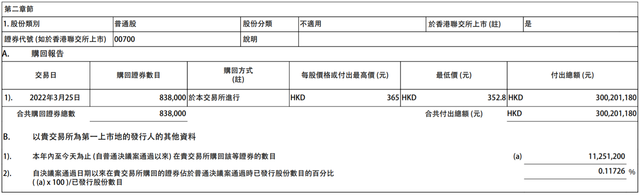

After Alibaba's buyback record of US $25 billion, Tencent and Xiaomi caught up. On the evening of March 25, Tencent announced that it had bought back 838000 shares at a price of HK $352.8 to HK $365a share, at a cost of about HK $300m.

On the other hand, Xiaomi Group spent about HK $49.867 million to buy back 3.46 million shares after spending nearly HK $50 million to buy back 3.4094 million shares on March 24. So far, Xiaomi Group has bought back shares of the company twice in succession, buying back a total of 6.8694 million shares, at a cost of nearly HK $100m.

Why do you buy back shares from Ali to Tencent?

From Alibaba Tencent to Xiaomi, these companies all have one thing in common-seeing that their share prices are undervalued but have money on their books, so they start buybacks.

Xu Hong, deputy chief financial officer of Alibaba Group, said the return was due to Alibaba's undervalued share price. "the substantial share buyback highlights our confidence in Alibaba's long-term and sustainable growth potential and value creation," he said. Considering our sound financial position and expansion plans, Alibaba's share price does not fairly reflect the value of the company. "

Tencent has also carried out several rounds of share buybacks over the past years, and the repurchase time is basically when the macro environment is downward or when it is bad for regulation. For example, when Internet regulation was strengthened last year, Tencent launched a round of buybacks.

There is a good chance that the stock buyback will drive up the stock price and increase earnings per share. In fact, after Ali bought back the stock, its share price rebounded immediately. Judging from the trend of its share price in the next few days, it rose by more than 11% on the 22nd, and the data level has risen by more than US $25 billion.

Listed companies use paper cash to buy back shares, and these repurchased shares can be cancelled. thus,The total assets of listed companies remain unchanged, reducing the number of outstanding shares, so that the average earnings per share ((EPS)) increases.

Earnings per share (EPS) = net profit after tax for the current period / number of common shares outstanding, if the denominator "number of common shares outstanding" becomes smaller, it will obviously increase EPS.

In theory, the more EPS earns, the higher the share price, but in the long run, it makes sense to take into account the price-to-earnings ratio. thereforeIn the evaluation, we can not directly look at the level of EPS, but also by the price-to-earnings ratio to judge.

Price-to-earnings ratio, also known as cost-to-earnings ratio, is the stock price divided by the ratio of earnings per share, that is, the stock price / EPS. For example, if the stock price is 100 yuan and EPS10 yuan, the cost-to-profit ratio is 10 times.

The cost-to-profit ratio can be regarded as "time to repay principal". The smaller the P / E ratio, the cheaper the stock price.

So from this point of view, if a company's EPS continues to grow from the past to the present, the smaller the P / E number, the higher the stock price. But on the other hand,If EPS is unstable, sometimes high and sometimes low, it also means that there is uncertainty about the trend of stock prices.

Therefore, when buybacks push up EPS, investors' expectations of corporate earnings rise accordingly, but if EPS is unstable, high and low, it will not be a good entry point either.

Therefore, the sustained growth of EPS is very important. Whether the market is optimistic about the valuation level of an enterprise depends on the "future sustainable growth" of earnings, that is, the price-to-earnings ratio. Therefore, stock buybacks can improve EPS, in a short time, but in the long run, the growth of EPS is quite important.

therefore,For investors, it is not easy to judge the market entry and the long-term trend of the stock price from the share price buyback.

From the point of view of Ali buyback, on the one hand, it is to improve the potential income of shareholders. As mentioned earlier, after the repurchase of shares, the number of shares does not change, but the net assets per share and earnings per share will increase, and the proportion of holding companies will increase. The probability of stock appreciation is bound to increase in a short period of time.

In addition,It also needs to stabilize confidence and military morale. On the one hand, it is to stabilize market sentiment through buybacks, so that investors are more sure of the current value of Ali. At the same time, we can also remove the sword of Damocles where US stocks are delisted.

On the other hand, many of Ali's P6 employees and many employees' wealth are tied to Ali's stock price. This wave of assets has shrunk, and Ali's internal morale also needs to be stable.

According to Tencent. According to media sources, Tencent has granted employees HK $384.08 per share to buy Tencent Holdings in the next seven years, and the income of the employees is the difference between the actual price of the stock and the exercise price. Obviously, the current Tencent buyback is also a signal to the market and internal employees that the stock price is undervalued.

Internally,Another function of share buybacks is capital gains.

Generally speaking, in terms of the income of employees within some companies, high cash dividends tend to make them pay high personal income tax, buy back shares and reduce cash dividends, which is equivalent to reducing this part of personal income tax.

Therefore, it is precisely because of the many benefits of share buybacks that we look across the ocean. Silicon Valley giants from Microsoft, Google to Apple like to play with buybacks, and these giants have been driving up stock prices through buybacks over the years.

Over the past year, Facebook has authorized $50 billion in share buybacks, and Apple plans to increase its share buybacks by $90 billion in 2021. Google also plans to increase its share buyback by $50 billion in 21 years, and Google plans to increase its share buyback by $60 billion in 21 years.

Typical is an apple.

