電動車銷量大爆發,除了買股票,還有什麼上車途徑?

新能源車迎來爆發元年

2021年,全球電動車市場賣爆了。

特斯拉全年交付量達93.62萬輛,逼近100萬大關,同比增長87.2%。比亞迪全年新能源乘用車銷量達59.37萬輛,同比增長231.6%。蔚小理年銷量均破9萬,哪吒約7萬,威馬、零跑破4萬。

(圖:造車新勢力月度銷量走勢,來源:莫尼塔研究)

(圖:造車新勢力月度銷量走勢,來源:莫尼塔研究)

展望2022年,機構稱,歐洲各國補貼政策基本延續,美國稅收抵免額度提升即將落地,中國私人需求持續增長,中汽協預測今年國內新能源汽車銷量將達到500萬輛,同比增長47%,在這些因素驅動下,預計全球新能源車市場有望迎來進一步增長。

新能源車ETF走勢強勁

面對持續火爆的新能源車,普通投資者除了直接買賣二級市場股票,還有什麼上車途徑呢?當然是新能源車相關的ETF。

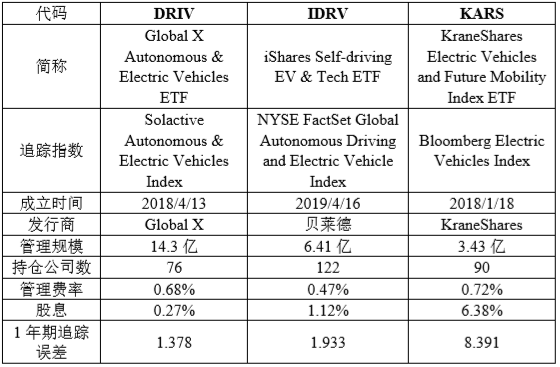

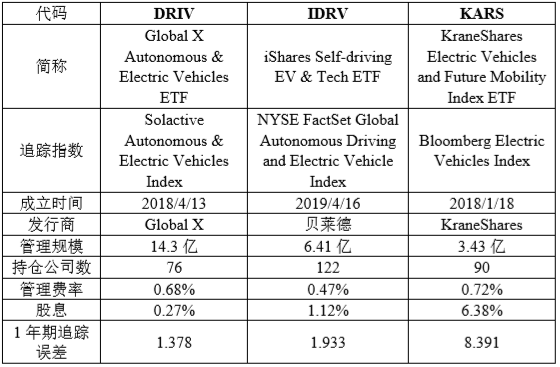

目前市場上較受歡迎的新能源車ETF有DRIV、IDRV、KARS三隻,分別追蹤不同的新能源車指數,成立於2018年和2019年。

DRIV的管理規模最大,達到14.3億美元,流動性最好,近90天的平均交易量爲50萬,追蹤誤差也是最低的。IDRV的管理費率是最低的,只有0.47%。KARS在2021年的股息率高達6.38%,因而受到投資者歡迎,不過往年的派息率在1%左右,去年的高股息持續性存疑。

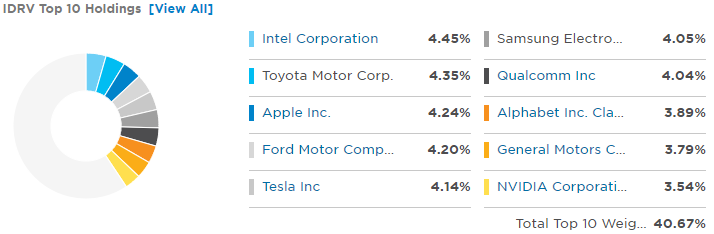

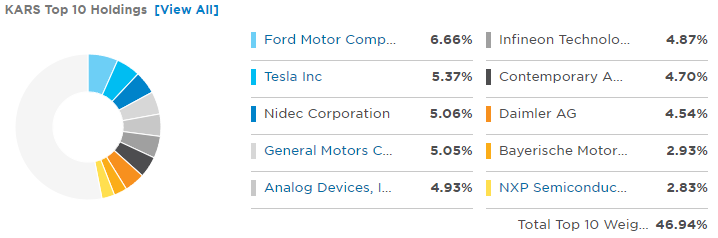

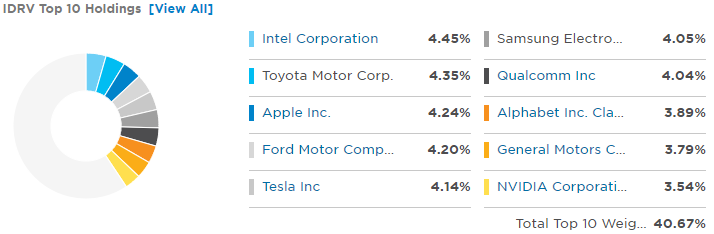

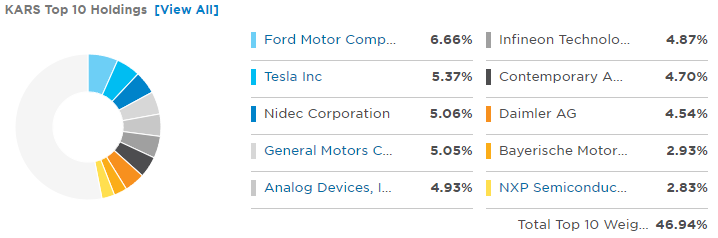

從持倉來看,DRIV和IDRV比較相近,IDRV重倉股包括英特爾、Toyota、蘋果、福特、特斯拉、三星、高通、谷歌、通用汽車、英偉達,DRIV重倉股包含特斯拉、英偉達、高通、蘋果、微軟、Toyota、谷歌、英特爾、福特汽車。而KARS的重倉股包括福特汽車、特斯拉、通用汽車、寧德時代。

從地區分佈來看,KARS因爲持有寧德時代等中國公司,所以中國比重高達31%,而DRIV和IDRV的美國比重較大,分別達到62%、48%。投資者可以根據自己的投資偏好進行選擇,如果更看好美國市場,可以選擇DRIV和IDRV,如果更偏重中國,則可以考慮KARS。

收益率方面,得益於這兩年新能源市場的景氣度上升,三隻ETF都取得了不錯的收益,2020年漲幅都在60%以上,2021年漲幅在30%左右。

如何構建ETF投資組合

ETF不僅是散戶的投資利器,也是機構的心頭好,根據三季度持倉報告,橋水基金的前四大持倉都是新興市場ETF和標普500ETF,高盛、巴克萊均重倉ETF,華爾街大佬們還買了哪些ETF?我們該如何抄作業?在2000多隻ETF中,我們又該如何構建ETF投資組合?

敬請鎖定uSMART直播間,1月18日19:30,盈立證券(新加坡)研究院高級市場策略師黃佳仁(James)爲您在線解答。

主講人簡介:黃佳仁(James),現任盈立證券(新加坡)研究院高級市場策略師,盈立證券(新加坡)金牌講師,新加坡交易所學院特邀培訓導師。

有任何關於基金的疑問可以加我們的官方運營人員微信諮詢。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.

(圖:造車新勢力月度銷量走勢,來源:莫尼塔研究)

(圖:造車新勢力月度銷量走勢,來源:莫尼塔研究)