騰訊控股(00700.HK)手游出海:騰訊的全球化野望,維持“買入”評級,目標價520-566港元

機構:國信證券

評級:買入

目標價:520-566港元

海外手遊市場空間廣闊+政策寬鬆,中國廠商萬眾出海

海外手遊市場空間廣闊且政策寬鬆,引中國手遊廠商萬眾出海。2019年,海外手遊市場規模約為國內市場的2倍,且內容審核相對寬鬆,給了中國手遊市場非常廣闊的發展空間。自騰訊發力手游出海業務以來,其在海外市場的市佔率顯著提升。卡位其IP、研發及運營優勢,我們判斷,短期內,其海外手遊業務存在翻倍空間;長期來看,海外遊戲收入有望和國內遊戲收入達到1:1。

騰訊:投遍全球,結盟海外遊戲全產業鏈

以投資換合作是騰訊遊戲佈局海外的核心戰略之一。其遊戲投資佈局始於2005年,16年來,已投遍全球遊戲的底層技術、遊戲研發、運營、渠道及輔助各個環節。技術方面,公司投資了虛幻遊戲開發引擎技術商EpicGames,並意外收穫頭部手遊《堡壘之夜》的代理權;IP及研發環節,公司投資了美國RiotGames(拳頭)、韓國藍洞、芬蘭Supercell,換取到了《英雄聯盟》、《PUBG》以及Supercell旗下全部手遊的代理權;發行方面,提早佈局東南亞廠商Garena及韓國廠商Netmarble,為公司遊戲出海鋪平了道路。

戰略跑通:頂級IP+手遊研發能力,有望持續輸出全球性爆款

《PUBGMOBILE》和《CODM》在全球的成功,驗證了“大IP+騰訊轉手遊+全球推行”的邏輯,從手遊廠商的研發實力、所在市場的規模以及研發、運營經驗來看,騰訊都具備了承接頂級IP的能力。存量IP方面,《英雄聯盟》、《DNF》最具看點;潛在IP方面,我們推測,《守望先鋒》、《超級馬里奧》、《精靈寶可夢》、《塞爾達傳説荒野之息》等均為頂尖的手遊種子IP,有望支撐其持續輸出爆款手遊。

風險提示

政策風險;全球頂尖IP流失的風險;手游上線時間、表現不及預期等。

投資建議:維持“買入”評級

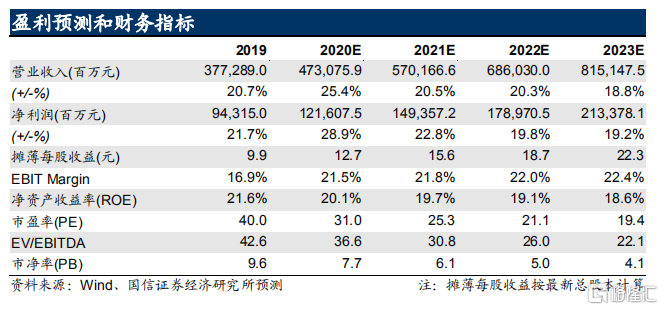

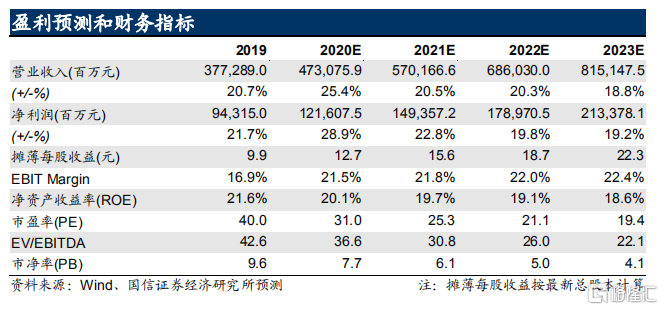

上調公司目標價至520-566港幣,對應2021年PE為30-33倍,相對公司當前股價估值空間為17%-27%,維持“買入”評級。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.