On Thursday, July 18, global chip foundry giant TSMC announced its second quarter 2024 financial report.

TSMC "lived up to expectations" and achieved full performance in the second quarter, with sales, net profit, and gross profit margin all exceeding expectations.

Key financial data

Sales: Q2 net revenue was NT$673.51 billion, a year-on-year increase of 40.1%;Net profit: Q2 net profit was NT$247.85 billion, exceeding market expectations of NT$235 billion, a year-on-year increase of 36.3%;Operating profit: Q2 operating profit was NT$286.56 billion, estimated at NT$274 billion, a year-on-year increase of 42%;Gross profit margin: Q2 gross profit margin reached 53.2%, up 0.1 percentage point from the previous quarter, and is expected to be 52.6%. The first quarter is expected to be 51%-53%.

(Source: TSMC)

Third quarter expectations

Sales: Sales in the third quarter are expected to be US$22.4 billion to US$23.2 billion, and the full-year sales growth forecast in US dollars is raised to above the mid-20% range, from the 21%-26% range to 24%-26%.Operating profit margin: The operating profit margin in the third quarter is expected to be 42.5% to 44.5%, compared with the market estimate of 42.1%.Gross profit margin: The gross profit margin in the third quarter is expected to be 53.5% to 55.5%, and the market estimate is 52.5%.Capital expenditure: The lower limit of full-year capital expenditure is raised, and annual capital expenditure is expected to be US$30 billion to US$32 billion. The previous capital expenditure guidance was US$28 billion-US$32 billion, and the market estimate was US$29.55 billion.

Specific revenue

TSMC's advanced process revenue in the second quarter rebounded from the previous quarter, with 3-nanometer and 5-nanometer processes accounting for half of the revenue in the second quarter. Revenue from advanced processes (including 7-nanometer and more advanced processes) accounted for 67% of wafer sales in the entire quarter, an increase from 65% in the previous quarter, of which 5-nanometer (N5) process shipments accounted for 35% , 3 nanometer (N3) process shipments accounted for 15%, and 7 nanometer (N7) process shipments accounted for 17%.

Among them, as TSMC’s most advanced chip process technology, the 3-nanometer process is an important factor in promoting growth potential. The company also previously stated that it plans to start mass production of the 2-nanometer process in 2025.

Brady Wang, deputy director of Counterpoint Research, predicts that throughout 2024, the production capacity of the 3-nanometer process will more than double year-on-year.

At the platform level, the AI chip foundry business continues to have strong momentum. At the same time, boosted by increased iPhone shipments, the smartphone business has steadily recovered.

HPC (High Performance Computing) platform revenue accounted for the highest proportion, reaching 52%, a significant increase of 28% month-on-month; smartphone business revenue accounted for 33%, automotive business accounted for 5%, IoT accounted for 6%, and DCE business accounted for 2 %.

Industry trends

TSMC’s second quarter 2024 financial report revealed a series of significant industry trends, demonstrating the development direction of the semiconductor industry and TSMC’s strategic positioning within it.

1. Upgrade of wafer foundry 2.0

Expansion of market space: TSMC has upgraded on the basis of traditional wafer foundry 1.0, incorporating packaging, testing, mask and memory manufacturing into its future territory. This integration strategy expanded the market space from US$115 billion to US$250 billion, doubling the market size.Investment in the packaging field: TSMC will increase investment in the packaging field. For companies that originally focused on packaging and testing, this means that TSMC will participate in the competition with its technological and financial advantages, creating a dimensionality reduction blow.

2. Ambition in memory manufacturing

Integrated packaging of logic and memory chips: In order to respond to customer demands for higher integration and better performance, TSMC not only plans to produce logic chips, but will also get involved in manufacturing memory chips and realize integrated packaging of logic and memory chips. Provide one-stop service.

3. Migration of advanced technology

Customers are migrating to advanced process nodes: TSMC’s process node with the largest revenue share is 5nm, accounting for 35%. In the future, customers will migrate from the 5-nanometer platform to the 3-nanometer platform, emphasizing the stability of gross profit margin during the process of process node migration.The goal of process upgrade: In the past, process upgrades driven by Moore's Law were to reduce costs, but now process upgrades are more about reducing power consumption. Although the cost of advanced processes (such as N7, N5, N3, N2 to A16) has increased, the power consumption has been significantly reduced, and power consumption has become a key indicator of future product competitiveness.

4. Promote AI demand

The rigidity of AI demand: AI is considered to be the key to greatly improving production efficiency, and TSMC also needs to line up to purchase Nvidia's AI chips. AI has significant applications in fields such as medical care, manufacturing, and autonomous driving, driving continued investment opportunities in related industry chains.

5. Prudent attitude towards production capacity expansion

Disciplined expansion: Despite strong demand, TSMC maintains a cautious approach to capacity expansion and ensures that expansion is based on actual demand.

