On December 9, Chinese assets staged a remarkable rally on Wall Street, with the Nasdaq Golden Dragon China Index soaring over 10% intraday before closing up 8.5%, marking its largest single-day gain since late September. Against the backdrop of a broader decline in the three major U.S. stock indices, Chinese concept stocks emerged as standout performers, garnering widespread attention in the financial markets.

(Source: Google Finance)

Chinese Stocks Rally, Fangdd Doubles in Value

Numerous popular Chinese stocks saw significant gains, with Fangdd surging 166% intraday before closing up 52.23%. Tiger Brokers rose by 26.3%, Bilibili climbed 21.6%, while Li Auto and XPeng surged over 13% each. Other notable gainers included NIO, iQIYI, KE Holdings, Vipshop, JD.com, and NetEase, all of which posted gains between 10% and 12%. Leading companies such as New Oriental Education, Trip.com, and Baidu also performed well, with gains ranging between 7% and 8%. Additionally, Alibaba rose over 7.4%, while Tencent Music and Weibo also delivered strong performances.

Chinese ETFs Show Robust Gains, YINN Soars Over 24%

Boosted by bullish sentiment, several U.S.-listed Chinese ETFs saw strong performance. The 3x Leveraged FTSE China ETF (YINN) skyrocketed 24%, with additional gains of over 2% in after-hours trading. The largest MSCI China ETF (MCHI) rose 7.7%; the Chinese Internet ETF (KWEB), which tracks major companies like Alibaba, Tencent, and JD.com, jumped 10%; and the iShares China Large-Cap ETF (FXI), which focuses on Hong Kong-listed blue chips, surged 8%. Meanwhile, the only ETF tracking A-shares, the CSI 300 Index ETF (ASHR), gained nearly 7%, with heavyweights like Kweichow Moutai and CATL leading the charge. Other leveraged ETFs also posted remarkable gains, with the 2x Leveraged Chinese Internet ETF (CWEB) surging 20%, the 2x Leveraged FTSE China 50 ETF (XPP) climbing 16%, and the 2x Leveraged CSI 300 ETF (CHAU) rising over 13.6%.

Policy Signals Boost Market Sentiment

This rally in Chinese assets was largely driven by positive signals from the December 9 meeting of the Chinese Communist Party's Politburo, which outlined its 2025 economic plans. The meeting emphasized implementing a "more active fiscal policy" and a "moderately loose monetary policy," the latter being explicitly mentioned for the first time in 14 years. This opens the door for future interest rate cuts and increased liquidity. Additionally, the Politburo placed unprecedented emphasis on "stabilizing the stock and real estate markets," raising market expectations for innovative policies aimed at supporting equities.

Offshore Yuan Strengthens Amid Growing Confidence

At the same time, the offshore yuan strengthened significantly against the U.S. dollar, breaching the 7.26 level intraday with a gain of over 250 points or 0.35%, reaching its highest level in nearly a month.In summary, bolstered by supportive policies and improving market sentiment, Chinese assets saw a powerful rally. The Nasdaq Golden Dragon China Index recorded its largest single-day gain in three months, with standout performances from Fangdd and other leading Chinese stocks. ETFs tracking Chinese equities also posted strong gains, reflecting growing optimism about China’s economic outlook.

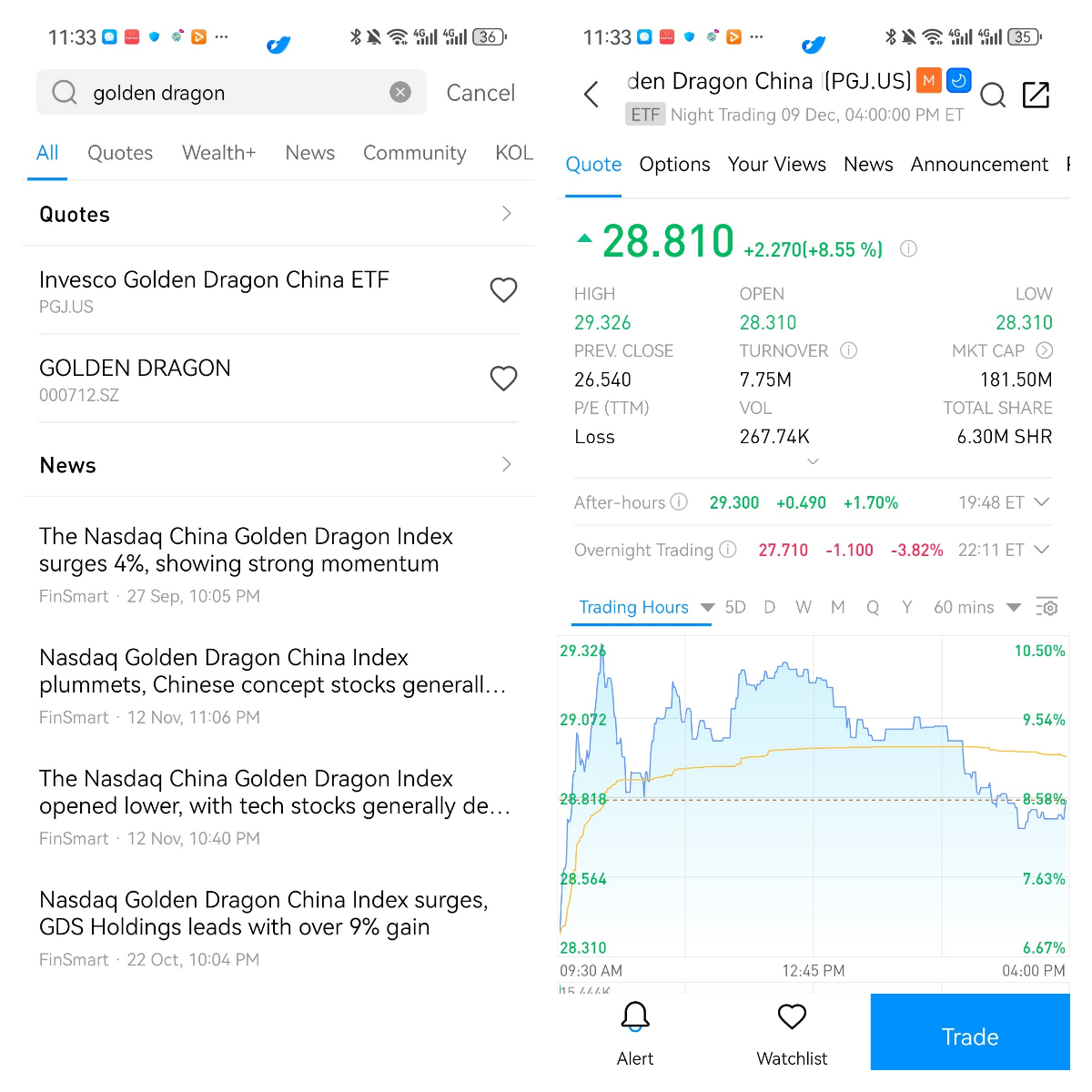

How to Trade on uSMART

After logging into the uSMART HK APP, click on the search icon at the top right of the screen. Enter the stock code, such as "PGJ.US" to access detailed information, trading history, and trends. Click the “Trade” button at the bottom right, select the “Buy/Sell” function, and submit your order after filling in the transaction conditions.

(Source: uSMART HK)