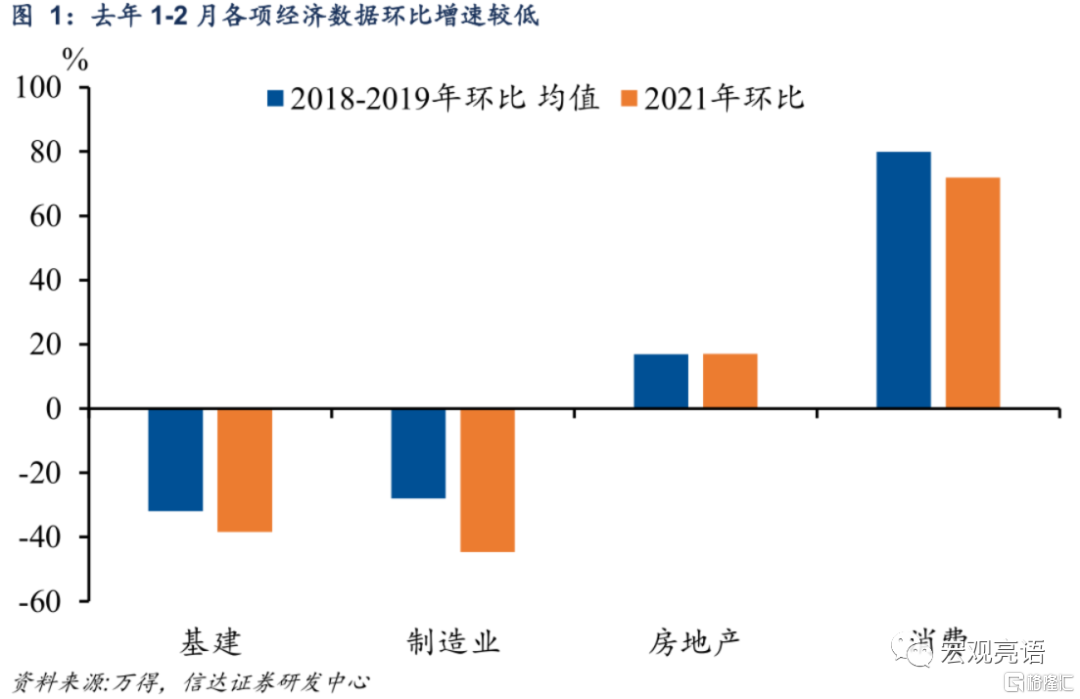

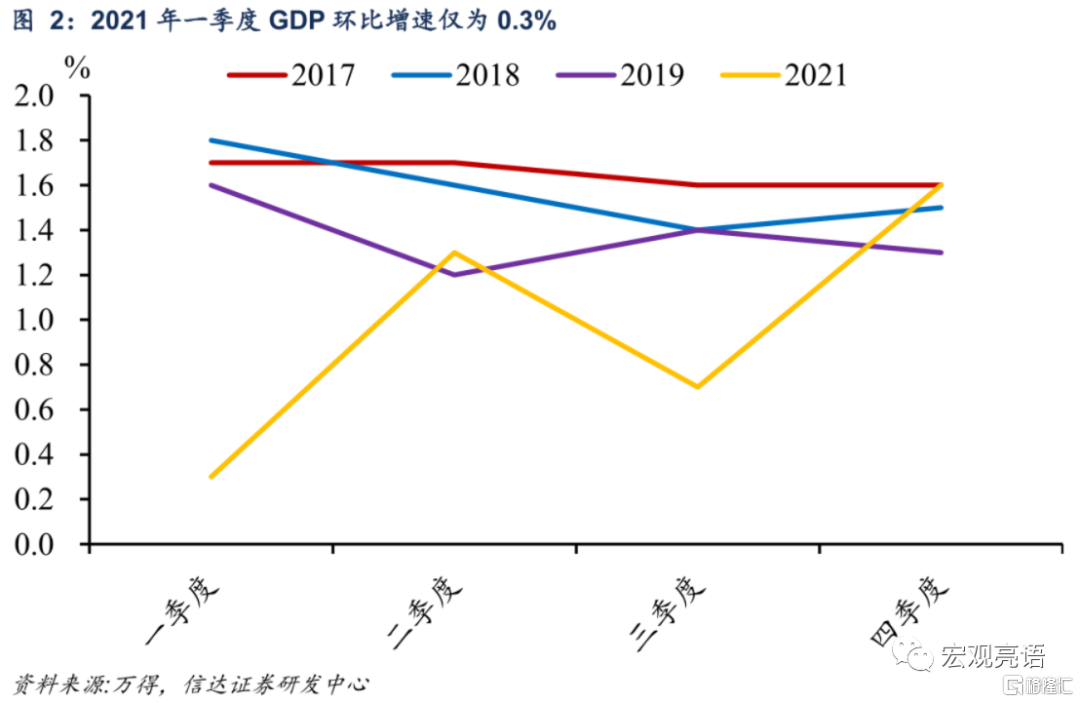

First, it was a low base, not a high base, in the first quarter of last year. Although the year-on-year growth rate of all data in 2021 is high, the month-on-month growth rate is low, so the first quarter is from a low base rather than a high base. We calculate the month-on-month changes of the data from January to February of the previous year compared with December of the previous year, and we can find that the growth rates of infrastructure, manufacturing and consumption in 2021 are all lower than the historical average. It is more intuitive to observe the month-on-month growth rate of GDP. The month-on-month growth rate of GDP in the first quarter of 2021 was only 0.3%, which is much lower than that of other years. Therefore, in the first quarter of last year, it was a low base rather than a high base, and the base effect supported the high growth of economic data to some extent.

Second, on the basis of a low base, the policy relies on the front, and the economy can be repaired vividly, resulting in a number of data that greatly exceed expectations. The current period of manufacturing investment, infrastructure investment and consumption performance is strong. (1) Investment in the manufacturing sector continues the strong trend since the beginning of last year, especially in the high-tech manufacturing sector. This year's government work report proposes to "increase incentives for enterprise innovation," specifically pointing out "increasing the implementation of the policy of R & D expenses plus deduction" and implementing a tax rebate of about 1.5 trillion yuan. The above measures provide large-scale financial support to enterprise innovation and help manufacturing enterprises to increase investment in technological transformation and purchase of new equipment. (2) Infrastructure investment rebounded as scheduled. Since September 2021, the policy has frequently emphasized that infrastructure investment is "moderately ahead" and "strive to create more physical workload in the first quarter". The growth rate of infrastructure from January to February was 8.1% compared with the same period last year, initially reflecting the effect of "steady growth" of infrastructure. (3) the prevention and control of the domestic epidemic situation is more accurate, the travel restrictions of residents are relaxed during the Spring Festival, and the Spring Festival holiday consumption is released.

