网易-S(09999.HK):游戏业务海外空间广阔,在线教育业务节节高升,给予“买入”评级,目标价203 港元

机构:国元证券

评级:买入

目标价:203 港元

投资要点

游戏自研能力强大,海外成为新增长点:

网易是中国领先的互联网技术公司,在开发互联网应用、服务等方面始终保持中国业界领先地位。其中网易游戏的研发能力在业内属于顶尖层次,分别从游戏整体市场和移动游戏市场份额的来看,公司的市场份额分别为20%和 21%是仅次于腾讯的游戏公司,而且大部分产品均是由公司自主研发,后续产品的 IP 运营也颇有成效。公司的在游戏研发上的优势开始在海外发力,《荒野行动》、《阴阳师》、《第五人格》等热门手游于 2019 年在东南亚市场获得巨大成功,多次晋升畅销榜前十,未来海外游戏市场将成为公司新的增长点。

有道发力在线大班,业务始终处于高增长通道

有道最早基于查找单词、翻译外语、寻找考试要点和掌握新技能获得了大量流量,后期开始发力在线教育业务。而目前教育业务开始发力在线大班业务,前期精品课在市场中已经建立了不错口碑和品牌,因此学习和产品质量提升、课程类别的拓展使得未来有道营收保持快速增长。从历史数据来看,付费学生人数从 2017 年 41.8 万增至 83.34 万人,而且客单价持续大幅提升,精品课付费用户单价从 2017 年 363 元提升至 899 元。大班课的推广将产生规模效应使得成本降低,同时让有道始终处于高增长通道。

网易云音乐获得更多版权,未来逐步提升付费水平:

网易云音乐的版权在和多家唱片公司达成战略合作后,在版权的布局较过去相比已经有了极大提升,这将有利于公司保持用户活跃度及增强竞争实力,而不至于被对手领先太多,另外也有利于公司未来提升整体付费水平,我们认为网易云音乐未来有较大发展潜力。

首次覆盖给予买入评级:

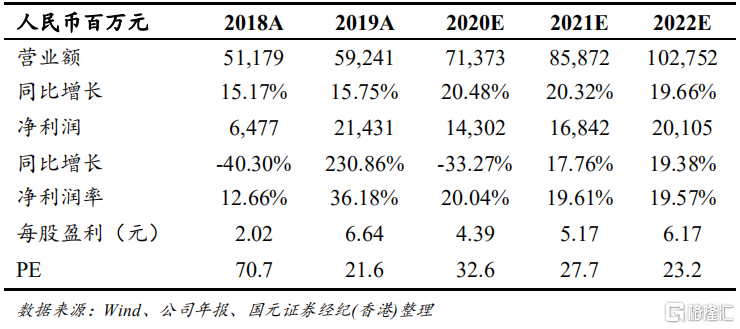

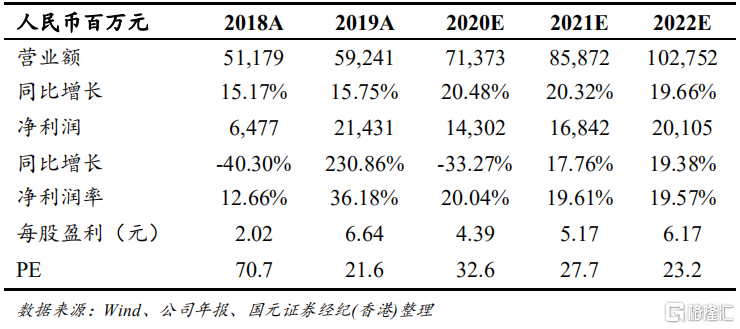

公司为中国移动游戏市场领先者,同时创新业务及教育业务成长态势显著,未来业务发展值得长期看好。我们分别给予游戏、有道、创新业务 30 倍 PE、8 倍 PS 及 5 倍 PS 估值,对应公司合理估值为 6621 亿港元,因此给予公司 203 港元的目标价,首次覆盖“买入”评级。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.