赢家时尚(03709.HK):并表推动上半年营收增长,关注近期可选消费回暖趋势,给予“买入-B”评级

机构:华金证券

评级:买入-B

投资要点

◆ 并表使上半年营收逆势增长,净利润受股份奖励影响:赢家时尚上半年实现营收20.13 亿元/+50.07%,净利润 1.31 亿元/-12.83%,基本 EPS 约 0.19 元。营收端,公司上半年营收增长 50%,主要源于集团旗下娜尔思等品牌 19 年下半年并表,并表口径变化使上半年营收大幅增长。若不考虑并表因素,多数品牌营收增速受疫情影响有所放缓。净利端,上半年净利下降 13%,受公司股份奖励成本 6253 万元影响,若剔除则上半年实现净利润 1.94 亿元/+28.65%,主要的增量同样为并表贡献。

◆ 并表推升门店数量,女装销售受到疫情影响:渠道方面,并表推动门店数量同比大幅增长。去年下半年公司收购集团娜尔思等系列品牌,门店数量大幅增长,上半年公司门店数量达 1750 家,较去年同期的 885 家大幅增长。分品牌看,各品牌上半年均受疫情影响。公司品牌大致可分为四个部分,一是泛 K系主品牌(珂莱蒂尔、拉珂蒂、珂斯),二是泛 N 系主品牌(娜尔思、奈蔻、恩灵),三是收购及自创小品牌 Cadidl、FF 仿佛,四是合作及代理小品牌 De Kora、O’2nd、Obzee。上述四个部分上半年营收占比分别约 51%、43%、4.6%、1.5%。疫情对上半年线下客流及消费信心均产生明显影响,中高端女装受冲击。泛 K 系主品牌营收合计下降 15%,其中偏向轻奢的拉珂蒂品牌实现营收正增长。收购及自创小品牌持续拓店,上半年 Cadidl 营收降幅约 4%,FF 门店数量大幅增长。合作及代理小品牌正处于收缩阶段,对公司整体影响有限。泛 N 系品牌无公开的同口径可比数据,若与去年下半年对比,整体营收下降约 34%。

◆ 疫情下电商及 O2O 提速,线上占比提升:疫情后最先恢复的为电商渠道,叠加公司年初微商城平台建立,电商渠道取得超 100%的快速增长,占比由去年同期的 10%快速提升至上半年的 14%,并有望在 O2O 驱动下继续提升。

◆ 线下客流逐步恢复,中高端女装消费回暖:疫情后线下客流逐步恢复,据ShooperTrak 预计,4 月国内总体客流降幅位于 30%~35%之间,而 5 月该降幅收窄至15%~20%之间。7 月,国内线下总体客流水平降幅约为 25%左右,并未明显恢复。进入 8 月之后,疫情、雨季等因素逐步消除,消费情绪回升,线下客流进一步回暖,同比降幅收窄至 15%左右,推动线下零售降幅收窄至 4%左右。上海服装协会统计的旗下通络的女士时装品类消费,在 7、8 月呈现明显回暖的趋势,增速分别约 30%、18%。赢家时尚旗下品牌在上海服装协会通路中具有较好的表现,2020 年以来珂莱蒂尔、娜尔思两个主品牌持续保持月度销售额前 5 名。赢家时尚在行业中处于领先地位,有望持续受益可选消费回暖趋势。

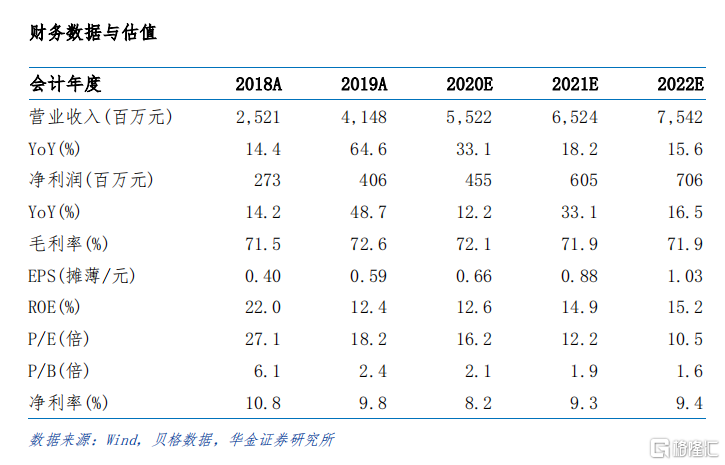

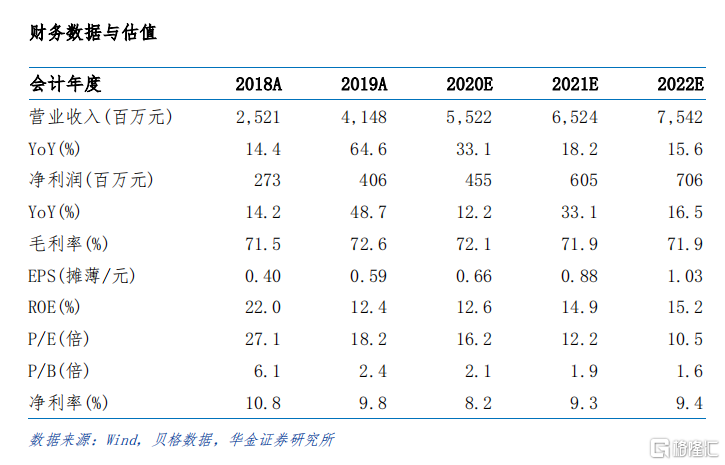

◆ 投资建议:赢家时尚是国内中高端女装市场中具有较强竞争力的公司,双主品牌珂莱蒂尔、娜尔思的销售规模名列行业前茅。5 月公司开始进行股份激励计划,员工积极性提升有望推动公司受益可选消费回暖趋势。我们预测公司 2020 年至 2022 年每股收益分别为 0.66、0.88 和 1.03 元。净资产收益率分别为 12.6%、14.9%和 15.2%。目前公司 PE(2021E)约为 12 倍,给予“买入-B”建议。

◆ 风险提示:疫情影响时段或超预期;新品牌推广及渠道扩张或不及预期;行业库存压力较大或影响公司盈利能力。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.