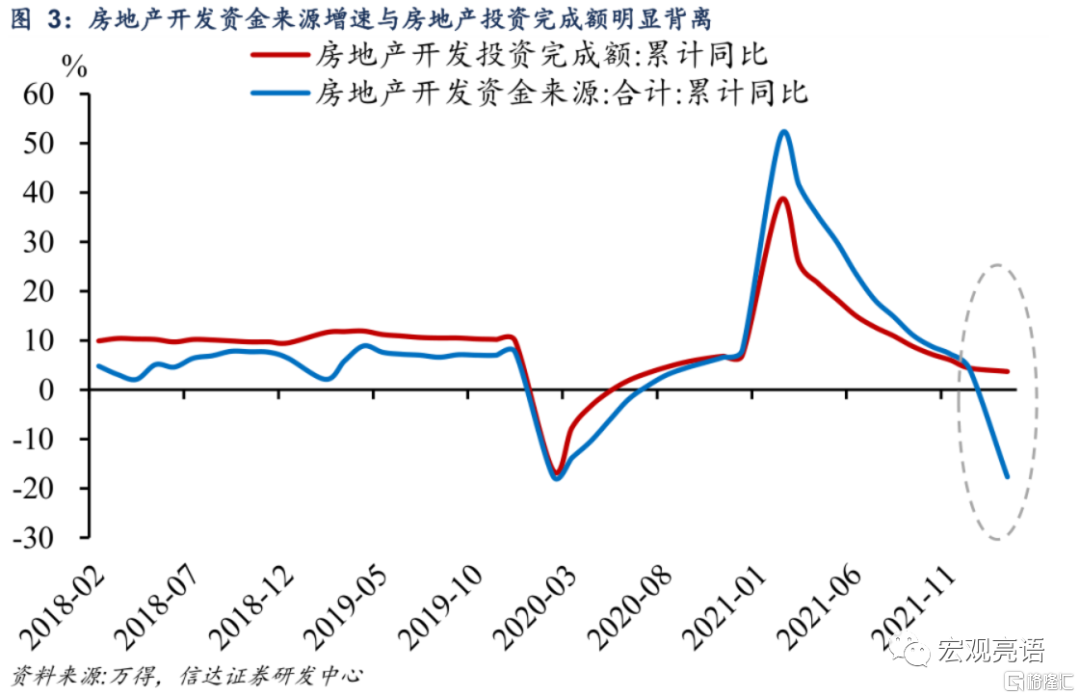

Third, the higher-than-expected rebound in real estate has attracted the attention of the market. We believe that there are two reasons why real estate investment can maintain positive growth. First, there has been an increase in the resumption of projects that have been suspended and delayed in the early stage. The construction area in this period increased by 1.8% compared with the same period last year. As the construction investment in real estate investment is closely related to the construction area, the positive growth of construction area can correspond to real estate investment. However, considering that the area of new construction and completed construction fell by 12.2% and 9.6% respectively, we speculate that under the influence of the gradual relaxation of real estate policy, especially the acceleration of mergers and acquisitions of real estate enterprises, and the standardized adjustment of the supervision system for the pre-sale of commercial housing, there has been an increase in the resumption of pre-construction projects by housing enterprises. Second, the real estate investment is the current price data, including the price impact, in the case of high PPI, the rising price of building materials supports the growth of real estate investment.

We maintain our judgment that the economy grew by 6% in the first quarter. In our annual outlook for "social finance rebound, infrastructure recovery and bimodal growth", we have pointed out that in terms of quarterly rhythm, economic growth may show a bimodal pattern in 2022; it is expected that there will be bimodal growth in the first and third quarters of 2022, driven by a low base and forward policies, the growth rate in the first quarter is expected to reach 6%. The economy got off to a good start from January to February, in line with our expectations.

Risk factors: vaccine failure caused by epidemic variation, domestic policy exceeding expectations, etc.

Text

First, why is the economic door so popular?

First, it was a low base, not a high base, in the first quarter of last year. The higher year-on-year growth rate of each data is related to the low base, although the year-on-year growth rate of each data in 2021 is very high, but the month-on-month growth rate is low, so the first quarter is from a low base rather than a high base. We calculate the month-on-month changes of the data from January to February of the previous year compared with December of the previous year, and we can find that the growth rates of infrastructure, manufacturing and consumption in 2021 are all lower than the historical average. It is more intuitive to observe the month-on-month growth rate of GDP. The month-on-month growth rate of GDP in the first quarter of 2021 was only 0.3%, which is much lower than that of other years. Therefore, in the first quarter of last year, it was a low base rather than a high base, and the base effect supported the high growth of economic data to some extent.

