轮证日报 |投行升目标价,小米牛证涨60%

| 今日市场短评

恒指今日小幅高开,涨0.35%,午间收涨1.26%,收报26502.84点,涨0.75%。恒生科技指数收涨0.21%。

盘面上,阿里概念股、互联网医疗股涨幅居前,在线教育股、光伏太阳能股走弱。

个股方面,新股华润万象生活收涨25.56%,报28港元;小米集团收涨4.36%,获中信上调目标价至36港元;京东健康上市次日收涨2%;华住集团收跌6.81%,遭瑞信下调评级至中性;华虹半导体收跌6.8%。

| 窝轮(认股证)

华润啤酒(00291)华啤认购证(18740)到期日:2021年5月杠杆:4.84倍

华润啤酒再创历史新高,机构指啤酒高端化拐点已至

交银国际指出,鉴于百威亚太和华润啤酒的强劲高端化趋势和明年从低基数的回升,仍然偏好啤酒行业。

中信证券表示,中国啤酒高端化拐点已至,这既是啤酒行业发展的必然阶段,也是反复博弈后啤酒龙头公司的必然选择。看好高端化拐点下的啤酒龙头,首推华润啤酒、重庆啤酒,推荐青岛啤酒、百威亚太。

友邦保险(01299)

友邦认购证(26594)到期日:2021年1月杠杆:15.96倍

瑞银:上调友邦目标价至105港元 料明年可强劲复苏瑞银发表报告表示,重申对友邦保险买入评级,上调对其目标价由83港元升至105港元,此按综合方式作估值,反映上调对其2021年至2024年新业务价值预测最多6%。该行上调友邦2021年及2021年每股摊薄盈利预测均3%,分别至0.6美元及0.66美元。瑞银料友邦明年可能是强劲复苏的一年,指友邦仍是该行保险业务的首选,料公司可从新冠疫情的影响中恢复,特别是香港离岸业务。该行预测友邦于2021年新业务价值按年增长36%、料其2022年至2024年新业务价值按年增长介乎23至27%。

| 牛熊证焦点

小米集团(01810)

小米牛证(67419)到期日:2021年6月回收价:24.2杠杆:9.12倍

中信证券发布小米集团深度跟踪报告。维持公司“买入”评级,上调公司目标价至36港元,这是小米上市以来,境内外机构给出的市场最高目标价,对应市值8700亿港元。中信证券认为小米手机×AIoT战略剑指下一代科技红利,有望成为最受益的中国科技公司之一,跻身万亿市值俱乐部。

中信证券认为,小米已经成为中国科技与互联网巨头中产业链最长、业务最复杂的全球化公司。2020年年初至今公司股价上涨144%,代表资本市场对小米的认知在持续演进。

报告中提出,小米不断得到资本市场认可的主要驱动力有三大方向。首先,小米手机业务重回全球第三,站稳高端。第二,手机×AIoT战略剑指下一代科技红利,小米在中国智能家居市场市占率排名第一。第三,手机×AIoT的场景融合,会让小米的长期变现空间扩大,这是真正超预期之处。

腾讯控股(00700)

腾讯牛证(62712)到期日:2021年10月回收价:550

杠杆:13.39倍

大和:腾讯控股重申买入评级 目标价700港元

大和发研报指,近日与腾讯控股首席策略官James Mitchell对话,管理层相信公司在长远自然增长,及并购方面的策略变动有限,将继续投资中小型企业少数股权。虽然目前有额外的监管要求实施,不过提供更公平的竞争环境,亦有助公司开拓新业务的机会。

该行指,预期未来批出的游戏,将推动网上游戏收入增长,料明年收入按年增长15%,管理层亦维持对公司长远增长的信心。公司的月活跃用户人数改善,亦有助推动货币化,但预期减少中国第三方应用程式的收费,有助改善毛利。

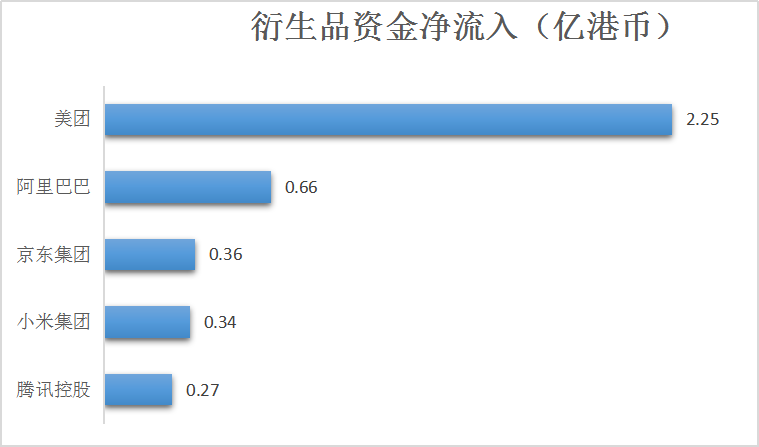

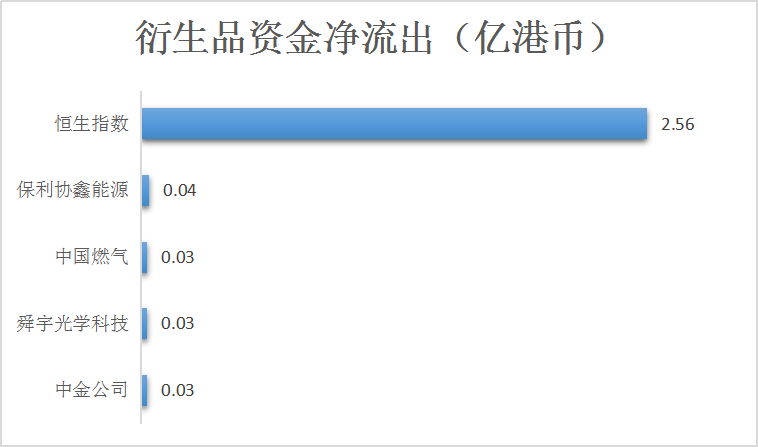

| 衍生品资金流入/流出

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.