港股 | 甘肅銀行(02139):單日下跌40%,銀行零售業務壞賬垮塌帶來的警示

來源:基本面力場

昨天,在香港上市的甘肅銀行(2139.HK)在發佈了年度業績報告後,股價瞬間垮塌,單日暴跌了;從更長週期來看,自從2018年初上市之後,甘肅銀行二級市場股價就沒能過上幾天好日子,IPO的發行價還高達2.46港元,截止到昨天,股價就只剩下0.65港元了,累計降幅、股價跌成了渣渣。

單看股價表現,就不難想象甘肅銀行2019年業績的令人失望:總收入同比下滑了18.47%,歸母淨利潤更是斷崖式下跌了85.18%,不良率從上年度的2.29增長到2019年的2.45,與之相對應的撥備率從上年度的169.47%下降到2019年的135.87%,核充也從2018年末的11.01%快速下滑到了2019年末的9.92%。

從某種意義上來説,甘肅銀行的垮塌放在經濟基礎本就相對落後的地區,疊加2019年的經濟整體景氣度下降,或許也並非完全的意外;這一點從甘肅銀行上市後一直頹廢的股價表現,也可以判斷出市場的預期。力場君(微信公號:基本面力場)感興趣的是,在甘肅銀行的這份報表數據,會不會讓某些區域性色彩濃厚的銀行戰慄?比如~~算了,還是不比如了,大家自己聯想吧。

還是説甘肅銀行,力場君拔出來甘肅銀行的數據,是覺得這家銀行的零售業務數據表現,給投資者、給整個市場提個醒。當前,幾乎每一家銀行都聲稱在做零售轉型,投資者也在熱捧零售銀行業務。單方向來説,這是對的;但是細節數據方面,風險也不容忽視。

以甘肅銀行為例,2019年不良的垮塌,直接動因就是零售貸款不良率的飆升,從2018年的1.73%猛增到2019年的4.01%,這一不良率水平,即便放在分行業公司貸款分類中,也是排名靠前的。

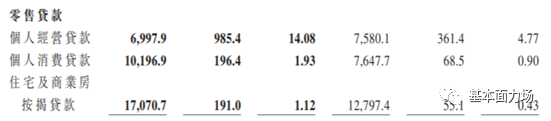

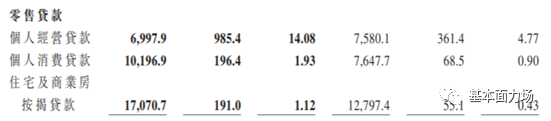

再細化來看,零售貸款不良垮塌的直接動因就是“個人經營貸款”,不良率從2018年的4.77%直線飆升到2019年14.08%,背後透露出來的信息,令人恐慌,但力場君不想多説什麼。事實上,從甘肅銀行的零售貸款構成來看,“個人經營貸款”一直佔據着很大的份額,在2017年之前,這一比例甚至一度達50%左右,即便是在2019年,這一比重也仍然高達20%左右。

這樣的份額佔比,在絕大多數上市銀行中,是不存在的。但是力場君(微信公號:基本面力場)特別提示一點,現在很多在申請上市中的農商銀行的零售貸款中,“個人經營貸款”所佔比重是不低的,值得關注和警惕。

此外,甘肅銀行的個人消費貸款和個人房貸,不良率在2019年也顯著提升。以銀行眼中“無比優質”的個人房貸,2018年不良率是0.43%,2019年就提高到了1.12%了;這個不良率絕對值並不高,但是同比來看,幾乎是2018年的3倍。可見,零售業務對於銀行來説,不能簡單地視為“免費午餐”,背後藴含的風險,更不能無視。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.