Second, on the basis of a low base, the policy relies on the front, and the economy can be repaired vividly, resulting in a number of data that greatly exceed expectations. The current period of manufacturing investment, infrastructure investment and consumption performance is strong. (1) Investment in the manufacturing industry continued the strong trend since the beginning of last year, with a growth rate of more than 20% from January to February, especially in the high-tech manufacturing sector. This year's government work report proposes to "increase incentives for enterprise innovation", particularly pointing out that "we will increase the implementation of the policy of addition and deduction for R & D expenses, and increase the proportion of addition and deduction for technology-based small and medium-sized enterprises from 75% to 100%." In addition, the government work report clearly states that it is estimated that the tax rebate for the whole year will be reduced by 2.5 trillion yuan, of which the tax rebate will be about 1.5 trillion yuan, and all the tax rebate funds will go directly to enterprises. The above measures provide large-scale financial support to enterprise innovation and help manufacturing enterprises to increase investment in technological transformation and purchase of new equipment. The high-tech manufacturing industry grew by 42.7% from January to February. (2) Infrastructure investment rebounded as scheduled. Since September 2021, the policy has frequently emphasized that infrastructure investment is "moderately ahead" and "strive to create more physical workload in the first quarter". The growth rate of infrastructure from January to February was 8.1% compared with the same period last year, initially reflecting the effect of "steady growth" of infrastructure. (3) the prevention and control of the domestic epidemic situation is more accurate, the travel restrictions of residents are relaxed during the Spring Festival, and the Spring Festival holiday consumption is released.

Third, the higher-than-expected rebound in real estate has attracted the attention of the market. From January to February, the growth rate of real estate investment recorded 3.7%, and the area of commercial housing sales decreased by 9.6% compared with the same period last year, both better than the market expected. We believe that there are two reasons why real estate investment can maintain positive growth. First, there has been an increase in the resumption of projects that have been suspended and delayed in the early stage. The construction area in this period increased by 1.8% compared with the same period last year. As the construction investment in real estate investment is closely related to the construction area, the positive growth of construction area can correspond to real estate investment. However, considering that the area of new construction and completed construction fell by 12.2% and 9.6% respectively, we speculate that under the influence of the gradual relaxation of real estate policy, especially the acceleration of mergers and acquisitions of real estate enterprises, and the standardized adjustment of the supervision system for the pre-sale of commercial housing, there has been an increase in the resumption of pre-construction projects by housing enterprises. Second, the price contributes a lot. Real estate investment is the current price data, including price impact, in the case of high PPI, the rising price of building materials supports the growth of real estate investment. But at the same time, we should also see that there is an obvious deviation between the growth rate of real estate development funds and the completion of real estate investment from January to February, indicating that the financial pressure of real estate enterprises is still large. From this point of view, the real estate regulation and control policy needs to be further relaxed.

We maintain our judgment that the economy grew by 6% in the first quarter. In our annual outlook for "social finance rebound, infrastructure recovery and bimodal growth", we have pointed out that in terms of quarterly rhythm, economic growth may show a bimodal pattern in 2022; it is expected that there will be bimodal growth in the first and third quarters of 2022, driven by a low base and forward policies, the growth rate in the first quarter is expected to reach 6%. The economy got off to a good start from January to February, in line with our expectations.

