信义玻璃(0868.HK):龙头业绩稳健,产能扩张持续推进,维持“审慎增持”的评级,目标价 11.51 港元

机构:兴业证券

评级:审慎增持

目标价:11.51 港元

投资要点

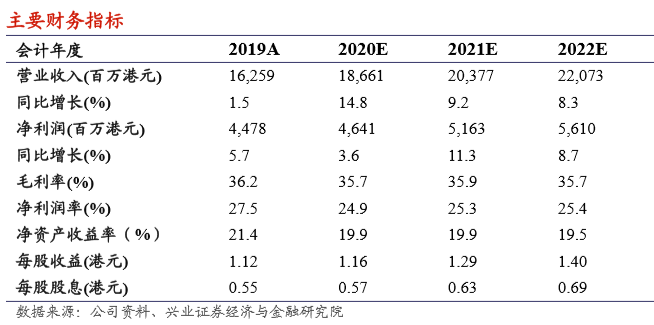

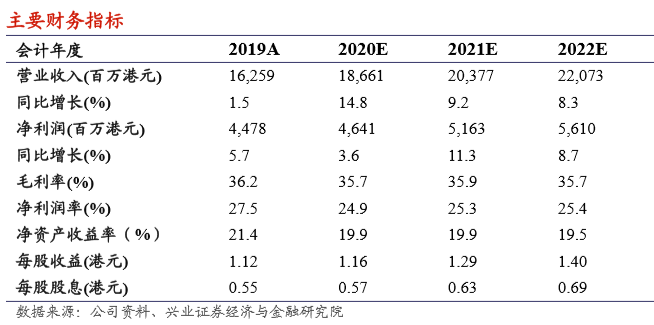

事件: 公司披露 2019 年业绩:公司收益同比增加 1.5%至 162.59 亿港元;公司股本权 益持有人应占纯利同比增加 5.7%至 44.78 亿港元;每股基本盈利为 111.8 港仙; 拟末期派息每股 30 港仙,全年派息比率为 49.3%。

点评:

(1)19 下半年,在地产竣工回暖的大环境下,公司浮法、建玻业务量价齐升, 汽玻业务稳定增长。2019 下半年,公司收益同比增长 6.6%,浮法玻璃同比增 3.5%,汽车玻璃同比增 7.6%,建筑玻璃同比增 12.5%。我们预计,浮法玻璃 主要是产品单价增长所贡献,汽车玻璃和建筑玻璃主要是销量增长。

(2)受益于浮法玻璃价格回暖和人民币贬值效应,19 下半年,三大业务综合 毛利同比增 8.0%,毛利率升至 36.3%,环比/同比均有改善。

(3)实际税率降至 10.6%,前值 14.5%。主要由于上半年出售及摊薄信义光能 的收益是免税的,马六甲工厂仍在享受税务优惠待遇。 我们认为,信义在国内的生产基地战略优势、规模效应、垂直整合及清洁能源 方面的优势无人能出其由,公司有着较强的竞争力,财务报表可管中窥豹。随 着信义产能扩张计划的落地,公司有望实现国内及国际市场份额的同步扩张。 20E 浮法玻璃有效产能同比增加 10.7%,汽车玻璃有效产能同比增加 11.1%。

我们的观点:立足短期,较高的库存压力是行业面临的主要压力,纯碱价格及 后续燃料成本下降有望缓解玻璃成本压力。立足长期,我们认为经济下行压力 下,房企融资环境升温,竣工数据仍有望延续 19Q4 的良好态势,20 和 21 年 会是竣工的两个大年。公司是竣工端复苏的最优标的。 我们维持“审慎增持”的评级,目标价 11.51 港元,预计公司 2020-2022 年实 现归母净利润分别为 46.41 亿、51.63 亿港元和 56.10 亿港元,最新收盘价对应 2020 年预测 PE 为 7.2X,股息率 6.8%。

风险提示:需求下滑、海外扩张不及预期、反倾销风险、汇率风险

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.