On Tuesday, server manufacturer Super Micro Computer (SMCI.US) announced a mixed fourth-quarter performance report, with revenue exceeding expectations, but gross profit margins falling, and EPS falling short of expectations. Specifically:

●Operating income: Q4 revenue was US$5.31 billion, a year-on-year surge of 143.6%;

●EPS (earnings per share): Q4 EPS was US$6.25, a year-on-year increase of 78.1%, which was lower than the expected US$8.14;

●Gross profit margin: Q4 gross profit margin was 11.2%, a year-on-year decrease of 5.8 percentage points.

Although revenue exceeded expectations, EPS fell short of expectations and gross profit margin declined. AMD's stock price first rose sharply after the market opened, and then plunged by more than 13%.

(Source: uSMART)

About Super Micro Computer Corporation

Super Micro Computer Inc provides high-performance server technology services to the cloud computing, data center, big data, high-performance computing and "Internet of Things" embedded markets. Its solutions range from servers, storage, blades and workstations to complete racks, network equipment and server management software.

The company follows a modular architectural approach, providing the flexibility to deliver customized solutions. The company is committed to developing and delivering high-performance server solutions based on innovative, modular and open standards architecture.

More than half of the company's revenue comes from the United States, with the remainder coming from Europe, Asia and other regions.

Super Micro Computer joined the AI battlefield with its AI server, but it was a pity that it was not well received

As a manufacturer of AI servers, AMD has also benefited from the artificial intelligence boom in the past two years. Since the beginning of this year, the company's stock price has doubled as demand for AI servers has increased, and it has been included in the S&P 500 and Nasdaq 100 indexes.

(Source: uSMART)

Moreover, Super Micro Computer predicted in its performance outlook on Tuesday that the company's revenue will reach US$26 billion to US$30 billion in the fiscal year ending June 30, 2025. Analysts on average expected $23.6 billion.

While the revenue outlook is positive, what really worries Wall Street is its long-term profitability

In the fierce price reduction war with server suppliers such as Dell (DELL.US) and Hewlett-Packard (HPQ.US), Supermicro's Q4 profit margin dropped 580 basis points year-on-year (down 430 basis points quarter-on-quarter) to only 11.3% .

AMD executives said after the results that gross margins were negatively impacted by business with large customers, which typically get preferential prices for large orders, and increased investment in a new liquid-cooled server supply chain. Super Micro Computer will achieve the target gross profit margin range of 14% to 17% by expanding new products and manufacturing supply chains in Taiwan and Malaysia.But Wall Street doesn't buy it. Some analysts pointed out that Super Micro failed to achieve its profit target in the latest quarter, which is likely to intensify Wall Street's concerns about its profitability. This is also a key reason for Super Micro Computer's after-hours plunge.

Lack of profitability seems to be a "common problem" among AI server manufacturers

AI server manufacturers generally face the problem of insufficient profitability, which has become a "common problem" in the industry. Not only AMD, but also competitors such as HP and Dell are struggling to maintain high profitability.

When Dell announced its first-quarter financial report at the end of May, it expected its adjusted gross profit margin to fall by nearly 150 basis points in fiscal 2025, with adjusted earnings per share (EPS) of $1.55 to $1.75, far lower than analysts' expectations of $1.84. Dell's management predicts that the high cost of investment in the AI server business will drag down the full-year gross profit margin, putting huge pressure on profits and making it difficult to meet the market's high expectations. Similarly, HP's gross profit margin in the second quarter was 33%, down 3 percentage points year-on-year and 3.4 percentage points quarter-on-quarter.

These data reflect the general decline in gross profit margins of AI server suppliers such as Super Micro, Dell and HP, indicating the escalating price war among these hardware companies to compete for AI server market share, while sending a signal that these Hardware giants are generally optimistic about the future of the AI business, as companies are significantly increasing investment in the AI business.

Despite these challenges, these companies remain optimistic about the future of the AI business. Super Micro Computer CEO Charles Liang also stated on Tuesday: "We are ready to become the largest IT infrastructure company."

Will Nvidia's delay in product launch affect AMD?

Foreign media "The Information" pointed out that TSMC discovered design flaws in Huida's Blackwell series chips. According to sources, the defect was discovered unusually late this time, which has also led to products such as B200 chips using the Blackwell architecture expected to be delayed by three months or even longer.Regarding reports that Nvidia may delay the launch of new Balckwell chips, Supermicro CEO Liang Jianhou said that when manufacturers launch new technologies, it is normal for delays to occur, and Supermicro can still provide Partners provide liquid cooling solutions without much impact.

Is Super Micro Computer worth investing in?

Advanced Micro Computer shares have fallen about 25% in the past few weeks as investors demand clearer returns on investments in artificial intelligence (AI) and concerns about a U.S. recession grow. Maintaining an increase of more than 120%.It is foreseeable that AMD stock price may continue to fluctuate during the remainder of 2024. If investors want exposure to data centers, AI and cloud computing, the stock may be worth considering. Wall Street analysts are bullish on AMD, with an average price target of $978 on the stock, reflecting nearly 60% upside.

