“不花錢”做空,這個期權策略幫你笑對熊市

持有股票頭寸時,期權的使用往往圍繞如何保護股票下行風險或如何降低股票持倉成本而進行。

保護股票下行風險有買入看跌期權的策略(Protective Put),降低股票持倉成本則可以進行備兌開倉(Covered Call)。爲了兼顧兩者,領式期權(Collar)——這種新策略就誕生了,值得一提的是,在真實的美國期權市場交易中,領式期權是很流行的針對股票的套保方式。

領式期權到底是什麼?

領式期權(Collar)實際上是保護性看跌期權(Protective Put)的改進策略。對實際投資者而言,使用期權保護現貨的投資組合與其說是實踐運用,不如說是一種理論練習。當人們真正試圖利用看跌期權保護股票時,常會發現保險的成本過高。

於是領式期權應運而生,它的操作方法是在持有股票的前提下,在買進一手虛值看跌期權爲保險的同時,賣出一份虛值的看漲期權用以支付保險的成本。這相當於在股票上放上了一個領圈(Collar),股票的收益被鎖定在其內部,領式期權由此得名。領式期權事實上是Protective Put 和Covered Call 的組合,它以拿掉了部分上行盈利的可能性爲代價限制了下跌的風險。

當交易者在相關市場擁有看多持倉,並希望保護持倉免受市場下行衝擊時,可利用領式期權。執行領式策略雖可防範下行風險,但亦會限制上行潛力。

領式期權有可能免費(零成本領式策略)

領子期權策略最常用作靈活的對衝期權。如果投資者持有股票的多頭頭寸,他們可以建立領式頭寸以防止鉅額損失。當標的資產價格下跌時,通過保護性看跌期權可以獲得收益。出售的有擔保看漲期權可用於支付看跌期權的費用,並且標的上漲時,仍有上行盈利空間,直至看漲期權的執行價格。當看跌期權的全部成本被賣出看漲期權所覆蓋時,這被稱爲零成本領式策略。

零成本鎖定虧損,戰勝大熊市(領式策略案例)

假設投資者持有最近現價爲 93.16 美元的100股Meta,在接連大跌下,投資者不確定近期內的價格會如何變化,想爲自己的持倉買一份保險。即可在持有Meta的前提下,在買進一手虛值Meta看跌期權做爲保險的同時,並賣出一份虛值的Meta看漲期權用以支付保險的成本。

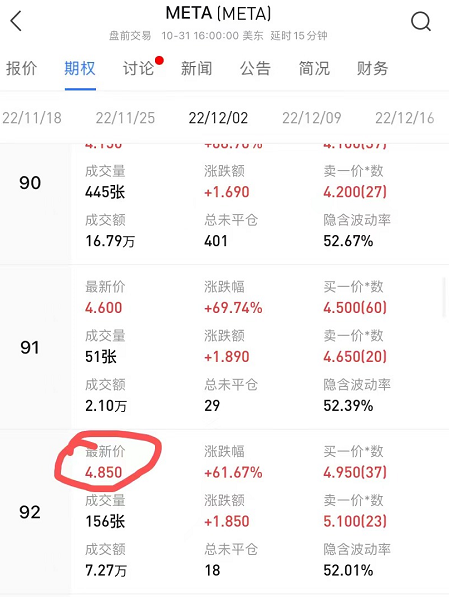

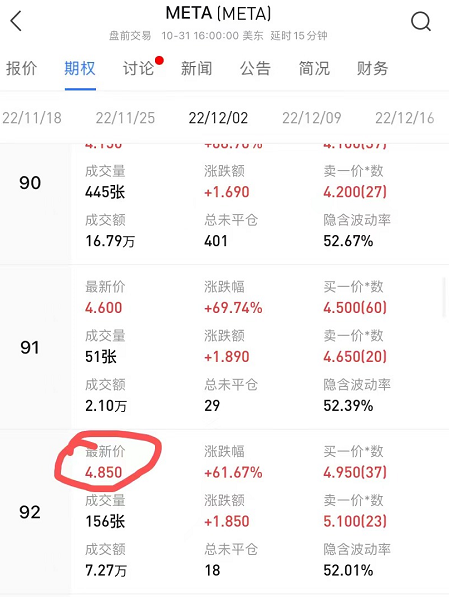

具體來說,投資者以 4.85 美元的價格買入行使價爲 92美元、到期日爲12月2日的看跌期權。還可以 96美元的執行價格賣出價格爲 4.85美元,到期日爲12月2日的看漲期權。按照這種方案,投資者即零成本建立了一個保護性策略。

在這個策略中,當到達合約到期日,領式期權的盈虧平衡點=標的價格-看跌期權權利金+看漲期權權利金,即爲93.16-4.85+4.85= 93.16美元。

而當標的價格上漲到賣出看漲期權的行權價格96美元時,組合獲得最大收益。最大收益=賣出看漲期權行權價格-標的買入價格+賣出看漲期權的權利金-買入看跌期權權利金,即96-93.16=2.84,每股最大利潤爲2.84美元,100股爲284美元。

最後策略的核心是領式期權的保護屬性。如果標的價格下跌超過買入看跌期權的行權價格92時,不管下跌到多低的價格,虧損都將被鎖定。最大虧損=買入看跌期權行權價格-標的買入價格+賣出看漲期權權利金-買入看跌期權權利金,即92-93.16=負1.16美元,100股爲116美元。不管Meta在12月2日之前下跌多少,投資者的最大虧損都將只爲116美元。

領式策略與保護性看跌策略的不同

可以清楚感受到,領式期權的應用主要還是以防止市場大跌爲主,同時保留股票適當的上升空間。零成本可以免費給投資者一張保護墊,非常適合在熊市中使用,若認爲短期會出現趨勢性上漲的行情,只不過擔心黑天鵝或者其他事件的擾動,纔買入看跌期權進行保護,那麼就不建議採用領式期權策略,採用保護性看跌期權策略即可。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.