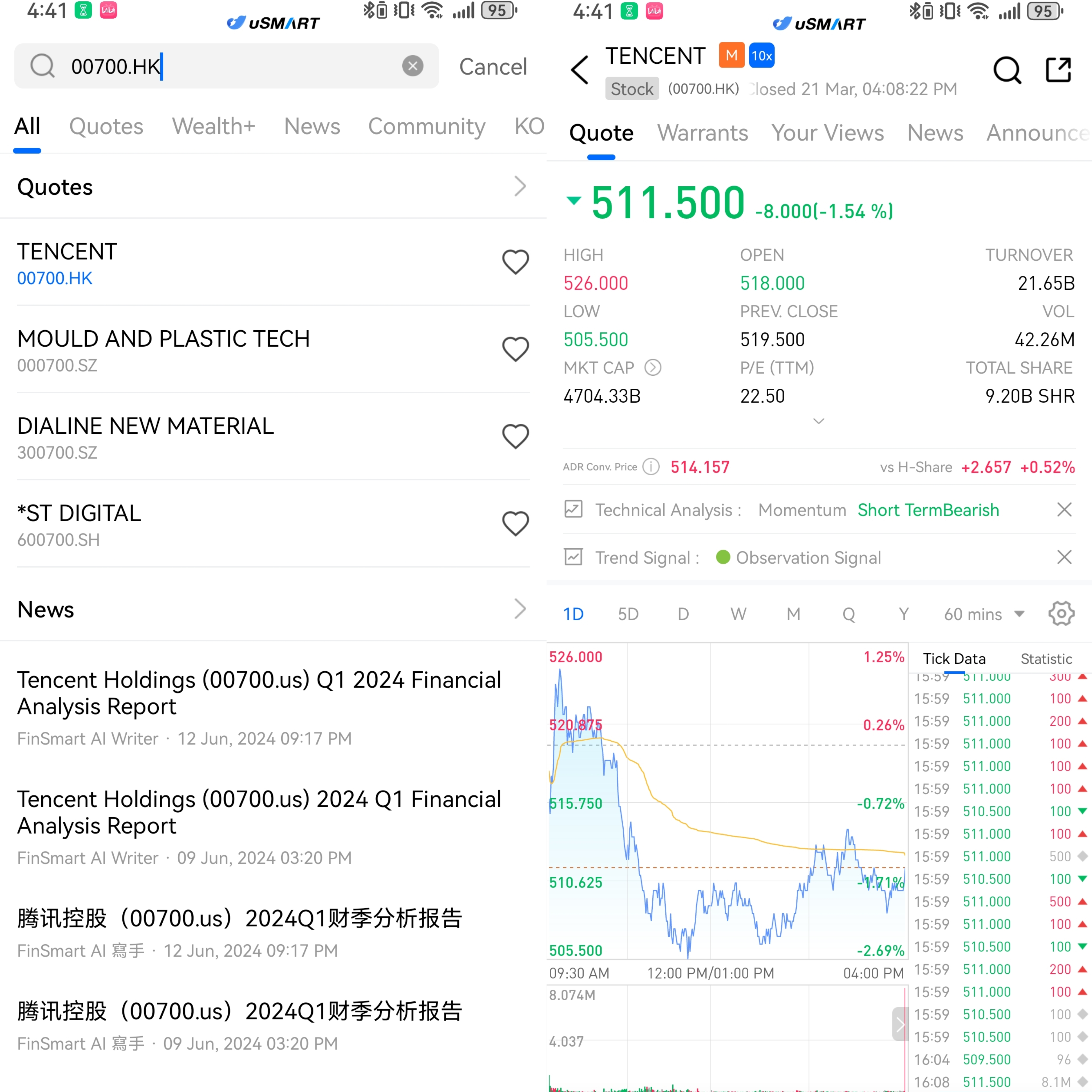

Recently, popular Chinese tech stocks have collectively surged, becoming the focus of market attention. With the stock prices of companies like Alibaba, Tencent, and Meituan rebounding, investor enthusiasm for Chinese concept stocks has also grown, further proving the investment potential of these stocks in the Hong Kong market. As of March 27, 2025, Tencent's stock closed at HKD 509.00, up 0.49% from the previous day. In the past week, its stock price has risen by approximately 2.5%, showing a positive market performance.

(Source: uSMART HK, Date: 2025/3/28)

"Chinese tech stocks" refer to Chinese technology companies listed in the U.S. or other overseas capital markets. "Chinese concept stocks" is short for "中概股" (Zhonggai stocks), while "tech stocks" refer to companies engaged in technological innovation, internet services, artificial intelligence, and other related fields. This includes typical internet companies like Tencent, as well as IT manufacturing companies like Xiaomi and high-end manufacturers like BYD.

Since the Hong Kong Stock Exchange (HKEX) revised its listing rules in 2018, 13 Chinese concept stocks have chosen to return to the Hong Kong market by conducting secondary listings while maintaining their U.S. listings. These companies are mainly concentrated in the consumer, information technology, and healthcare sectors. In terms of industry structure, among the 13 companies that have secondary listed in Hong Kong, 5 are in the consumer sector, 5 are in information technology, and 1 is in healthcare, with consumer sector companies accounting for nearly 89% of the total market value.

The increasing external pressure encourages more Chinese concept stocks to consider returning from a long-term perspective, especially given the relatively low cost of returning. At the same time, the Hong Kong Stock Exchange welcomes the return of Chinese concept stocks with a more open and inclusive attitude, and may further relax the requirements. More importantly, the positive feedback effects after returning, such as the aggregation effect of "new economy" companies and support from familiar investor groups, have become the driving force for more Chinese concept stocks to return.

uSMART Helps Investors Build the Hong Kong ATM Portfolio with 'Zero Cost'

Faced with such a hot market opportunity, uSMART has recently launched a promotional activity for Hong Kong stock trading. By purchasing the "Three Tech Giants ATM," the three most representative Chinese tech stocks, investors can enjoy 0 commission and 0 platform fees*. This includes Alibaba (9988.HK), Tencent (700.HK), and Meituan (3690.HK). This promotional offer not only lowers the investment threshold but also provides investors with a more efficient and convenient investment solution, helping them easily invest in the world's most innovative tech companies.

If you want to learn more details, you can click for more information

*Terms and conditions apply.

How to Buy "ATM" on uSMART

After logging into the uSMART HK app, click on "Search" at the top right of the page, access the details page and view transaction details and historical trends. Then click the "Trade" button at the bottom right, select the "Buy/Sell" option, fill in the transaction conditions, and submit your order.

(Image source: uSMART HK)