新城悦服務(01755.HK):儲備充足,拓展積極,高速增長,給予“買入”評級,目標價32.0港元

機構:興業證券

來源:買入

目標價:32.0港元

投資要點

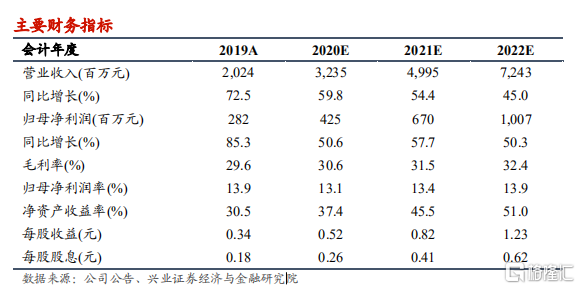

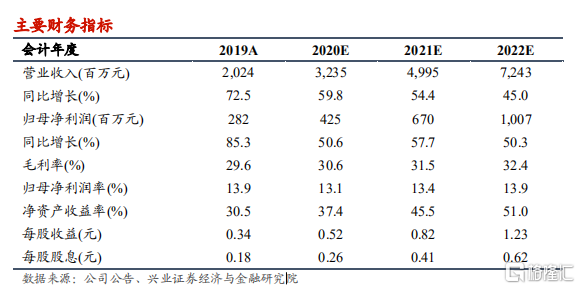

首次評級覆蓋給予“買入”評級,目標價32港元:物管行業正處在快速擴張期,持續享受規模紅利。當前公司已覆蓋全國105個大中城市,逐步向二三線城市發力,關聯方新城控股的土儲與銷售充足,物管品牌實力將為第三方外拓與增值服務持續賦能。基於公司清晰的關聯方交付計劃、明確的三年規劃及高效執行能力,我們預計公司2020-2022年的營業收入分別為32.4、50.0、72.4億元人民幣,分別同比增長59.8%、54.4%及45.0%,淨利潤分別為4.3、6.7、10.1億元人民幣,分別同比增長50.6%、57.7%和50.3%。首次評級覆蓋給予“買入”評級,目標價32港元,對應2020-2022年分別55、35、23倍PE,較2020年8月4日收盤價有29%上升空間。

儲備充足,在管規模加速擴張:背靠新城控股,公司擁有充足的儲備項目,合約在管比維持在2.54的較高水平,2015-2019年在管面積複合增長率達到33%。通過內生+外延併購,2019年第三方項目佔比達到29%,非住宅業態佔比也將提升,預計2019-2022年在管面積的複合增速將超過50%。?積極拓展,開發多種增值服務:公司開發了多類型的增值服務,在常規的開發商相關服務和社區相關服務以外,還增加了智慧園區服務,2019年增值服務的營收佔比已經達到58%,毛利佔比達到60%。

激勵豐厚,管理層執行力強大:公司秉承職業經理人制度,主要管理層具有豐富的行業經驗,發放高行權條件股權激勵彰顯管理層決心與執行力。2019年公司加大拓展力度,第三方拓展團隊增加1倍,年內新增1010萬方第三方面積,其中70%為新項目。同時收併購也積極推進,年內落地的收併購使公司進入商管領域,在管業態進一步豐富。

風險提示:業務擴張和收購不及預期;物業管理費提價受阻;收繳率不及預期;增值業務拓展不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.