From March 2012 to the first quarter of 2017, Apple has bought back and written off 20% of its shares. As of August 2021, Apple had spent more than $467 billion on share buybacks.

What is the concept of 467 billion dollars? Based on Alibaba's market capitalization of $305 billion as of March 35, 2022, the shares repurchased by Apple can now buy 1. 5 Ali.

Apple uses its own cash to buy back its own shares, and after the repurchase, it will directly write off the repurchased shares and increase its shareholding percentage, so that holders can enjoy more dividends, gains and cash dividends.

Over the years, a large part of Apple's money has been spent on share buybacks and dividends.

In 2018, for example, Apple announced a $100 billion share buyback and dividend, and that year Apple's buyback plus dividend has gradually exceeded the amount of money it can earn. This is rare in the Jobs era, and according to the data, Apple's stock dividends and repurchase cash are rising to tens of billions of dollars a year.

In April 2021, Apple launched a $90 billion share buyback program, exceeding 80 per cent of the market capitalization of the S & P 500.

When the market is bad, buybacks are more cost-effective than investments.

When a company has a lot of cash flow on its books, it can either invest in it, increase its investment in research and development, or buy back shares. Here, the giant large-scale share buybacks also have different voices and disputes.

When stocks are too low and cash flows are too highWhen the rate of return on investment falls, stock buyback is a better means of capital appreciation than investment. Apple is still a vivid example of profiting from share buybacks.

Data show that from October 1, 2014 to March 2020, Apple's free cash flow reached $321 billion, of which $278 billion, or 86%, was used for share buybacks.

Over the past five and a half years, Apple's outstanding shares have fallen by 26%, from 5.865 billion shares to 4.334 billion shares. Shareholders who hold Apple shares since 2014 have found that the company's regular buyback program has increased their profit share by more than 1/4.

But some analysts have questioned the repurchase of shares by companies such as Apple, arguing that they should reinvest the money. Bruce McCain, chief investment strategist at Key Private Bank, said that companies should invest in themselves and develop their business, and that the long-term growth prospects of those companies that buy back shares may not be good.

Because, according to common sense, if high-profit manufacturers make money, they will have more money to invest in R & D, and then they can come up with better products to improve competition barriers, product innovation experience, after-sales service and so on, forming a benign R & D-driven innovation cycle.

But Apple didn't do that, which, of course, has something to do with Apple's relatively strong moat and market position in the smartphone industry.When there is no absolute external crisis, share buybacks push up the company's share price, increase the income of investors, let shareholders get higher dividends and dividends and focus on current earnings, which is also a good choice.

After all, companies should look to the future, but also live in the present.

However, the situation of Alibaba is different from that of Apple. Alibaba faces more competition in the e-commerce market than Apple faces in the mobile phone market.

At present, there are similar voices and views in the market:

Short-term share buybacks can boost market confidence in the company and benefit the stock price. The essence is to subsidize shareholders with the company's cash flow, so that each shareholder has a bigger cake.

But if you look at the market as a whole, buying back shares will not make the market bigger. In the long run, if a company spends a lot of paper cash on buying its own shares and putting it into a meaningless redistribution game, it has no value to society and the industry, because it is not to invest or engage in research and development, which may mean that the Internet giants are entering a stable period of stagnation.

There is some truth in this view, but it does not take into account the current general environment and the rate of return on investment, and whether the money in the account should be used to invest or buy back shares should be viewed in stages.

Judging from the Internet economy and market conditions that are now moving towards maturity, it can be seen from Ali's financial report that the rate of return on investment has dropped to 5.19%, and its indicators will look better after share buybacks.

In terms of rate of return, buybacks are cost-effective-with such a large revenue scale and profits every year,In the current downward economic cycle, not spending money on investment is also a sound strategy. Instead of investing in other businesses with low returns, buy back your own shares.

In addition, from the current large market background, the current decline of US-listed stocks has little to do with the fundamentals of the company, but is in an emotional period of delisting of US stocks and liquidity concerns of Hong Kong stocks, which is a systemic risk.Stock buyback is one of the means to hedge the systemic risk of the stock market.

In the business world, any collective action is not an isolated event, its emergence should be observed in a large business background and a large economic cycle. At present, the interconnection is bearish, the US stock market is worried about delisting, and the liquidity concerns of Hong Kong stocks have not been resolved, and the giant buyback may be a helpless choice.

Overall, large-scale corporate buybacks can be used as one of the signs that the market is bottoming out, but it does not necessarily indicate that a phased bottom has arrived.

At present, the giant needs to send a signal that it is optimistic about the investment logic and value development in the future, and it can also reflect the good operating condition and abundant cash flow of the company. But buybacks cannot be used as a core indicator of rising share prices.

After all, Xiaomi has bought back many times in the past, especially more than 123 million shares by October 2021, but has had a very limited effect on the share price.

The flip side of large-scale buybacks is that money does not have a good place to invest and channels, which may also mean that the engine of future profit growth has weakened.

Of course, companies from Ali to Tencent are companies with excellent fundamentals. Buffett has said in the past that huge investment opportunities often come from excellent companies being trapped by unusual circumstances, which will cause their stocks to be mistakenly undervalued.

At present, domestic policy has been loosened, and with the gradual improvement of macro policies and fundamentals, there will be a process of valuation repair for China-listed stocks.From the perspective of market sentiment and capital movements, where the money is, confidence is there. In times of emotional downfall, confidence is more important than faith.