同程藝龍(00780.HK):復甦趨勢明朗化,上調至“買入“評級,目標價18港元

機構:浦發銀行

評級:買入

目標價:18.00港元

漸進式復甦與我們此前預期一致:我們曾在 5 月 6 日首次覆蓋報告《同程藝龍:靜待“寒冬”消退》中,給出不同於市場的觀點——“持有”評級,主要由於“行業回暖速度或慢於預期,考慮到疫情不確定性以及‘後疫情’影響”。而此後北京、新疆等地先後暴發二次疫情,進一步推遲了全國旅遊業相關政策的放開, 並抑制了居民的出行意願因此,公司近幾個月的股價表現也落後於 MSCI 中國可選消費指數20 日均價與我們此前14.0 港元目標價基本一致。

疫情得到控制,出行需求不斷釋放,上調至“買入”評級:隨着國內疫情趨於穩定,經濟逐步回暖,旅遊業復甦趨勢明朗。我們認為公司已經度過至暗時刻,增長的不確定性基本消除,所以上調至“買入”評級。政策端,全國景區承載量已由 30%上調至 50%,並開放景區室內場所,出行基本恢復常態;十一黃金週火車票預訂恢復往年火爆,出行意願高漲;經濟穩步復甦,助力居民旅遊消費能力提升。公司層面,得益於有效成本管控,二季度利潤遠超市場預期。同時,公司預計第三季度收入同比下降 5~10%,正逐步恢復到疫情前水平。

加大線下獲客,豐富流量入口:我們仍然看好公司獨有的微信流量紅利,以及在低線城市的優勢。低線城市旅遊業在疫情中率先回暖,二季度公司低線酒店間夜量同比上升 15%。此外, 同程藝龍也與酒店、旅遊景區合作,加碼線下流量獲取,包括增設線下掃碼,汽車售票機等。線下獲客使得公司獲客渠道更加多元化,且成本較低。目前,線下獲客用户貢獻約8%的MPU,預計下半年有望超過10%。

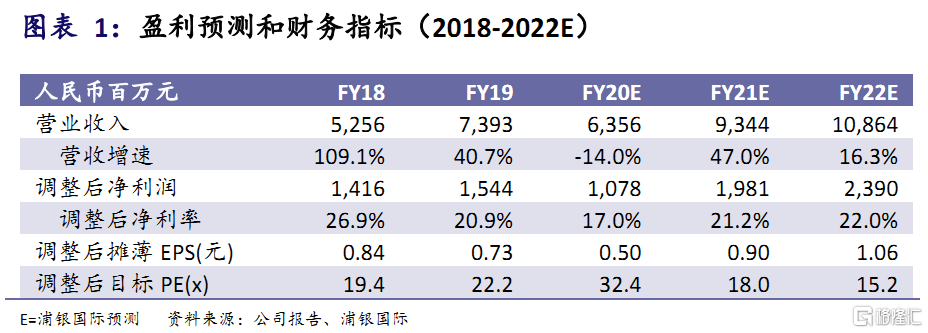

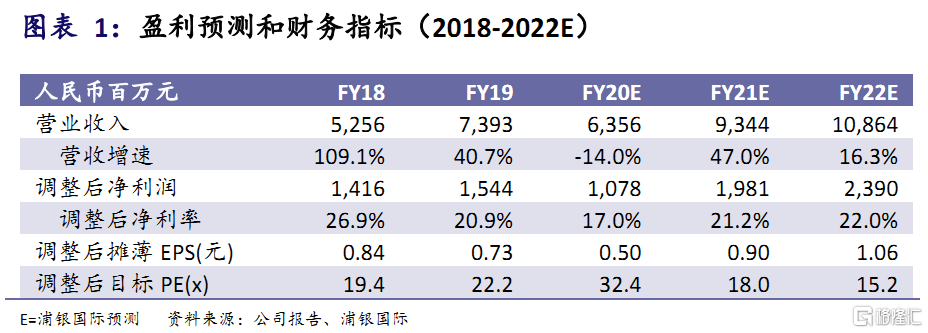

上調至 “買入” 評級,提升目標價至 18.0港元: 由於外部環境改善,我們將 FY20-22 年調整後淨利潤分別上調 7.3%、9.2%和 8.0%,目標價提升至18.0 港元,對應32x和18x的2020E 和2021E 年市盈率。

投資風險:宏觀經濟放緩;競爭激烈。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.