美高梅中國(2282.HK):19Q4勝預期,賭場停業期間日均Opx達150萬美元

機構:興業證券

投資要點

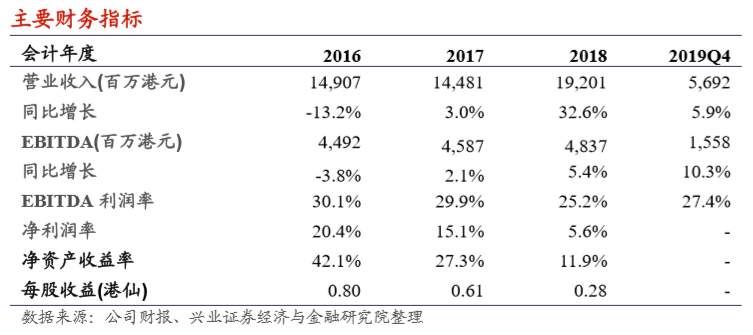

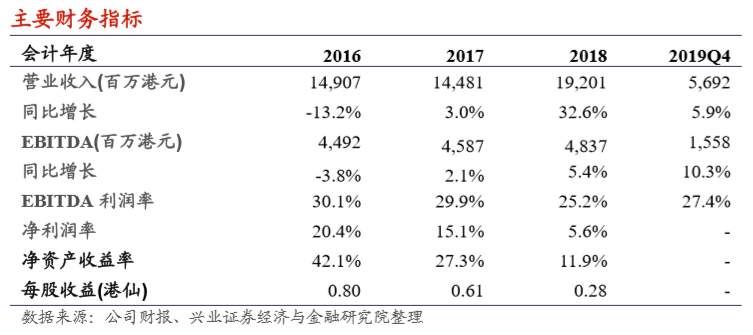

⚫ 公司 2019Q4 收入同比增 5.9%,EBITDA 同比增 10.3%,勝市場預期。隨着 美獅美高梅的發力,美高梅中國 19Q4 錄得收入 56.92 億港元(YoY+5.9%, QoQ-1.5%) ,錄得經調整 EBITDA 15.58 億港元(YoY+10.3%,QoQ+0.6%) , 勝市場預期。其中,澳門美高梅 EBITDA/收入分別按年-3.3%/-4.6%至 9.18 億 /29.8 億港元,美獅美高梅 EBITDA/收入則分別快速增長 38.3%/20.4%至 6.4 億/27.1 億港元。公司期內 EBITDA%增至 27.4%。公司盈利能力的提升主要 得益於:1)贏率提升,2)美獅美高梅進一步爬坡後經營槓桿的提升。

⚫ 按業務看,公司中場業務發力,整體博彩市佔率按年上升 1.3pct。公司期內 錄得博彩淨收益 50.9 億港元,yoy+6.5%;若不考慮佣金獎勵,公司期內錄得 博彩毛收入 67.91 億港元(YoY+ 5.3%, QoQ-2.7%),而同期澳門 GGR 同比 -8.4%,環比+1.9%。受美獅美高梅推動,公司期內整體 VIP/中場/角子機分別 錄得毛收入 22.68 億/ 39.44 億/ 5.79 億港元,按年-19.91%/+30.6%/-3%(同期 行業同比增速為-23.1%/+9.4%/-1%),按季分別-8.9%/+0.7%/+1.1%(同期行業 環比增速為+4%/+0.2%/+1.4%),中場表現亮眼。從市佔率看,公司博彩 GGR 市佔率較上年同比+1.3pct 至 9.7%,中場市佔按年提升 1.8pct。

⚫ 我們的觀點:受益於高贏率及美獅美高梅的發力,公司期內表現勝市場預期。 公司亦表示其 1 月首幾周的日均 EBITDA 高達 250 萬美元,表現良好。短期 看,公司賭場根據政府政策於 2 月 5 日至 2 月 20 日間停業,而公司業績會上 表示其賭場停業期間每日營運開支仍為 150 萬美元左右(主要為人員開支), 預計公司近期收入及盈利能力將承壓。然而,隨着 2 月 20 日重啟賭場,公司 博彩收入有望從無至有,加上博彩企業費用相對固定,公司賭場重新開業後 的經營槓桿較停業時期有望得到相對改善。中期看,我們預計行業整體有望 於 2Q20 開始修復並於下半年恢復至正常水平。雖然隨着澳博上葡京及金沙倫 敦人開業,行業 20H2 競爭或加劇,但公司 Mansion Villas 還處爬坡階段,其 VIP 業務仍有增長點,再加上公司今年隨着 MGM 2020 Plan 將進一步優化效 率,節省開支,在行業整體受到挑戰時有望做到開源節流。而長期看,我們 仍看好澳門多元化、大眾化的發展以及基建日益完善後澳門博彩旅遊業對內 地市場滲透率的提升。公司現估值處歷史低位,建議投資者適當關注。

風險提示:大陸經濟不景氣,競爭加劇,新項目表現不及預期,監管政策變化

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.