暗盤前瞻丨金融街物業:國企背景的商業物管公司,國配獲得20倍認購,比肩沛嘉醫療

uSMART友信智投 07-03 16:00

uSMART友信智投7月3日消息,今日有1隻新股公佈中簽結果,並將於16:15進行暗盤交易。

金融街物業在2020年中國物業百強企業中排名16,背靠的母公司為金融街集團,控股股東是西城區國資委。

不同於目前港股上市的大部分物業公司,金融街物業的大部分收入來源於以辦公樓為主的商業物業。相對於住宅物業來說,商業物業的增速相對較慢,金融街物業2019年的收入同比增速只有14%,低於同行,同為商業物業為主的寶龍商業35%,而其他住宅物業為主的增速普遍在40%以上。

從估值來看,金融街物業以中間價7.36港元定價,發行市值26.5億港元,在已上市的22隻物業股中排在中下位置。對應2019年靜態市盈率約21倍,寶龍商業約59倍,港股物業股的中位數約40倍,綜合考慮金融街物業的增速,其估值較合理。

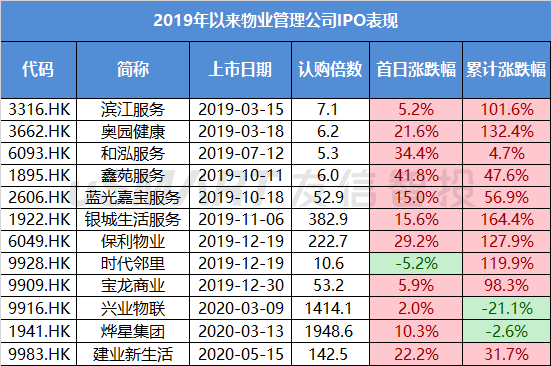

從物業行業表現來看,自2019年以來,有12家物業公司上市,除了發行估值較高的時代鄰里首日微幅破發,其餘都上升,首日平均收市升幅16.5%。從累計表現來看更加驚豔,出現了多隻翻倍股。

暗盤預報

uSMART友信證券暗盤交易時間:7月3日 16:15~18:30

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.