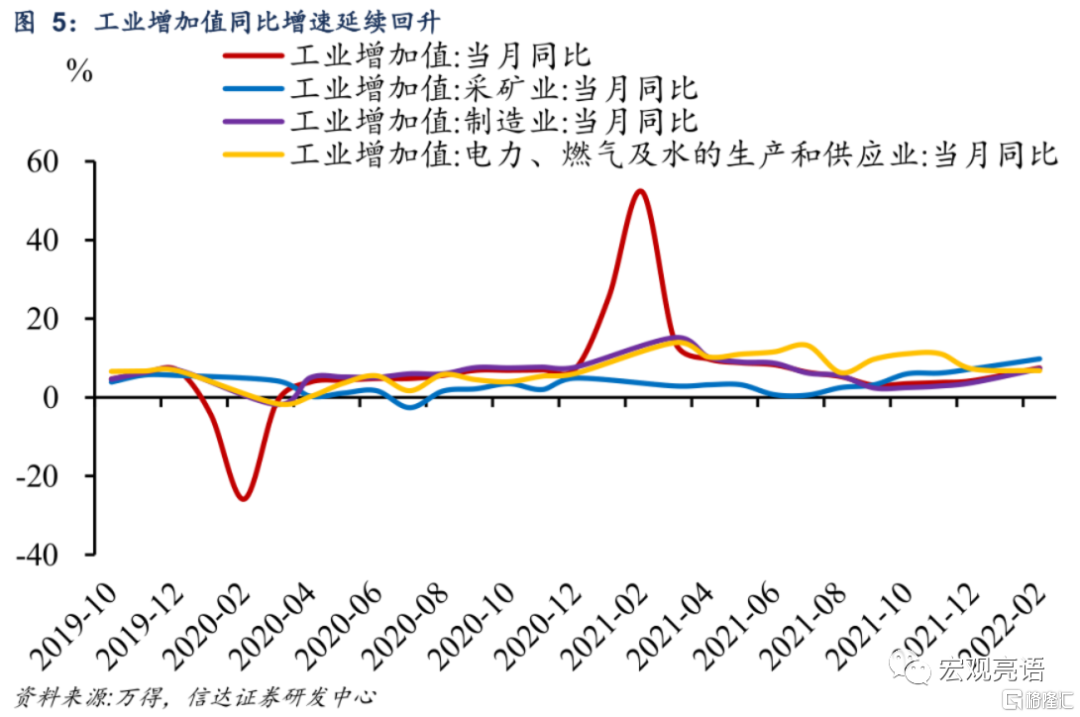

II. The growth rate of industrial added value continues to pick up.

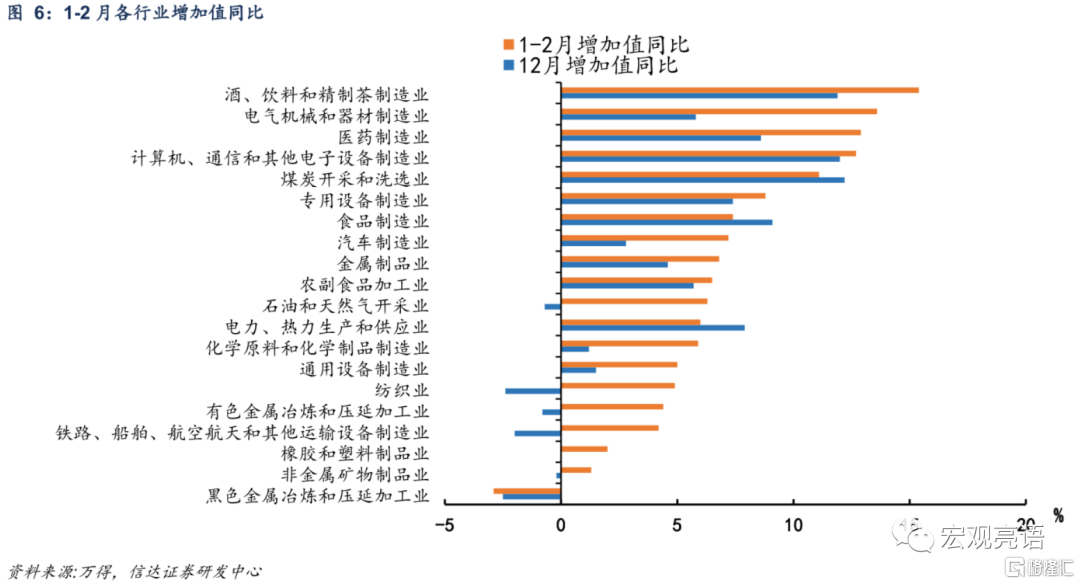

The growth rate of industrial value added continued to pick up. From January to February, the added value of industries at and above the national scale increased by 7.5 percent over the same period last year, 3.2 percentage points higher than in December 2021 and 1.4 percentage points faster than the two-year average growth rate in 2021. From a separate point of view, the year-on-year growth rate of the mining industry and manufacturing industry was further improved compared with December. Steady progress in domestic commodity supply and stable prices, coupled with rising demand for infrastructure investment, the mining industry grew 9.8 per cent year-on-year, 2.5 percentage points faster than last month. In the manufacturing sector, equipment manufacturing and high-tech manufacturing maintained a high growth rate, driving the added value of the manufacturing sector to grow by 7.3% over the same period last year, 3.5 percentage points faster than last month.

The effect of "on-the-spot Spring Festival" from January to February is weaker than that of last year, and there are four reasons for the substantial increase in industrial added value when the Winter Olympic Games are held to disturb production. First, the overseas supply chain is affected by the epidemic, the export chain continues to be strong, and the production of electrical machinery, computer communications, special equipment and other industries remains prosperous. Second, many departments stressed that "do a good job in ensuring the supply and price of commodities". For example, the National Development and Reform Commission said on March 9 that it would strive to stabilize the country's daily coal output at more than 12 million tons. The coal mining and washing industry grew by 11.1%. Third, the conflict between Russia and Ukraine continued to ferment, and the prices of crude oil, non-ferrous metals and other overseas commodities rose, driving the added value of the oil and natural gas mining industry to increase by 6.3%, and the smelting of non-ferrous metals by 4.4%, up from-0.7% and-0.8% respectively in December. Third, the global epidemic has been repeated, and the added value of the pharmaceutical manufacturing industry has maintained rapid growth.

