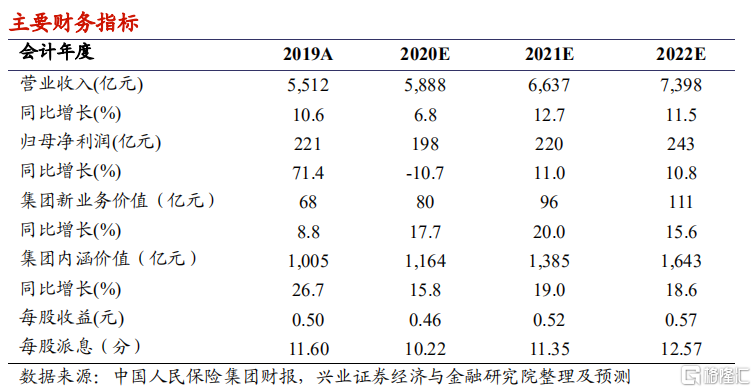

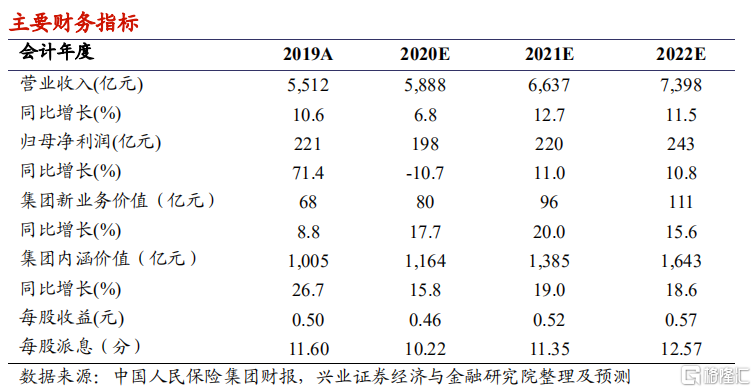

中国人民保险集团(01339.HK):财险综合成本率提升,人身险续期拉动效应加强,维持“审慎增持”评级,目标价10.65港元

机构:兴业证券

评级:审慎增持

目标价:10.65港元

投资要点

我们的观点 :人保集团控股人保财险、人保寿险、人保健康等子公司,公司财险龙头地位稳固,寿险健康险业务边际改善,长期发展向好。我们维持公司“审慎增持”评级,维持目标价 2.94 港元。2020-2022 年,目标价对应的集团每股净资产各为 0.55、0.50 及 0.46 倍,建议投资者关注。

税收因素致使归母净利润同比下滑:2020Q1-3,人保集团营业收入同比增长 6.9%至 4,531 亿元(人民币,下同);税前利润同比增长 7.8%,但归母净利润同比下降 12.3%至 187.4 亿元。主要是 2019 年执行手续费税务新规的一次性影响所致(新政对 2018 年所得税费用的影响金额一次性确认在2019 年,2020Q1-3 所得税费用低基数高增长)。

财险承保利润下滑,但融资性信保业务逐渐出清:2020Q1-3,人保财险原保费同比增长 3.7%至 3,442 亿元,其中车险、非车险原保费增速各为 5.3%、1.6%。2020Q1-3,公司的车险、融资性信保业务、政策性业务、商业非车险业务的综合成本率分别为 96.4%、139.8%、99.7%、96.4%,承保利润分别为 70.0、-38.1、1.4、15.5 亿元。融资性信保业务大幅亏损,致使人保财险全口径综合成本率同比提升 0.5pcts 至 98.4%,承保利润同比下降15.5%至 48.8 亿元。公司主动压缩低价值率的信用保证保险,Q1-3 该险种累计保费同比下降 71.2%至 52.0 亿元,占财险保费之比降至 1.5%。

寿险续期拉动效应加强,健康险保费大幅增长:1)、子公司人保寿险 “大个险”战略持续推进,2020Q1-3 原保费同比下降 5.3%至 821.2 亿元。其中,期交续期原保费同比增长 8.5%至 417.5 亿元,占比达 50.8%,续期拉动效应显著加强。2)、2020Q1-3,子公司人保健康实现原保费 273.3 亿元,同比增长 45.4%;其中,期交首年及期交续期保费分别同比增长 19.3%、 166.3%。

投资风格稳健,偿付能力充足:2019Q1-3,人保资管积极把握债券配置机会,在年内相对收益高点加大了长期债券配置力度,拉长资产久期。截至2020 年 9 月 30 日,人保集团、人保财险、人保寿险、人保健康的综合偿付能力充足率分别为 320%、299%、266%和 216%,满足监管要求。

风险提示:资本市场波动,保费增速不达预期,公司经营风险,保险行业政策改变。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.