建材行业周观点:无惧短期雨水影响,后续需求集中释放旺季或更旺

机构:太平洋证券

报告摘要

短期雨季压制需求,下半年旺季或更旺。长江流域遭遇近年来少见的雨水天气,水泥企业发货受到明显影响,库存上升价格持续调整,目前沿江熟料下调 2 轮,累计约 50 元/吨;江浙沪地区水泥价格调整约 70-100 元/吨,淡季价格回落超出市场预期;短期雨水压制需求,但雨季过后或迎来需求更集中释放,从 6 月份挖机销量同比增长约 63%来看,需求依旧强劲;同时近期国家再次下发 1.26 万亿专项债,累计达 3.55 万亿,上半年基建投资开始逐步回暖,下半年有望更进一步提振需求。我们认为,随着部分地区开始自律停产推动价格反弹,淡季价格调整基本接近尾声,后续可积极布局下半年价格触底反弹的行情,需求推迟并未消失,旺季需求集中释放或迎来价格更猛烈的反弹。整体来看,基建催化将贯穿全年,以基建为主的区域需求有望超预期,西北及华北区域价格弹性十足;其次下半年华东、华南地区有望保持高景气度,尤其地产快速恢复,新开工及施工仍将保持稳定增长,稳经济背景下,地产投资或再超预期带来新的惊喜。水泥仍将是内需里最确定的板块,当前主要水泥企业估值在 6-8 倍,估值仍处低估区间,随着国内流动性宽松,板块整体估值或抬升,板块行情有望贯穿全年。

其次,精装时代坚守消费建材龙头,B 端快速放量,龙头企业集渠道、品牌、规模于一体,市场份额稳步提升;而在 B 端集采快速推动的时代或打造出新的护城河,未来有望迎价值重估;叠加上半年成本下行带来的红利,龙头品牌建材成长性突出。

玻璃:7 月以来库存下滑超预期,价格上涨趋势不改。本周行业库存环比下滑 4.29%,超出市场预期,这与龙头企业高出货率相互验证;库存持续去化,价格仍呈上涨趋势,玻璃行业底部反转景气度确定性回升,下半年盈利弹性十足。从需求端来看,5 月份玻璃表观需求增速同比增长约 31%,强势转正,进入 6 月份行业库存继续下降,需求韧性十足;我们认为,随着价格反弹,企业盈利快速恢复,近期部分生产线有点火复产计划,但考虑到复产成本及部分生产线窑龄到期,下半年产能有望保持动态平衡,全年来看产能仍有望保持收缩态势;全年来看,2020 年仍有望进入竣工周期,5 月份地产竣工面积增速已经同比转正,从部分地产企业公布的 2020 年竣工计划来看,全年仍保持稳定增长,地产新开工仍有望加速向竣工端传导提振行业需求。而由于今年成本更低,目前纯碱价格已跌至 1300 元/吨以下,较去年同期下滑 500 元/吨以上(纯碱价格每下跌 100 元/吨,玻璃箱成本节约 1 元/重箱);同时石油焦及煤炭等价格也持续下滑,原燃料价格下行使的企业成本更低,因此价格反弹过程中企业盈利弹性更大。当前行业处于底部反转向上趋势,供需格局持续改善,龙头企业反弹力度十足。

玻纤:龙头迎中长期布局良机。我们认为,国内下游需求逐步复苏,尤其以风电纱为主,供需格局稳中向好,而当前国外疫情仍处于爆发期,出口仍受到一定影响,部分国家欲积极推动复工复产,国外拐点也有望渐行渐近。拉长周期来看,当前仍处于周期底部,我们测算,当前价格下中小企业已经不赚钱,且接近亏现金流,若当前价格持续较长时间,且疫情影响全球供需格局,不排除部分小企业会被淘汰出局,行业集中度继续提升。而 19-20 年新增产能大幅减少,待疫情影响减弱需求旺季到来,2020 年仍将是行业新周期的拐点,对于中长线投资者来说,当前低估值龙头配置价值明显,行业龙头具备规模、渠道及产品结构等优势,反弹力度将大于行业平均。玻纤行业我们首推行业龙头中国巨石:1)公司核心工艺升级引领行业差异化发展,产能稳步扩张;2)电子纱产能扩张优化产品结构;3)规模及成本优势铸就高护城河;4)国际化进程稳步推进,抗风险能力提升,行业触底回升,估值中枢有望迎来修复。

其次关注玻纤制品小龙头长海股份,1)公司池窑技改完成后,生产效率进一步提升,2)打通玻纤纱-制品-精细化工产业链一体化,自我调节能力强;3)产能保持继续扩张(扩建 10 万吨树脂产能,10万吨玻纤纱,5 条薄毡线),打开新的成长空间,向上弹性十足。

