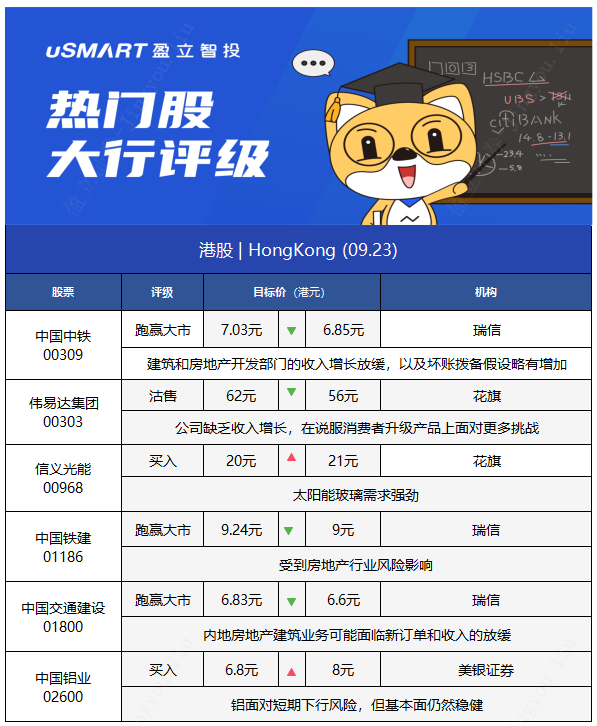

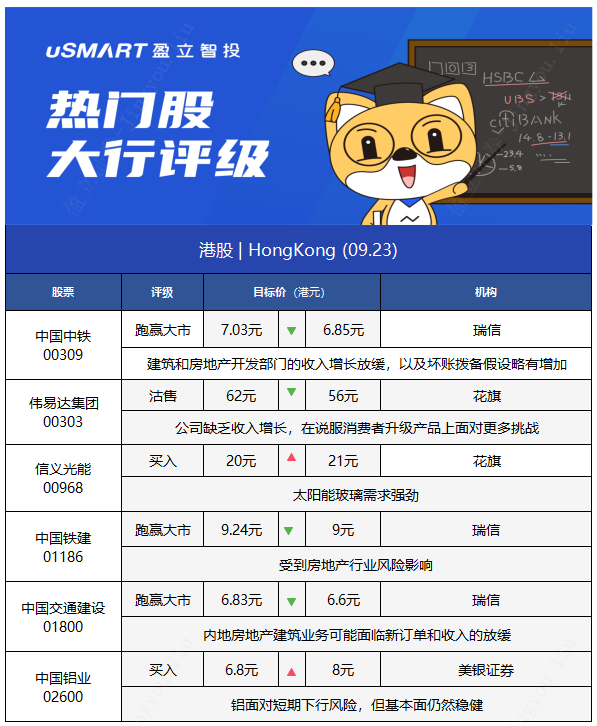

大行每日評級 | 瑞信維持中國中鐵跑贏大市評級

1.瑞信:維持中國中鐵(00390)“跑贏大市”評級 目標價降2.5%至6.85港元

瑞信發佈研究報告稱,維持中國中鐵(00390)“跑贏大市”評級,將2021-23年的每股盈利預測各下調2.6%及2.8%,原因是建築和房地產開發部門的收入增長放緩,以及壞賬撥備假設略有增加。該行將公司H股目標價由7.03港元下調至6.85港元,並將A股目標價由9.45元下調至9.2元人民幣。

2.花旗:重申偉易達集團(00303)“沽售”評級 目標價降9.6%至56港元

花旗發佈研究報告稱,重申偉易達集團(00303)“沽售”評級,公司盈警預告中期純利跌35%至40%,表現遜於該行預期,因此降其2022-24年度盈利預測分別10%/7%/4%,目標價由62港元降至56港元。該行指,公司缺乏收入增長,在說服消費者升級產品上面對更多挑戰,而且也難以將貨運及原料成本上升轉嫁客戶。

3.花旗:重申信義光能(00968)“買入”評級 目標價升5%至21港元

花旗發佈研究報告稱,重申信義光能(00968)“買入”評級,以反映太陽能玻璃需求強勁,今年需求預計同比增長38%,加上近期加價有助毛利率小幅上升,足夠抵銷原材料及天然氣每單位成本,同時行業新增產能也較先原預期少等利好因素。下調公司今年全年盈利預測9%以反映較低銷量,上調明年盈測28%以反映均價提升,下調2023年盈測4%以反映更保守毛利率預期,目標價自20港元上調至21港元。

4.瑞信:維持中國鐵建(01186)“跑贏大市”評級 目標價降2.59%至9港元

瑞信發佈研究報告稱,維持中國鐵建(01186)“跑贏大市”評級,目標價由9.24港元降至9港元,將今年至後年的每股盈利預測下調3%,預計該公司收入增幅會放緩,並輕微上調壞賬撥備預測。

報告中稱,所覆蓋建築商因爲承建房企工程以及發展自身物業項目,因而受到房地產行業風險影響,包括新訂單及收入減少、房價下跌、收賬減慢、融資環境收緊。

5.瑞信:維持中國交通建設(01800)“跑贏大市”評級 目標價降3.3%至6.6港元

瑞信發佈研究報告稱,維持中國交通建設(01800)“跑贏大市”評級,目標價由6.83港元下調至6.6港元,將2021-23年的每股盈利預測下調各3.3%及3.2%,因爲收入增長略微放緩,而且對其壞賬準備的假設較高。

該行表示,公司A股目標價由11.47元人民幣下調至11.09元人民幣,並認爲內地房地產建築業務可能面臨新訂單和收入的放緩,及應收賬款回款速度放緩的風險。

6.美銀證券:重申中國鋁業(02600)“買入”評級 目標價升17.6%至8港元

美銀證券發佈研究報告稱,重申中國鋁業(02600)“買入”評級,上調2021-23年鋁銷售均價預測介於3%至21%,並升氧化鋁銷售均價預測介於5%至9%,2021-23年盈測升介於34%至109%,以現金流折現率計,目標價由6.8港元升至8港元,併爲內地金屬及鋼行業首選。

報告中稱,該行全球商品團隊指出跨種商品進一步價格上行面臨風險。內地政府正出手重組商品密集行業,在物業市場收緊信貸、持續遏制排污(損害鋼鐵生產及鐵礦砂需求),以及汽車芯片短缺下,致商品需求下降。

該行表示,上調今年鋁價預測0.4%至每噸2465美元,及明年升13%至每噸3250美元。認爲除中國內地外,全球鋁生產商均缺乏意欲加大投資和產量。而中國鋁價則受減產和新生產線押後,4500萬噸產能上限未達限所支持;至今187萬噸產能已被停止,預計未來更多;新能源車、再生能源和出口增長多於房地產業潛在下行。雖然鋁面對短期下行風險,但基本面仍然穩健。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.