愛帝宮(00286.HK):中國領先的月子服務專家,給予“買入”評級,目標價0.79港元

機構:安捷證券

評級:買入

目標價:0.79港元

公司專注月子服務,通過“內生+外延”的方式發展。公司於2019年9月收購深圳愛帝宮母嬰健康管理有限公司(以下簡稱“深圳愛帝宮”) 88.52%股權,合共持有94.95%股權,成為月子服務行業的頭部企業,未來將專注發展月子服務業務,核心月子服務內容分為九大體系,服務內容豐富,目前“愛帝宮”品牌主打高端市場。未來將通過新建子品牌進入中端月子中心市場,公司有望進一步擴寬市場及增強先發優勢。

投資亮點:

1) 深圳愛帝宮正處於高速擴張的初期階段,未來將在一線/新一線城市加速佈局“愛帝宮”品牌,預計建設月子房目標總數超5,000間;

2)公司將通過外延的發展戰略發展舒適型月子中心子品牌,將通過“愛帝宮月子產業基金”,以體外孵化的方式進行行業整合發展,愛帝宮將對其輸出技術及管理體系,待實現經營提升後,適時收購成熟店,從而實現全方位地佔領月子服務市場;

3) 月子服務業具有獨特的剛需屬性,全球新冠肺炎病毒疫情大流行的背景下,深圳愛帝宮所有的月子中心嚴格執行國家有關部門頒佈的防禦措施,保持正常營運;

4)公司2019年平均單房年盈利24萬港幣,ROE高達38.6%,客户需提前3-6個月預訂,並預付30%的合同訂金,入住當天付全款,預付費模式造就公司強勁的現金流。

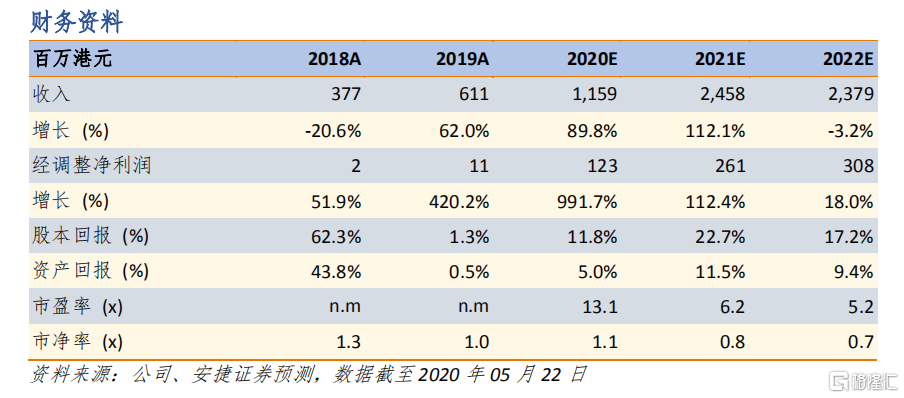

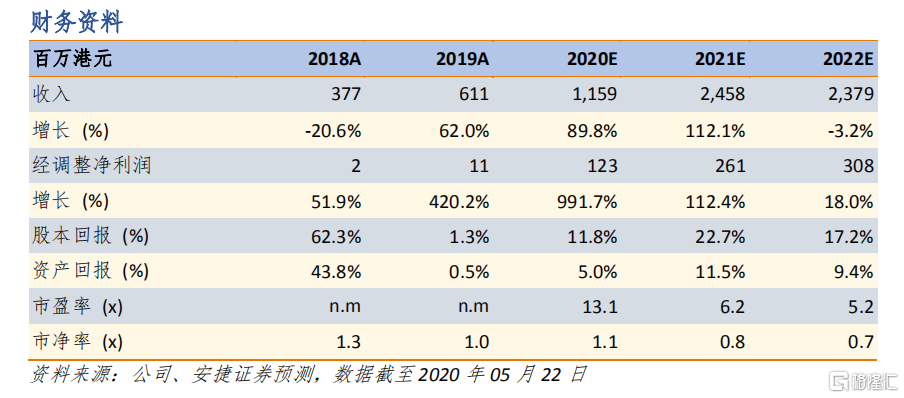

財務假設:安捷證券預測深圳愛帝宮的收入FY20E-22E將按照+20.0%/+47.0%/+51.0%的增長率增長至約7.90/11.62/17.54億港元,月子服務業務將佔公司整體收入約68.2%/47.3%/73.7%。FY20E/21E/22E公司整體毛利率為42.0%/38.3%/41.5%,其中,深圳愛帝宮的毛利率為43.8%/43.0%/42.5%。基於月子服務板塊帶來的利潤貢獻,FY20E/21E/22E公司整體淨利潤預計同比增長+991.7%/+112.4%/18.0%,整體淨利率達10.6%/10.6%/12.9%;深圳愛帝宮的淨利率為16.4%/15.8%/15.5%,預計淨利潤達1.30/1.83/2.73億港元。

估值與風險:安捷證券採用現金流貼現(DCF)方法對公司進行估值。我們基於現金流貼現的估值方法顯示,公司的隱含價值為30.2億港元,目標價為港幣0.79港幣,對應24.7倍FY20E年市盈率水平,首次覆蓋給予買入評級,原因為:1) 中國新增人口紅利;2) 愛帝宮品牌優勢;3) 新興行業具備較大成長空間;及4) 強勁的盈利能力及現金流。風險:1) 行業監管真空,政策未來存在不確定性;2) 經營成本的不確定性;及3) 服務事故及糾紛。公司專注月子服務,通過“內生+外延”的方式發展。公司於2019年9月收購深圳愛帝宮母嬰健康管理有限公司(以下簡稱“深圳愛帝宮”) 88.52%股權,合共持有94.95%股權,成為月子服務行業的頭部企業,未來將專注發展月子服務業務,核心月子服務內容分為九大體系,服務內容豐富,目前“愛帝宮”品牌主打高端市場。未來將通過新建子品牌進入中端月子中心市場,公司有望進一步擴寬市場及增強先發優勢。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.