TSMC’s financial report not only reflects its strong performance in the current market, but also reveals several important trends in the future semiconductor industry:

The expansion of market scale and business integration, and the wafer foundry 2.0 upgrade will promote the expansion of market space and drive more business integration. Driven by advanced processes, customer demands will migrate to more advanced process nodes, pursuing lower power consumption and higher performance; AI will continue to be an important force in promoting the growth of the semiconductor industry; on the basis of actual demand, TSMC will take Disciplined capacity expansion strategy.

These trends indicate that TSMC will continue to maintain its leading position in the future semiconductor industry and continue to meet customer needs through technological innovation and market expansion.

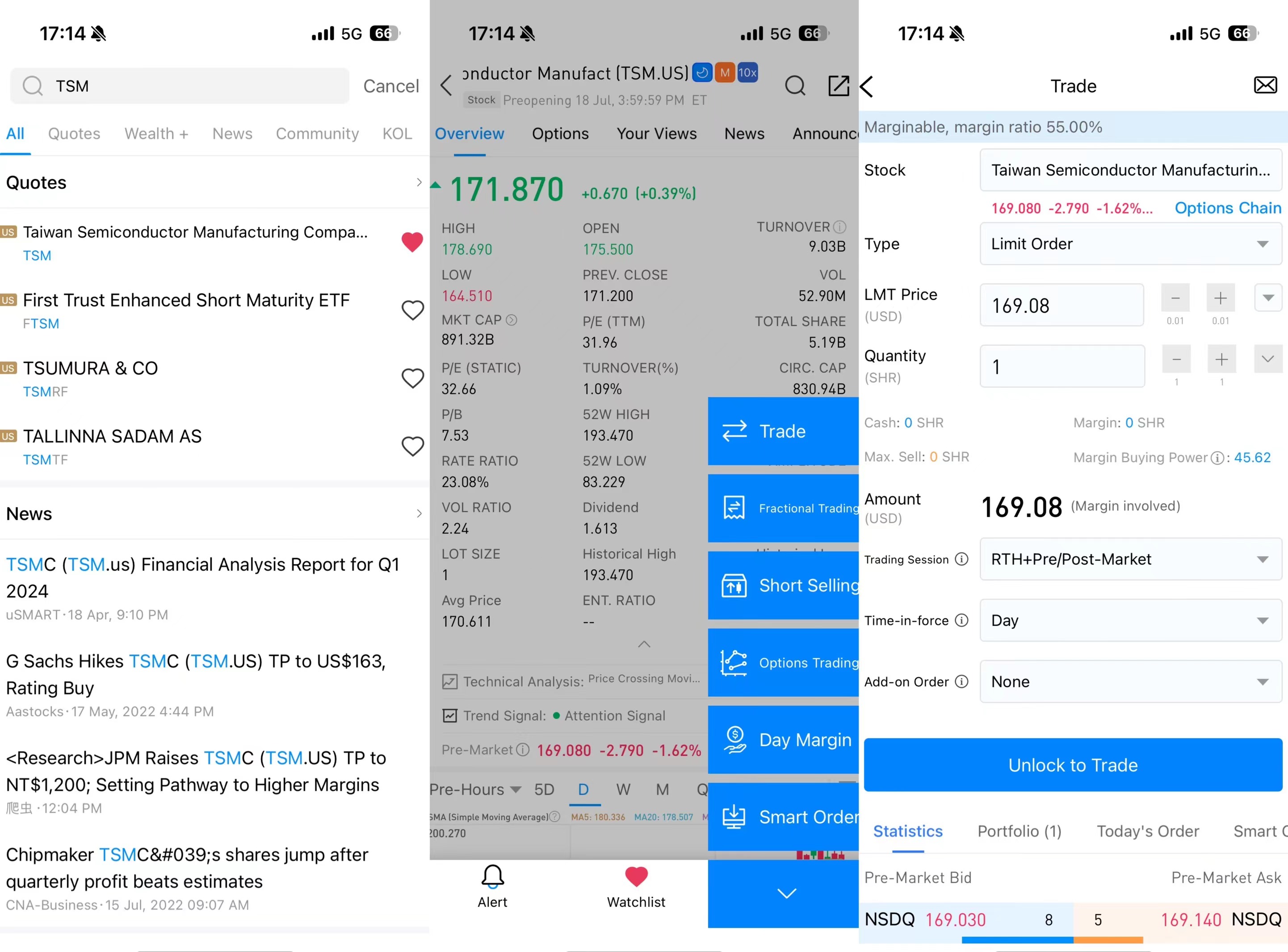

How to invest in TSMC on uSMART?

After logging in to uSMART HK APP, click "Search" from the upper right corner of the page, enter "TSM" or "TSMC", you can enter the details page to learn about transaction details and historical trends, click "Trade" in the lower right corner, and select "Buy/Sell" "Send" function, finally fill in the transaction conditions and send the order; the picture operation instructions are as follows:

(來源:uSMART)