輪證日報|海運股繼續活躍,中遠海控牛證漲80%

今日市場短評

港股主要指數收盤漲跌不一,恆指漲0.55%,國指跌0.1%,恆生科技指數跌1.16%,下破5000點大關再創新低價。盤面上,菸草概念板塊跌幅最大,思摩爾國際大跌近10%,中汽協預計2月汽車行業銷量環比下降34.2%,汽車股午後跌幅進一步擴大,長城汽車重挫超11%;在線教育股、手遊股、教育股紛紛走低。另一方面,機構稱俄烏戰事或將刺激航運運價上行,海運股持續走強,受益燃油附加費上調,航空股上揚明顯,煤炭、石油、黃金等避險板塊活躍,內房股、物管股、大金融股撐市。大型科技股科技股漲跌各異,網易跌超2%,美團、快手、騰訊控股皆跌超1%,百度、阿裏巴巴小幅收漲。

窩輪焦點

中國鋁業(02600)

中鋁認購證(25740)到期日:2022年3月槓桿:55.05倍

有色金屬板塊走強 能源成本導致海外鋁廠大規模減產 倫鋁創歷史新高

消息面上,受俄烏局勢緊張影響,倫敦市場鋁價站上3400美元/噸,超過2008年來最高位。據悉,俄羅斯作爲全球第二大的電解鋁生產國其產能佔到全球的6%,歐洲能源價格的高漲也帶來當地電解鋁減產的進一步加劇。3月1日 LME 鋁庫存減9750噸至814275噸。分析人士表示,能源成本仍導致海外鋁廠大規模減產,支撐鋁價高位運行。

牛熊證焦點

中遠海控(01919)

遠海牛證(25432)到期日:2022年3月

回收價:8.74槓桿:22.92倍

海運股繼續活躍

摩通:料今年集裝箱航運業發展更強勁,予中遠海控、東方海外增持評級

摩根大通發表研究報告指,雖然市場擔憂即期運費及利潤增長趨勢見頂,但預期全球集裝箱航運業今年發展將更加強勁,其中調研機構Drewry預測行業息稅前利潤(EBIT)將達到2,000億美元,高於2021年的1,900億美元。

摩通預期,受合約費率及比率較高所支持,今年行業被低估的情況將轉變,同時預期今年即期運費將有所調整,整體行業供需將變得更加有利。中遠海控(1919.HK)管理層透露年初至今合約費率續簽進展順利,長途航線的費率好過早前預期,淡季內船舶利用率仍保持高位,預期農曆新年假期後需求將反彈,同時全球港口擁堵問題未必在短期內得到解決。

同時摩通指出,馬士基巨型貨船日前擱淺,證明隨着全球供應鏈拉長,整個行業便容易發生事故;Omicron疫情惡化,導致人手短缺,亦加劇美國主要港口的擁堵狀況。

但該行認爲需求高企下,今年行業收益有望進一步攀升,各航企去年第四季業績亦異常強勁,重申對中遠海控、東方海外(0316.HK)及長榮海運的“增持”評級。中遠海控目標價由29港元輕微上調至30港元,而東方海外目標價則由387港元升至401港元。

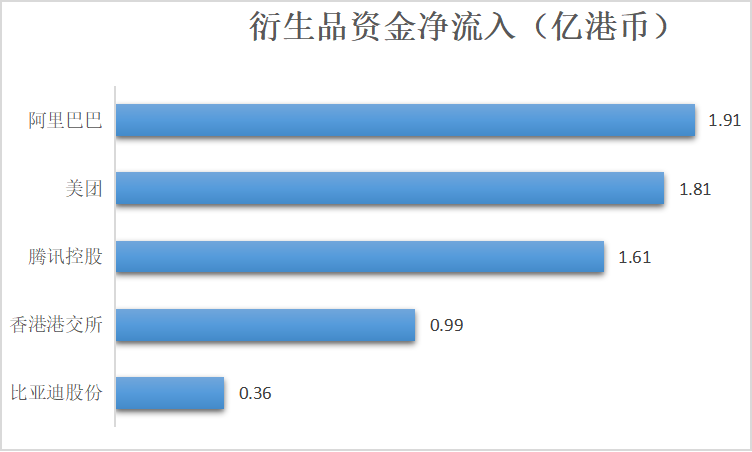

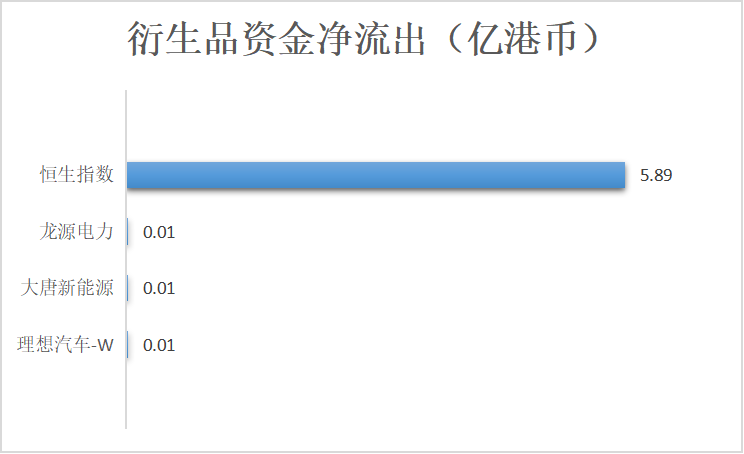

衍生品資金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.