In addition, Super Micro Computer disclosed in its financial report that the company's board of directors has approved a 1-for-10 split of the company's common stock, and it is expected to start trading on the split-adjusted stock starting from October 1, 2024. .The commentary said that investors had previously hoped that AMD would follow NVIDIA's lead in splitting its shares, and AMD's actions this time were expected.Stock splits make it easier for retail investors to buy stocks, increase the liquidity of stocks in the market, and generally trigger a rise in stock prices. Since Nvidia split its shares, its stock price has soared. Optimistic estimates suggest that AMD's stock price will have a great chance of rising to a certain extent after the stock split.

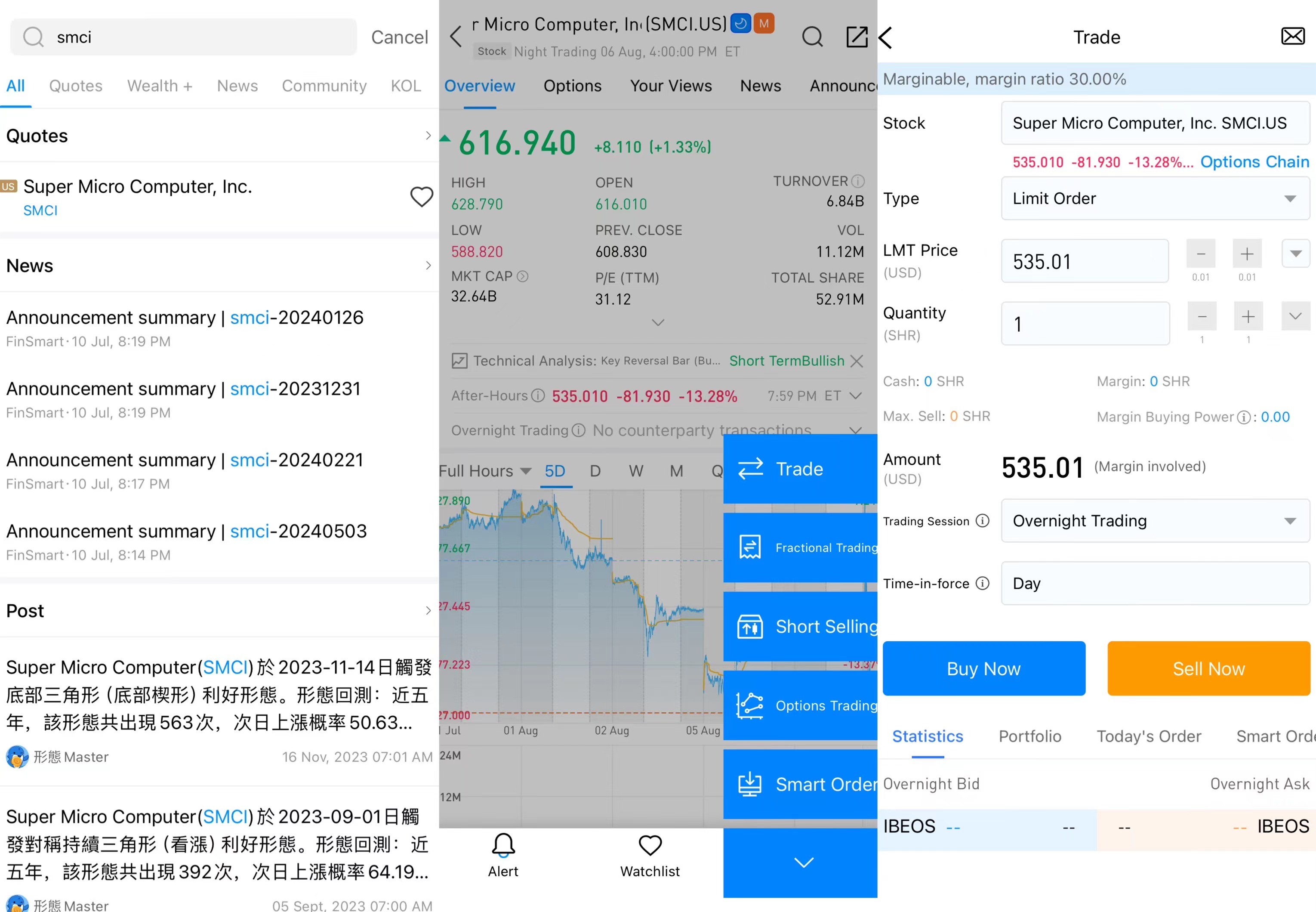

How to invest in AMD on uSMART?

After logging in to uSMART HK APP, click "Search" from the upper right corner of the page, enter "SMCI" or "Super Micro Computer", and you can enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select "Buy/ "Sell" function, finally fill in the transaction conditions and send the order; the picture operation instructions are as follows: