騰訊控股(00700.HK):細水長流,萬業互聯,維持“買入”評級

機構:申港證券

評級:買入

投資摘要:

公司核心競爭力在於極致產品力基礎上積累的超級流量,以及長期在開放生態中互聯互通帶來的多維變現。

C端細水長流:Freemium基因穩固敵手難尋,高流量+低 ARPU 築就高壁壘。

遊戲:高 MAU +ARPU 穩定造就世界龍頭。中國市場增速領先全球,手遊升級全球主戰場:1)作為世界龍頭,騰訊領跑高增速、大體量手遊賽道,國內發展土壤優質(超級流量壁壘,用户習慣上偏愛手遊,尤其是新遊戲)。2)國人遊戲支出能力持續提升(2015-2018年 CAGR 40%,對比美、歐、日 17%、0%、14%) ,消費水平超越歐盟、直追日美。預期騰訊手遊用户數將持續攀升,新遊戲備受矚目,ARPU穩定但與網易相比仍有巨大提升空間,出海帶動業績增長亦可期。騰訊遊戲板塊 2020年整體收入預計增速在13%。

數字服務:付費是大勢所趨。對照國際經驗,受益於國內版權意識提高和付費習慣形成,MAU、付費率、ARPPU均有望提高,在線視頻、音樂娛樂、在線閲讀等數字業務增速未來三年預期增速在 20%以上。

B端萬業互聯:社交賦能多元場景商業變現,產業互聯新願景穩步實現中。

廣告:社交廣告是未來主要增長方向,視頻廣告行業輝煌不再。從 DAU、信息量、加載率、CPM 四個指標分拆社交廣告空間,我們認為朋友圈廣告投放最為剋制(加載率遠低於競爭對手, 50%E), 小程序作為一個超級 APP入口增速最快(77%E)、公眾號增速進入穩定期(30%E) 。疫情影響有限,但媒體廣告可能繼續維持負增速,2020年廣告業務收入預計增速在 35%。

金融科技與企業服務:戰略突破與轉型的開始。1)金融科技:移動支付浪潮勢不可擋,憑藉流量優勢理財通在線下消費和個人交易領域更佔優勢;在資金轉移渠道上,理財通逐漸縮小與支付寶之間的服務差異;年齡分佈上理財通用户更具老齡化特徵,更大概率吸引資產規模增速更快的高淨值客羣投資。2)雲計算:全球公有云市場增速進入 20%以下時代,國內起步較晚目前整體增速高於全球約 10pct,IaaS仍是增長最快的細分領域。全球雲計算市場格局穩定且集中度有望進一步提高。騰訊目前國內市場份額僅次於阿里雲,追趕有力,產業互聯網政策利好且優勢領域發力明顯。預期板塊增速30%以上。

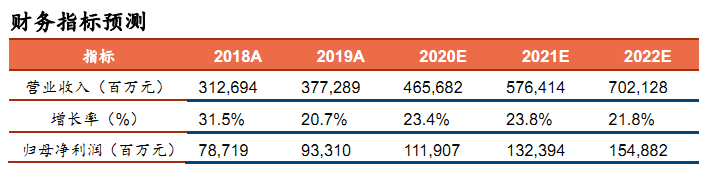

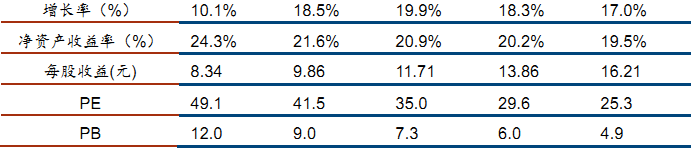

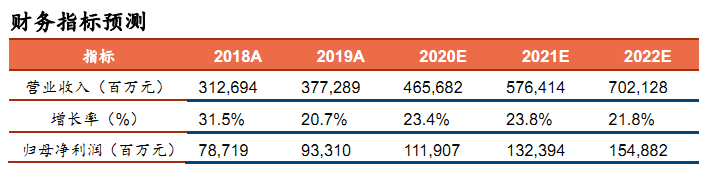

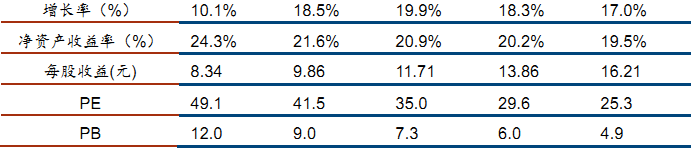

投資建議:公司擁有流量上的超級壁壘,消費互聯網細水長流的變現模式根基深厚,廣告、金融科技與企服增速亮眼,B端延伸融合有望實現萬業互聯,我們預計公司 2020-2022 年歸母淨利潤為 1,119 億/1,324 億/1,549 億元,EPS為 11.71/13.86/16.21元,當前股價對應 P/E為 35X/30X/25X,維持“買入”評級。

風險提示:用户增長不及預期;疫情對宏觀經濟的衝擊;股市整體低迷

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.