吉利汽車(00175.HK)中報深度點評:關注PMA架構和新一代混動系統帶來的新機遇,維持“買入”評級,目標價19.3港元

機構:西部證券

評級:買入

目標價:19.3港元

● 核心結論

2020年中報業績低於預期,調低全年銷量目標和Capex計劃,維持研發投入。公司公佈1H20收入368億元,同比下滑23%,淨利潤23億元,同比下滑43%,低於預期,原因包括:1)公司上半年ASP同比下滑6%至7.1萬,主要受新能源車國地補退坡、對經銷商返點增加影響;2)由於新工廠攤銷成本增加、研發投入加大,1H20營業費用率上升至13.2%,同環比增長3.3pct、3.7pct,為2015年以來最高;3)領克淨利潤1.9億元,同比下滑29%,主要受新工廠攤銷壓力增加影響。往前看,公司基於全年行業批發下滑10%的預期,調低銷量目標至132萬台。預計年初Capex計劃進一步縮減,與此同時公司研發支出持續攀升,1H20約22億元,全年研發費用率將維持在6%。

PMA平台即將亮相,Waymo加持加速奔向自動駕駛。今年9月PMA平台將在北京車展亮相,該平台採用全新電子電氣架構,具備OTA升級能力,覆蓋A00級到C級車型。首款新車是中大型純電SUV,在領克品牌下推出,預計明年下半年上市,第二款是MPV。2022年吉利、Smart在PMA架構下的產品也將投放市場。我們預計Waymo和沃爾沃將基於PMA平台共同研發L4級 別自動駕駛,後續將有更多品牌加入PMA的“朋友圈”,加速奔向自動駕駛。

新一代混動系統對標日系,新車將全面搭載HEV版本。公司搭載GHS1.0混動系統產品終端接受程度高,明年推出的GHS2.0混動系統和豐田THS、本田iMMD系統展開正面競爭,新車也將全面搭載HEV版本,吉利有望成為首個突破油電混合技術的自主品牌。

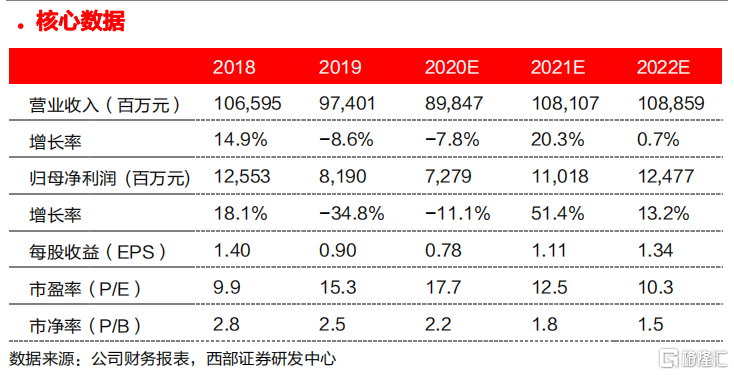

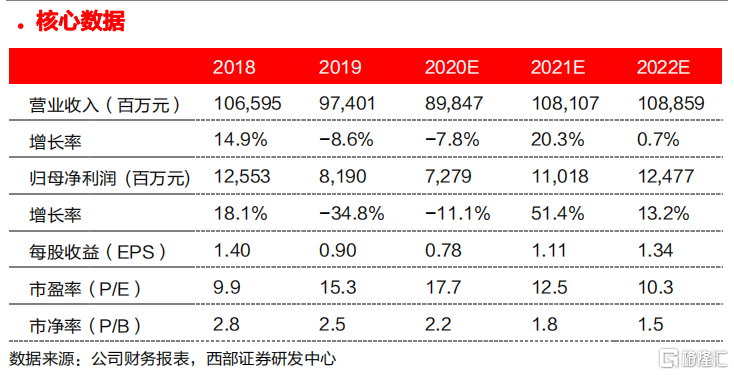

投資建議:我們下調2020-2022年歸母淨利潤預估至73/110/125億元,對應EPS0.78/1.11/1.34元,反映業績不及預期、部分新品上市時間推遲和新工廠攤銷壓力的影響,我們調低目標價至19.3港元,基於DCF模型,隱含2021/2022年16/13倍市盈率,維持“買入”評級。

風險提示:疫情擴散進度超預期、新產品銷售不及預期、車市價格戰加劇。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.