中国燃气(0384.HK)销气量持续增长煤改气快速推进维持“买入”评级

机构:广发证券

评级:买入

核心观点

FY2019业绩超预期增长

公司公布了2018/19财年的业绩,公司实现营业收入593.9亿港元,同比增长12%,归母净利润为82.2亿港元,同比增长34.9%,超出预期。去除一次性损益后,核心归母净利润同比增长28%至81.5亿港元。业绩增长超预期主要是管道天然气销量大幅增长和农村煤改气接驳数量超预期。

燃气销售:天然气销量保持快速增长,毛差展望趋稳

2018/19财年,公司通过城市燃气项目销售天然气147.4亿立方米,同比增长25.1%。新增居民、工业、商业用户将持续带动公司销气量稳步提升,我们预计未来两个财年的燃气销量分别同比增长25%左右。毛差综合来看比较稳定,本财年毛差从上个财年的人民币0.623元/立方米略微下降到0.61元/立方米,符合我们的预期。我们认为毛差未来三年趋稳。

燃气接驳保持稳定,乡镇气代煤贡献主要增量

公司实现燃气接驳和工程设计及施工经营利润分别为34.4/21.0亿港元,同比增长18/62%。公司新增居民接驳510.8万户,同比大幅增长30.07%,其中农村居民用户239万户,超出预期。城市燃气和乡镇气代煤项目平均接驳费略有下降,为人民币2508元/户(-15元)和3010元/户(-79元)。预计未来农村煤改气继续持续推进,接驳户数有所上升,FY 2020-2022所有居民接驳总户数为550/630/630万户。

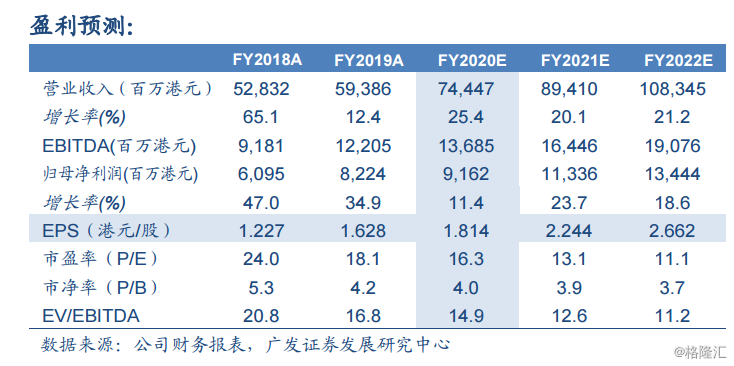

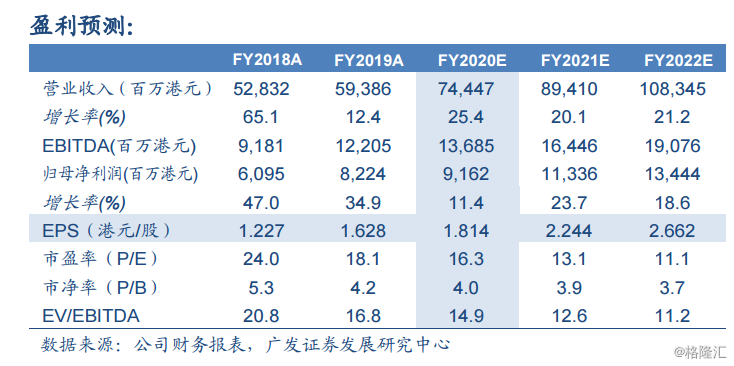

盈利预测与投资评级

2019年6月25日中国燃气(00384.hk)收盘价为29.05港元。我们认为公司将持续受益于销气量的增长,尤其会大幅受益于中俄管线,以及乡镇气代煤的推动,我们预测FY 2020-2022 EPS为港币1.814/2.244/2.662元。由于公司业绩增长预期较好,我们基于2019/20财年18倍市盈率,给予合理价值32.65港元/每股。维持“买入”评级。

风险提示

城镇气代煤工程进度不及预期,工商业煤改气进度慢于预期,新接驳数量不及预期,油价下跌。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.