華立大學集團(01756.HK):經調整淨利增25%,派息率達38%。維持“買入”評級

機構:華西證券

評級:買入

事件概述

公司發佈中期業績,截至 2020 年 2 月的 6 個月中期營收 3.93億、同比增長 15.9%,經調整淨利 1.61 億、同比增長 24.8%,該業績符合公司正面盈利預告不少於 20%增長的指引。公司派息 6162 萬元、摺合每股 0.051 元,按經調整淨利口徑計算其中期股息支付率達 38.3%。

分析判斷:

收入增長主要來自學費增長貢獻:(1)從就讀人數看,2020H1集團整體就讀學生人數同比增長2.1%達4.56萬人,其中華立學院/華立職業學院/華立技師學院分別同比增長 17.4%/-2.9%/-11.8%至1.78/1.98/0.8萬人。從人均費用看,2020H1集團人均半年學費及住宿費同比增長 13.4%達 0.86 萬元,其中華立學院/華立職業學院/華立技師學院分別同比增長 9.6%/13.0%/1.0%至 1.25/0.61/0.63 萬元。 (2)分拆學校來看,華立學院/華立職業學院/華立技師學院分別同比增長 28.7%/9.7%/-11%。

毛利率提升及經常性費用率下降推動公司盈利更快增長:從毛利率看,2020H1集團毛利率同比提升 1.6pct至 57.4%,主要得益校區使用率提升及人均學費上漲,其中增城/雲浮校區使用率分別提升 1.4/10pct 至 93.1%/25%。從費用率看,2020H1 集團銷售 / 剔 除 上 市 開 支 後 管理 / 財 務 費 用 率 分 別 下 降 -0.6/1.3/0.5pct 至 3.0%/11.7%/5.8%,銷售費用增長主要來自技師學院擴招初中生、邀請學生到校參觀。由此從經調整業績看,2020H1 集團經調整淨利同比增長 24.8%至 1.61 億,經調整淨利率同比提升 2.9pct至40.9%。

投資建議

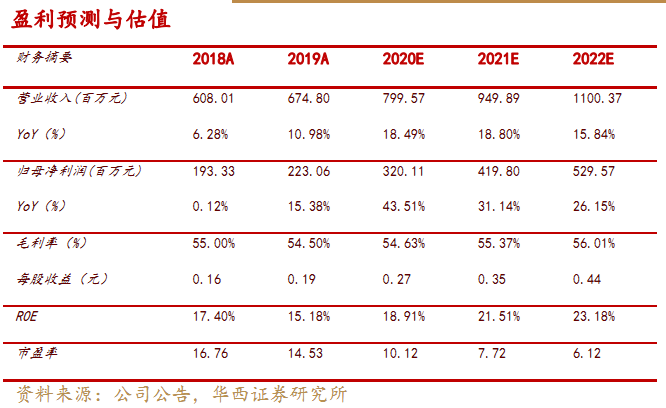

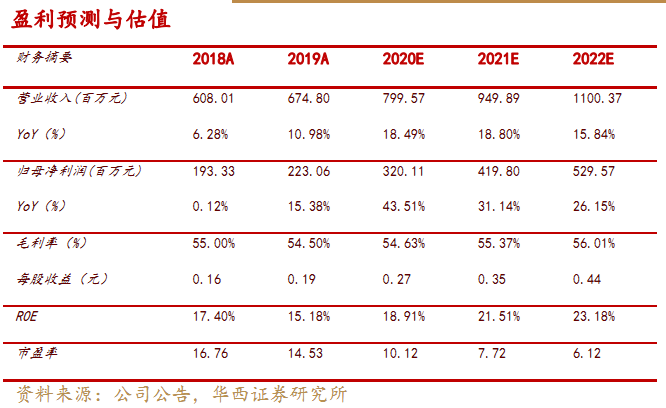

維持FY2020/2021/2022EPS為0.27/0.35/0.44 元,對應 PE 分別為 10/8/6X,公司看點在於:(1)考慮所處廣東省毛入學率提升空間較大,因此伴隨增城、雲浮校區擴建,以及江門校區計劃申請新的大專牌照、華立技師學院改變學制後將迎來招生增長;(2)本科學費每兩年提升 10%,期待職業學院升級本科落地;(3)獨立學院轉設加速,脱鈎後有望增厚業績;(4)在手現金充裕,未來存在併購預期;(5)淨利率潛在改善。綜合公司低估值及較高成長空間,維持“買入”評級。

風險提示

招生情況不達預期風險、轉設進度不及預期風險、政策風險、首發解禁風險、 系統性風險。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.