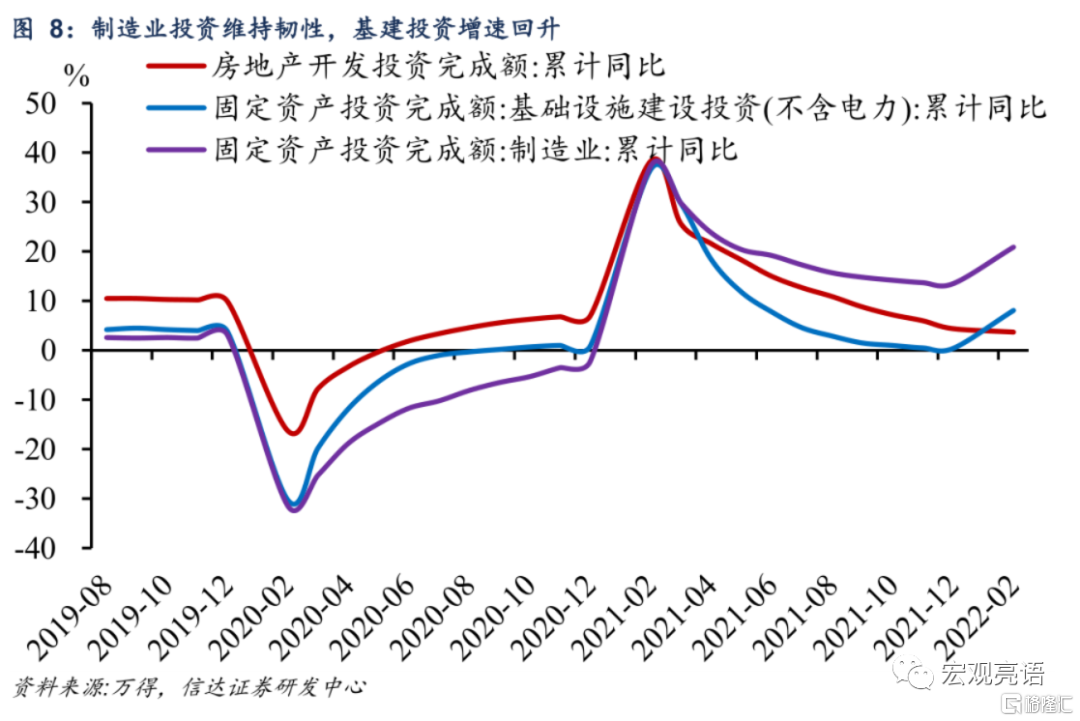

III. Manufacturing investment is more resilient, and infrastructure investment has rebounded as scheduled.

From January to February, China's fixed asset investment (excluding farmers) totaled 5.0763 trillion yuan, an increase of 12.2 percent over the same period last year, 7.3 percentage points higher than in 2021 and 8.3 percentage points faster than the average growth rate in 2021.

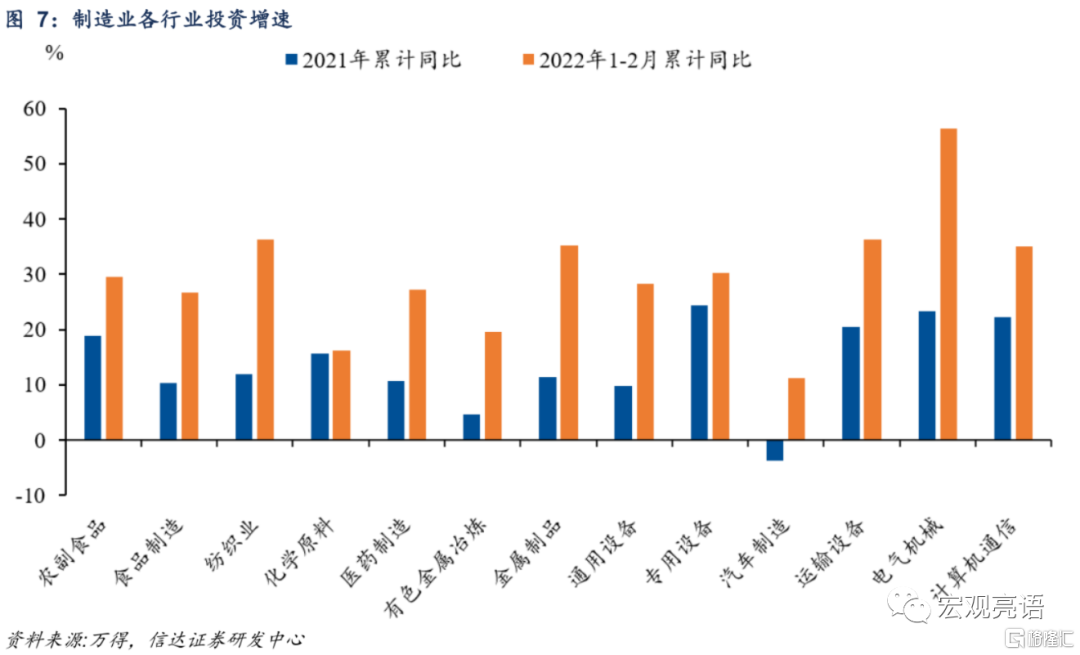

Investment in the manufacturing sector continued the strong trend since the beginning of last year, with a growth rate of more than 20% from January to February. From January to February, investment in the manufacturing sector increased by 20.9% over the same period last year, up 7.4 percentage points from the previous period. (1) from January to February, the high-tech manufacturing industry increased by 42.7%, of which investment in electronic and communication equipment manufacturing, medical equipment and instrumentation manufacturing increased by 50.3% and 41.2%, respectively. (2) the problem of lack of cores in domestic cars has been further alleviated, and the growth rate of investment has rebounded to 11.3% from-3.7% in 2021.

