與勁敵相比,第一太陽能被低估了

有分析認爲,在太陽能概念股方面,與SunPower(SPWR.US)相比,第一太陽能(FSLR.US)目前是更好的選擇。數據顯示,第一太陽能的市銷率約爲3.4倍,與SunPower的3.3倍相當;但其Price/EBIT僅爲16倍,遠低於SunPower的210倍。

兩家公司都在疫情期間受益,對太陽能產品的需要總體上升使得兩家公司在2021年上半年均錄得21%的同比增長。2021年上半年,第一太陽能的每股收益爲2.75美元,較上年同期的1.21美元增長127%;相比之下,SunPower的每股收益由上年同期的0.11美元小幅增長至0.16美元,不過該公司的持續運營每股收益實際上由上年同期的0.46美元下降至0.16美元。

分析人士在對比了第一太陽能和SunPower在營收增長和運營利潤率增長方面的差異之後,認爲在目前的估值水平上,第一太陽能比SunPower更值得投資。

1、營收增長方面,第一太陽能是明顯的贏家

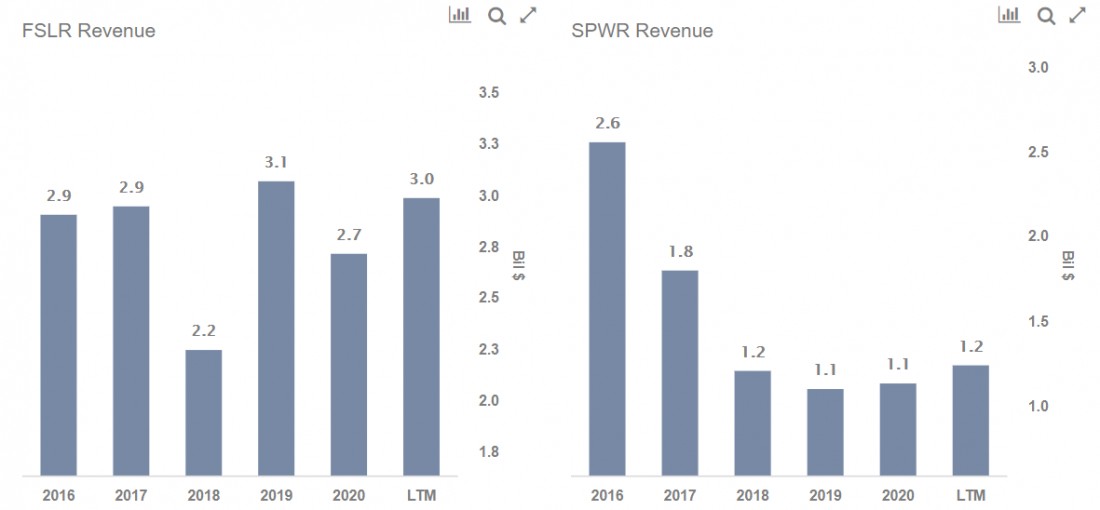

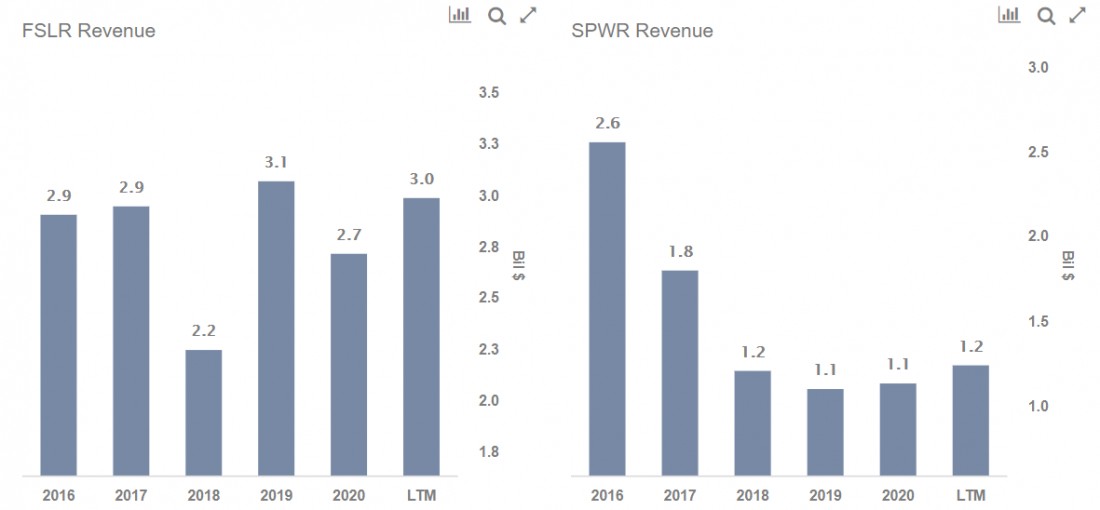

由於需求大幅減少,所有太陽能公司在2018年的營收都有所下滑。第一太陽能的營收由2016財年的29億美元下降至2018財年的22億美元,而同一時期,SunPower的營收則由26億美元下降至12億美元。

之後,第一太陽能扭轉了局面,並在過去的12個月裏錄得30億美元的營收;與此同時,SunPower的營收水平仍維持在2018財年。

此外,第一太陽能是一家規模更大的公司,其營收規模是SunPower的2.5倍,加上該公司過去三年強勁的營收增長,第一太陽能明顯勝出。

2、利潤率方面,第一太陽能再下一城

雖然兩家公司的利潤率在過去3-4年時間裏都在穩步上升,但SunPower直到最近才實現盈利,並且仍在努力維持其盈利水平;該公司在2019財年的息稅前利潤率爲5.5%,過去十年首次錄得正值,而其過去12個月的利潤率僅爲1.6%。相較之下,第一太陽能近年來的息稅前利潤率增長強勁,由2019財年的-5.3%上升至2020財年的11.7%,過去12個月的利潤率進一步上升至19%。

3、總結

在營收和利潤率方面,第一太陽能在近年來都勝過SunPower且增長更爲強勁。即便考慮到疫情後期的復甦情況,第一太陽能的表現也遠遠好於SunPower。雖然兩家公司在估值上存在較大差距,但在強勁的財務業績支撐下,第一太陽能有望彌補與SunPower之間的估值差距,因此,就目前而言,第一太陽能是一個更值得買入的標的。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.