Alibaba announced that it had previously announced that it would voluntarily change the company's secondary listing status on the Hong Kong Stock Exchange to its primary listing status, which will take effect today. The company is currently dual-primarily listed on the Hong Kong Stock Exchange and the New York Stock Exchange. The Company's ordinary shares listed on the Hong Kong Stock Exchange and American depositary shares listed on the New York Stock Exchange continue to be convertible.

After the announcement, Alibaba’s U.S. stock price was the first to react. The stock price rose by more than 3% at the beginning of the trading session, hitting $85.72, setting a new high since May 20. The total market value once again exceeded the $200 billion mark, surpassing Pinduoduo. It closed down 0.38% to $81.45.

(Source: uSMART)

Alibaba’s listing in Hong Kong has experienced twists and turns

Alibaba has experienced twists and turns in its listing in Hong Kong. In 2014, due to the issue of different rights for the same shares, it gave up listing in Hong Kong and chose to go to the New York Stock Exchange in the United States to list. Later, the Hong Kong Stock Exchange revised its listing regulations, and Alibaba was finally listed in Hong Kong in the form of a secondary listing in 2019.

Later, in July 2022, Alibaba filed an application for a primary listing in Hong Kong. In July of that year, Alibaba announced that its board of directors had authorized the group's management to submit an application to the Hong Kong Stock Exchange to add Hong Kong as a major listing place. Earlier, Alibaba Group’s announcement showed that Alibaba is currently listed on the main board of the Hong Kong Stock Exchange and will apply for Hong Kong as the main listing place in accordance with the Hong Kong listing rules. It is expected to take effect before the end of 2022. Subsequently, in November 2022, Alibaba Hong Kong Exchange announced that it would not complete the main listing by the end of 2022 as originally planned.

This move is for inclusion in Southbound Hong Kong Stock Connect

In order to meet strategic needs, Alibaba hopes to be included in the Hong Kong Stock Connect during the half-year review in September this year. Industry insiders pointed out that Alibaba's dual primary listings in Hong Kong, China and New York, the United States, will further expand the investor base from mainland China and other parts of Asia, promote the diversification of shareholder structures, and increase the liquidity of Hong Kong stocks. This also provides investors with greater flexibility to hold and trade Alibaba shares in the public market.

Although Alibaba has already met the objective conditions for inclusion in Southbound Trading, due to its secondary listing status in Hong Kong, it has been unable to be included in the North Water trading scope of Southbound Trading. Regulators in major listing places have primary regulatory power. The Shenzhen Stock Exchange and the Shanghai Stock Exchange have stated that unless Alibaba changes Hong Kong's secondary listing status to a primary listing status, it will consider including Southbound Connect in accordance with relevant regulations.

In order to expand the investor base, especially to allow mainland institutional investors and retail investors to directly buy and sell Alibaba shares, Alibaba needs to convert its secondary listing status in Hong Kong to a primary listing status. Alibaba's business is mainly concentrated in the mainland. These businesses and business models are well known to mainlanders and they often use its related services. Therefore, this move is expected to attract a large amount of North Water capital to pour into the Hong Kong stock market.

After Alibaba completes its dual primary listing in Hong Kong, it will meet the conditions for inclusion in Southbound Trading and is expected to be included as soon as September. Morgan Stanley predicted in a research report that after the inclusion of Southbound Trading, the shareholding ratio of southbound funds may stabilize at more than 10% in the long term, which is expected to provide considerable incremental support for the company's value.

This move may also be to buy insurance

China and the United States are engaged in a long-term game. The United States has launched all-round suppression against China. Following the trade war and technology war, it has also restricted Chinese companies such as the shopping platform Shein from listing in the United States. Republican lawmakers have occasionally put pressure on Chinese concept stocks to delist.

Coupled with the fierce election in the US presidential election, the chances of former President Trump returning to the pot are very high, which has increased the risk of escalating the Sino-US trade war. Alibaba chose to dual-list in Hong Kong and the United States at this time. It cannot be ruled out that it is hedging risks in advance, because in the dual In a primary listing, the company's shares on each exchange are independently listed, and delisting from one exchange will not affect the listing status of another exchange, providing better protection for investors.

Once Alibaba is included in the Southbound Trading List, it will officially take effect on September 9. By then, the long-awaited ability of mainland investors to directly trade Alibaba is expected to become a reality, which will attract Beishui to pursue purchases southward. A Goldman Sachs research report estimates that there may be as much as 124.8 billion yuan in potential net inflows of funds. Even if the funds are not influxed all at once, if billions of yuan are added every day to pursue purchases, it will not only benefit the circulation of shares, but also be enough to increase the company's overall valuation.

The challenges facing Ali

Alibaba achieved revenue growth in fiscal 2024, but still faces multiple challenges. Although revenue and overseas business have increased, multiple business segments, including local life and entertainment, are still in the red. In particular, Alibaba International Digital Business Group has significantly expanded its overseas markets while also increasing investment, resulting in expanded losses.