Infrastructure investment rebounded as scheduled. The year-on-year growth rate of infrastructure from January to February was 8.1%, a significant improvement over the 0.4% growth rate for the whole of 2021, initially reflecting the effect of "steady growth" of infrastructure. In 2022, the new special debt line will be set at a higher level of 3.65 trillion and will be issued in advance. 877.5 billion yuan has been issued from January to February, accounting for 24% of the annual quota. In addition, the government work report shows that 640 billion yuan will be invested in the central budget this year, an increase of 30 billion yuan over the previous year. We can see that there are plenty of funds for infrastructure investment this year, and infrastructure investment will continue to support economic growth.

Real estate indicators have been analyzed in the previous article.

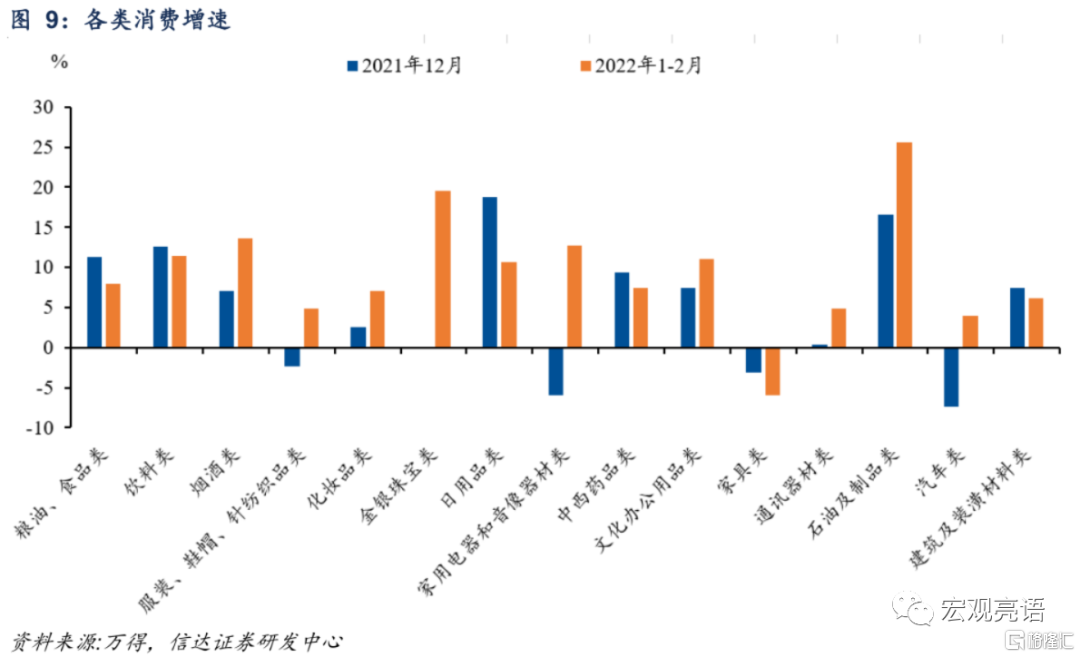

Fourth, the Spring Festival effect has been partially released, and consumption has recovered faster than expected.

The Spring Festival effect was partially released, and consumption recovered faster than expected. From January to February, the total volume of retail sales of consumer goods increased by 6.7% compared with the same period last year, 5.0 percentage points higher than in December 2021 and 2.8 percentage points faster than the average growth rate in the two years of 2021. From a structural point of view, the pull items of consumption in this period include: first, the epidemic did not break out from January to February, superimposed by the Spring Festival to drive offline consumption, catering income increased by 8.9%, cosmetics consumption increased by 7%, and gold, silver and jewelry consumption increased by 19.5%. Second, automobile consumption increased by 3.9%. Stimulated by policy encouragement and the introduction of new energy vehicles to the countryside, data from the China Automobile Association showed that sales of new energy vehicles from January to February were 765000, an increase of 1.5 times compared with the same period last year. Third, the rise in global oil prices contributed to a 25.6% year-on-year increase in retail sales of oil and products from January to February.

Risk factors:

The variation of the epidemic situation led to the failure of the vaccine; the domestic policy exceeded expectations and so on.