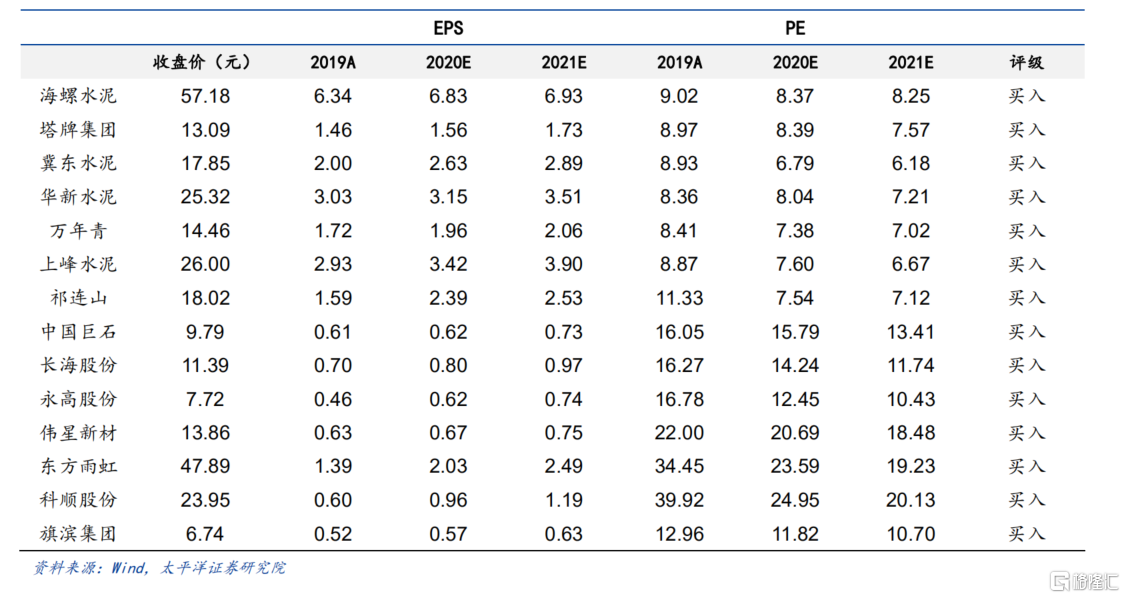

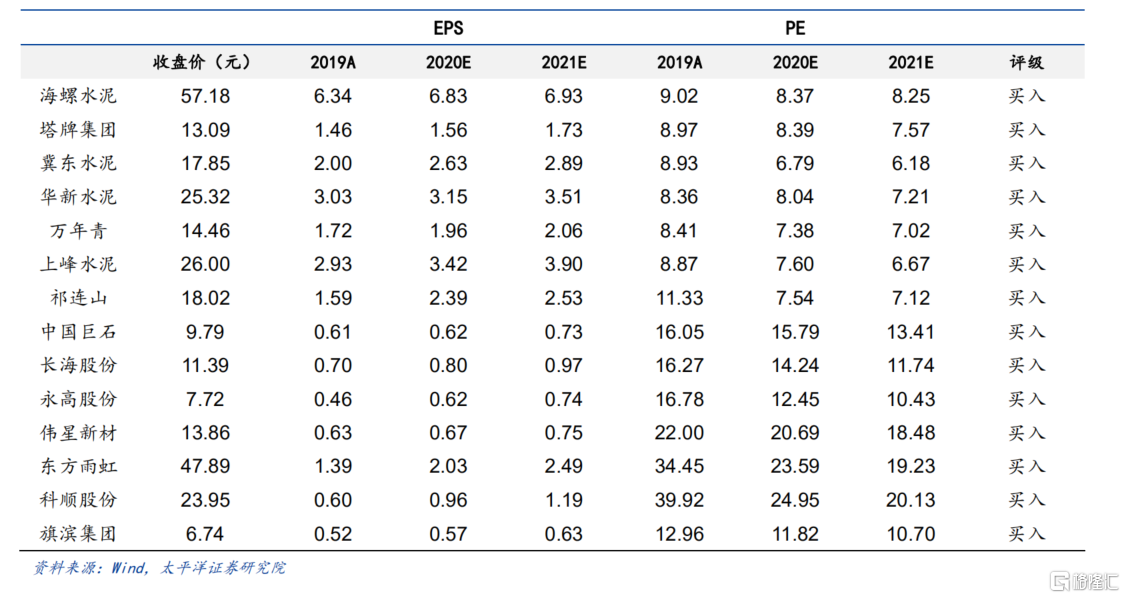

投资建议:首选基建链条的祁连山、冀东水泥;弹性品种塔牌集团、上峰水泥、万年青;标配核心资产海螺水泥、华新水泥;其次是消费建材首选东方雨虹、科顺股份、永高股份、伟星新材等,以及玻璃龙头旗滨集团,关注玻纤底部机会中国巨石、长海股份。

风险提示:地产投资大幅下滑,错峰生产不及预期, 成本大幅上涨

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.