鐵鷹式策略(Iron Condor)由兩個看漲期權和兩個看跌期權組成,當投資者預測股價在一段時間內將在一個小範圍內波動,或者當投資者預測股價在一段時間內將劇烈波動時,投資者可以使用鐵鷹式策略,此策略風險有限,盈利也有限。

鐵鷹式之所以如此命名,是因爲損益圖的形狀,因爲形似老鷹,所以策略被稱爲鐵鷹,

鐵鷹式實際上是兩種垂直價差策略的組合,同時利用了看跌、看漲垂直價差的交易策略。策略具有相同的到期日和四種不同的行使價。與單一垂直價差(看跌價差或看漲價差)相比,鐵鷹的實際優勢之一是鐵鷹的初始和維持保證金要求通常與單個垂直價差的保證金要求相同,但鐵禿鷹提供了兩份權利金而不是隻有一份權利金。當交易者預計股票價格不會發生重大變化時,這可以顯着提高潛在的資本風險回報率。

多頭鐵鷹式

多頭鐵鷹式策略適用於投資者預測股價在一段時間內將劇烈波動時(大幅上漲或下跌)使用。多頭鐵鷹式策略由兩個看漲期權和兩個看跌期權組成,四個期權使用四個從低到高價差相等的行權價格,合約數量比例爲1:1:1:1。此策略風險有限,盈利也有限。期權到期時,如果股價高於最高行權價或股價低於最低行權價,投資者可以獲得最大的盈利。

空頭鐵鷹式

空頭鐵鷹式策略適用於投資者預測股價在一段時間內將維持不變或在一個很小的區間內波動時使用。空頭鐵鷹式策略由兩個看漲期權和兩個看跌期權組成,四個期權使用四個從低到高價差相等的行權價格,合約數量比例爲1:1:1:1。此策略風險有限,盈利也有限。期權到期時,如果股價在兩個中間行權價的區間內,投資者獲得的最大盈利爲創建此策略收到的淨權利金。

案例:

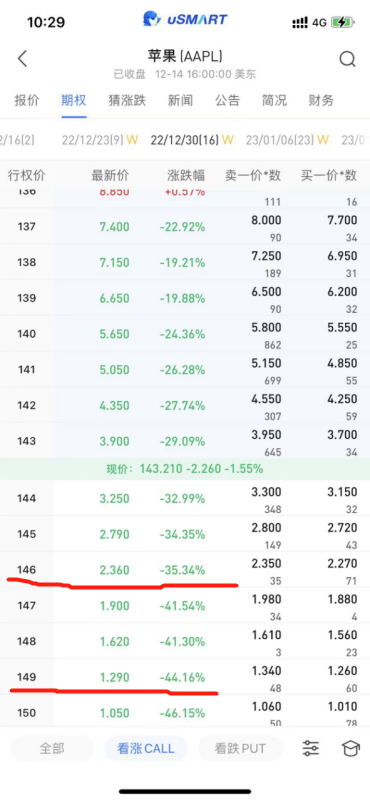

以空頭鐵鷹爲例,在蘋果上可以通過四個期權建立鐵鷹策略。

1、賣出一張行權價爲141的蘋果看跌期權(12月30日到期),收穫236(2.36×100)美元。

2、買入一張行權價爲138的蘋果看跌期權(12月30日到期),付出152(1.52×100)美元。

3、賣出一張行權價爲146的蘋果看漲期權(12月30日到期),收穫236(2.36×100)美元。

4、買入一張行權價爲149的蘋果看漲期權(12月30日到期),付出129(1.29×100)美元。

建立策略完成,整體上收穫191美元權利金。

在這個策略的構成中,看漲期權行權價之間的差和看跌期權行權價之間的差相等,所有期權在開始時都是虛值的。在這些標準下,建立該頭寸時常能獲得一筆收入。

如果蘋果股票在到期日時,位於141-146的行權價之間,那所有期權都會無價值到期,該交易者能獲得等於初始收入的盈利。這是該交易能提供的最大潛在盈利,本例中爲191美元。

相反的,如果蘋果股價在到期時大於149或者小於138,那就會實現最大損失,在本例中是109美元。最大損失=較高行權價之差—最初的收入=149-146-1.91=1.09.

就本案例而言,空頭鐵鷹式策略是在下注於蘋果股價不會大幅度波動。在統計學上,股票大幅度波動確實是少數會發生的情況,整體上看鐵鷹式策略實際上是一種成功率很高的策略,鐵鷹式策略有很大的機會獲得小額盈利。理想情況下,投資者可以把這些行權價設置得離當前股票價格足夠遠,讓出現最大損失的概率足夠小。