中芯國際(00981.HK):穩步推進先進工藝開發,維持“買入”評級

機構:國信證券

評級:買入

Q3 收入同比增 32.6%,中國內地及香港收入佔比持續上升

Q3 營收為 10.83 億美元(約合人民幣 76.38 億元),同比增長 32.6%,環比增加 15.3%,高於市場預期的 9.948 億美元;Q3 毛利為 2.620 億美元,同比增加 54.3%;歸母淨利潤為 2.56 億美元,同比增加 122.7%,創歷史新高;毛利率為 24.2%。中芯國際調整全年收入增長預期,上修為 24%到 26%,全年毛利率目標高於去年。三季度營收增長的主要原因是報告期內需求強勁、平均售價上升和其他收入增加。分地區看,中國大陸收入佔比持續增長至 69.7%,證明我們去年以來的判斷——受益於芯片代工國產化,我們認為該趨勢仍將持續,並將維持高速增長趨勢。

2020Q4 收入指引環比減少 10~12%

由於出貨量減少、產品組合變化導致 ASP 下降,產能利用率下降,以及其它收入貢獻減少,公司對 2020Q4 收入指引環比減少 10%~12%。

14/28nm 合計貢獻 14.6%收入

14/28nm 合計佔 9.1%,環比提升 5.5 個百分點。

在中國大陸擁有絕對壟斷的競爭格局,維持“買入”評級

買科技公司,就是買壟斷。中芯國際的競爭格局超過中國大陸任何一家公司。

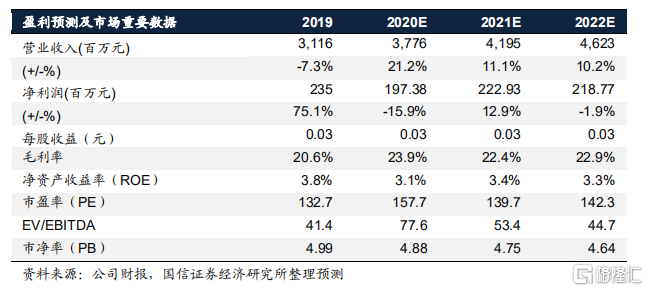

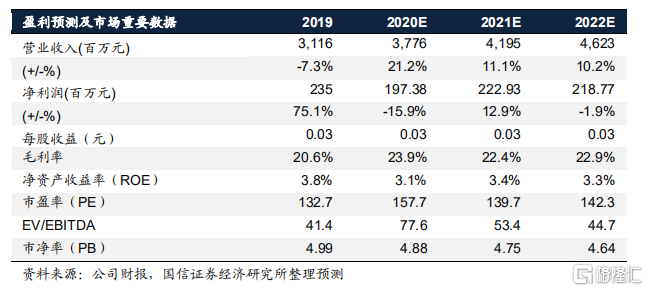

“資金+技術”雙壁壘確保公司龍頭地位競爭對手難以企及。從全球範圍看,中芯國際作為半導體代工的技術跟隨着,技術節點突破是關鍵,應該先看公司的技術,再看收入,最後才是利潤。從供給的角度看,在中國大陸中芯國際的競爭格局非常好,既是現在的龍頭,也是未來的龍頭。在可見的未來,在 14nm及以下的先進製程領域,中芯國際在中國大陸不會有競爭對手。預計2020~2022 年收入分別為 37.76 億美元/41.95 億美元/46.23 億美元,增速21.2%/11.1%/10.2%,2020~2022 年利潤分別為 1.97 億美元/2.22 億美元/2.18億美元,增速-15.9%/12.9%/-1.9%。維持業績預測和“買入”評級。

風險提示

先進工藝進展不及預期,全球產能鬆動,影響公司毛利率。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.