維達國際 ( 3331.HK) 2019Q3點評:木漿下行業績彈性顯現,高端產品推廣順利,首次覆蓋給予“強烈推薦”評級

機構:長城證券

評級:強烈推薦

Q3經營溢利同比+192%,業績超預期。2019Q1-3公司實現營業收入117.29億港幣,同比+9.1%,剔除匯率擾動因素同比增長13.6%;實現經營溢利增長29.8%至9.98億港元;分季度來看,Q1/Q2/Q3單季實現營業收入40.79/38.12/38.38億港元,同比分別+7.88%/7.29%/12.45%,實現經營溢利3.4/2.89/3.68億港幣,同比分別+2.72%/-7.37%/+192%。

高端紙巾推廣順利,個護新品上市,收入增速雙雙回暖。分品類來看,紙巾前三季度單季的收入增速分別為+10.2%/+9.13%/+14.23%,在木漿價格下行面臨降價壓力的情形下,公司高端紙巾新品推廣順暢及降價策略制定得當,公司Q3收入增速回升,表現靚麗。立體美、得寶的收入佔比由去年同期15%提升至今年20%。個護方面,前三季度單季的收入增速分別為-2.1%/-0.58%/+5.21%,6月份北歐品牌Libresse正式推出,帶動Q3表現較佳。

木漿價格下行彈性顯現,費用投入控制有效。公司的木漿庫存穩定在1個季度左右,儘管Q2毛利率已環比提升,但由於去年同期公司產品價格基數較高,H1利潤彈性尚未顯現。Q3來看,單季度毛利率達31.3%,同比+4.2pcpts,環比+1.3pcpts,Q1-3毛利率為29.14%,同比+0.26pcpts,利潤彈性顯現。Q3單季經營溢利率為9.59%,同比+5.89pcpts,環比+2.01pcpts,Q1-3經營溢利率為8.49%,同比+1.31pcpts。判斷公司隨着規模擴大及品牌樹立,費用投入比例逐漸減小。

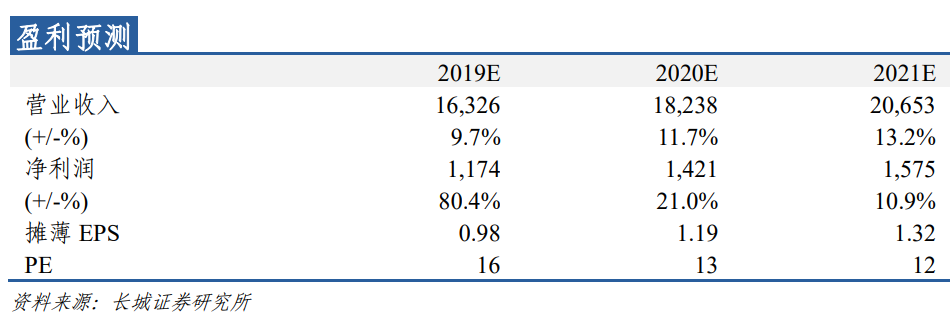

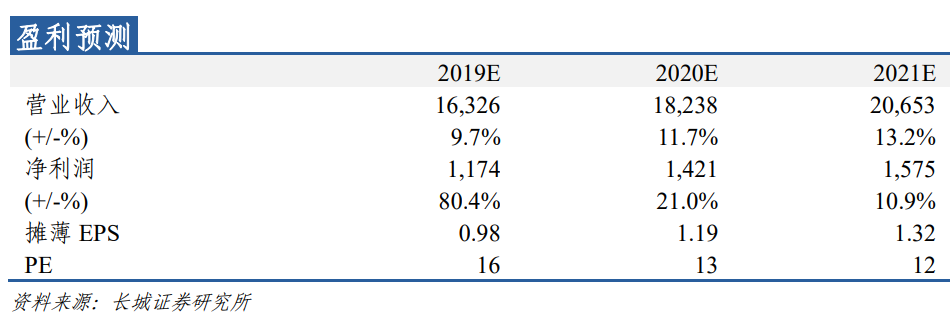

投資建議:木漿價格催化下半年利潤彈性顯現,估值有望修復。長期來看,依靠領先的產品及優勢渠道佈局,維達有望成長為亞洲個護用品龍頭企業。預計2019-2022年EPS為0.98、1.19、1.32港元,對應PE為16、13、12x,首次覆蓋給予“強烈推薦”評級。

風險提示:原材料價格上漲風險;產能釋放不及預期;行業產能擴張大於需求,競爭加劇;擴品類推廣不及預期;營銷渠道建設不及預期。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.