騰訊控股(00700.HK):手遊重回強勁勢頭,各業務展望均不錯,維持“買入”評級

機構:廣發證券

評級:買入

核心觀點:

Q2手遊淡季不淡。Q1手遊收入同比大幅增長64%,遞延收入達837億,為Q2增長奠定基礎,我們判斷Q2收入雖會回落,但仍強勁,根據SensorTower數據,在五五開黑節,520等年度活動助力下,《王者榮耀》5月收入環比增長31%,同比增長42%,帶動騰訊手遊收入環比增長15%,PUBG海外收入4、5月維持環比增長態勢。

DNF手遊暑期上線是近期重要催化,儲備的頂級IP手遊、海外市場是後續增長驅動。DNF手遊是今年下半年到明年的重要增量,LoL手遊、CODM國服等為明年及後年提供增量。截至6月初DNF手遊預約量超4,200萬(來自官網),熱度持續增長。Supercell的《荒野亂鬥》國服近日上線並排到iOS暢銷榜第2。

商業支付恢復,從私域流量到交易閉環,驅動社交廣告、支付增長。央行數據顯示,Q1非銀行支付機構交易額同比增長5%達61萬億元,公司財報顯示微信支付4月最後一週日均商業交易額已恢復至2019年底的水平。騰訊今年重點強化的商業生態(實現交易閉環)、線下商家數字化(藉助互聯網為線下引流),將正向促進廣告銷售,在今年618大促中也將得到驗證。小程序MAU達8.5億(數據來自Questmobile),成為全民、全場景工具。

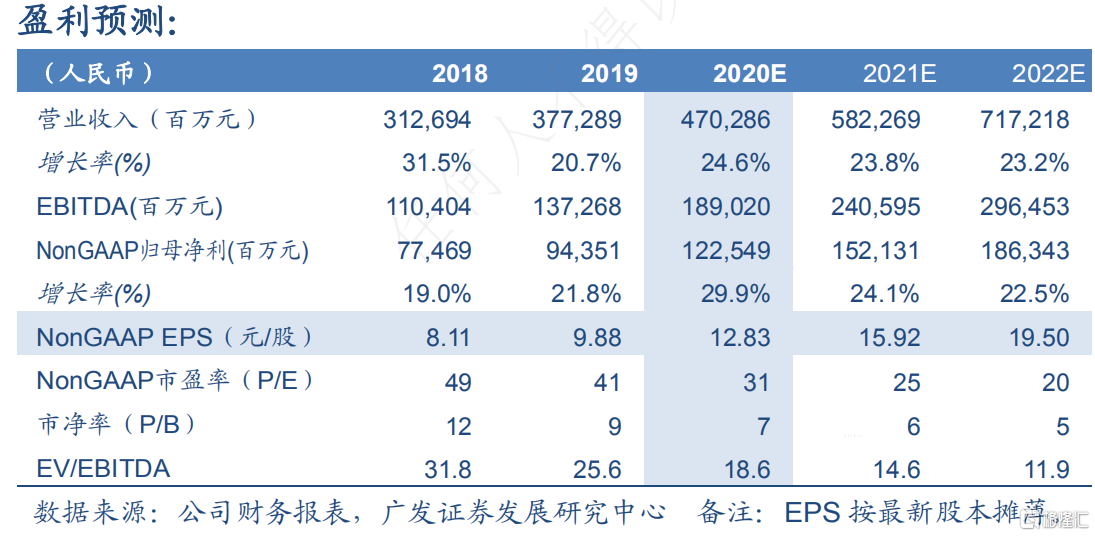

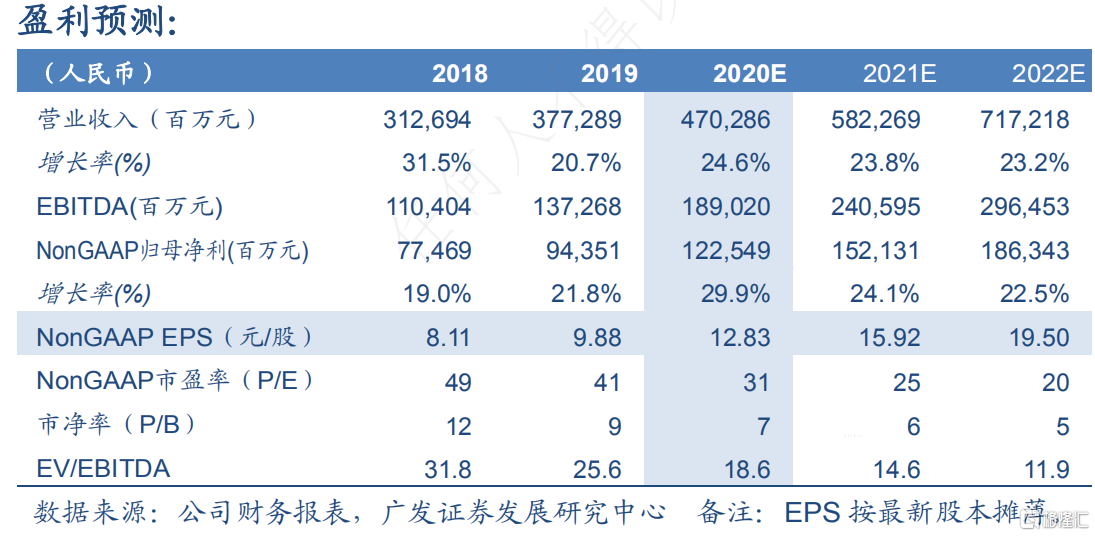

維持“買入”評級。預計20~21年NonGAAP歸母淨利為1,225億元、1,521億元,當前股價對應20~21年PE為31倍、25倍。展望未來,我們認為騰訊的各項業務增長態勢都很不錯,手遊重回強勁增長勢頭,組織架構調整、2B業務佈局已顯成效,正向促進廣告、支付、雲業務快速增長,金融科技和廣告盈利繼續提升,微信商業生態提速,疫情加速企業數字化、在線化,2B業務打開中長期增長空間。基於SoTP,得到合理價值537.0港元/股。

?風險提示:疫情短期影響支付和廣告增長;新遊版號發放和流水不達預期;微信商業生態進展不及預期;支付和雲行業競爭致費用提升。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.