Behind the losses in various businesses, Alibaba is also constantly laying off employees. The financial report shows that as of June 30, 2024, Alibaba's total number of employees was 198,162, and as of December 31, 2023, it was still 219,260. This means that in the first half of 2024, the number of Alibaba employees will decrease by 21,098.

In addition, Alibaba faces strong pressure from emerging competitors such as Shein, Temu and TikTok Shop in the global market. Angel investor and senior artificial intelligence expert Guo Tao said that compared with 2023, China's cross-border e-commerce will face greater challenges in 2025. With the development and changes of the global economy, various countries' policies and regulations on cross-border e-commerce may be adjusted, which will bring certain uncertainties to China's cross-border e-commerce.

How to invest in Alibaba on uSMART?

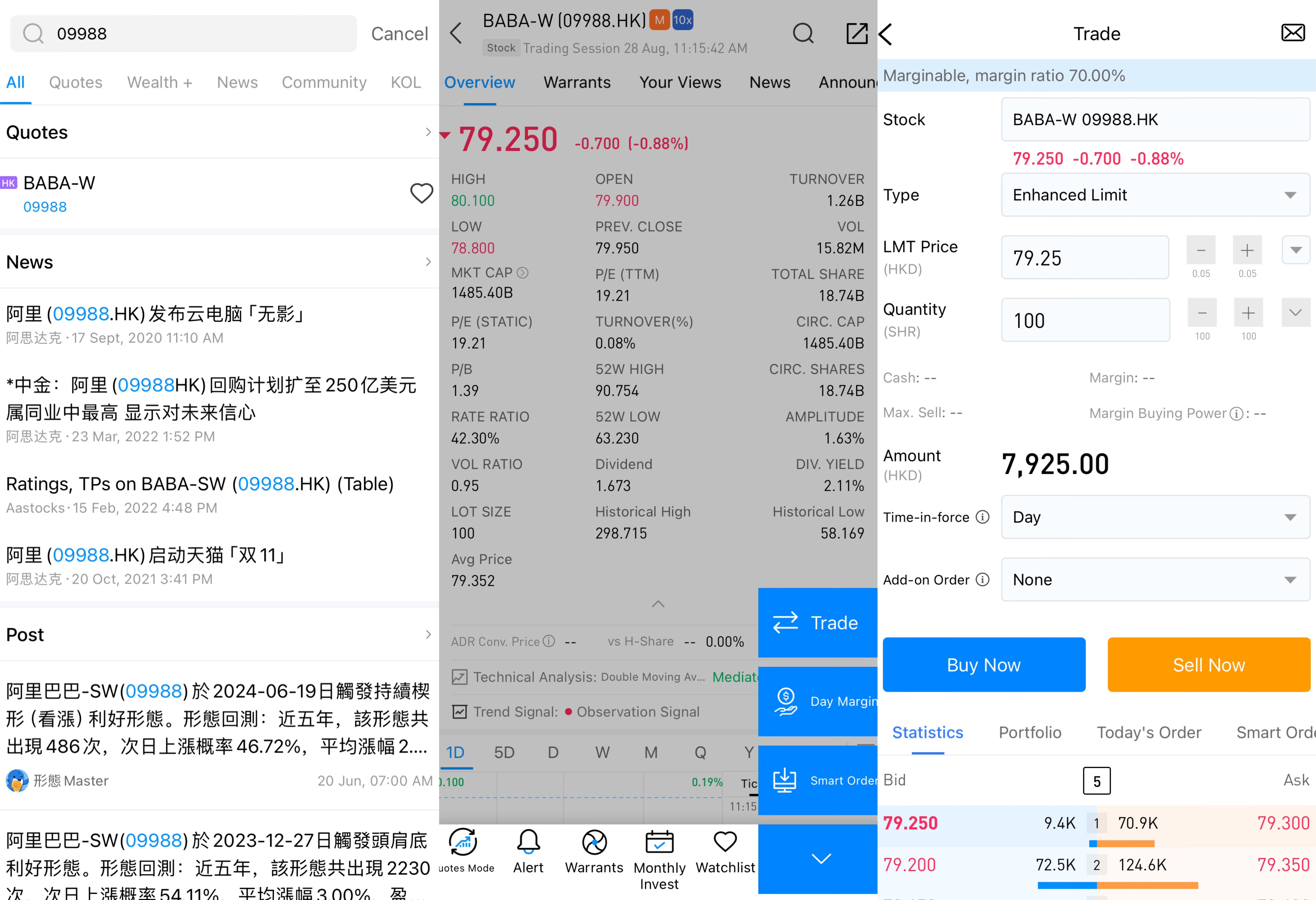

After logging into uSMART HK APP, click "Search" from the upper right corner of the page, enter "09988" or "BABA", you can enter the details page to learn about transaction details and historical trends, click "Trade" in the lower right corner, and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the image operation instructions are as follows:

This image is for illustrative purposes only

This image is for illustrative purposes only