Since July, the trend of the weight-loss drug sector in the U.S. stock market has been divergent. Market leaders Novo Nordisk (NVO.US) and Eli Lilly (LLY.US) have seen their share prices fall, while stronger chasers Roche (RHHBY.US), Pfizer (PFE.US) and Amgen (AMGN. US) and Viking Therapeutics (VKTX.US), which rose sharply yesterday, both achieved share price increases in July.

Increasing competition has investors worried about the duopoly of Novo Nordisk and Eli Lilly as more drugmakers enter the lucrative weight-loss drug market. Giants will have to work hard to justify their inflated valuations.

Novo Nordisk (NVO.US)

In July, Novo Nordisk’s stock price continued to fall.

(Source: uSMART)

Fierce competition in the weight-loss drug space is a big factor driving Novo Nordisk's share price lower.Roche announced last Wednesday that its second weight-loss drug candidate, CT-996, significantly reduced patients' weight. Another benefit of this oral weight loss pill is that it can be taken at any time of the day, not just on an empty stomach.

Novo Nordisk is also developing the oral weight loss drug Amycretin, but its clinical studies show that the weight loss effect is not as rapid as Roche's similar products. Data released by Novo Nordisk in March this year showed that in a small phase 1 clinical study, patients' weight loss after 12 weeks of treatment with the product was 13.1% (vs. 1.1% in the placebo group).

Amycretin will enter Phase II trials in the second half of this year. In addition, the combination therapy CagriSema being developed by Novo Nordisk - a combination of semaglutide (the active ingredient of Ozempic and Wegovy) and cagrilintide - has entered Phase III trials.

Some analysts pointed out that the valuation of Novo Nordisk's weight loss drug business is approximately US$172 billion, but the valuation contributed by semaglutide is only US$57 billion, which means that most of the valuation of the company's weight loss drug business comes from Unproven drugs. Therefore, any adverse factors in clinical trials, such as Amycretin and CagriSema not performing as well as expected, may have a significant impact on Novo Nordisk's stock price.

Eli Lilly (LLY.US)

In July, Eli Lilly's stock price continued to fall, but the downward trend was gentler than that of Novo Nordisk.

(Source: uSMART)

Eli Lilly's weight loss drug Tilpotide (the active ingredient in Zepbound and Mounjaro) has a better weight loss effect than Novo Nordisk's Semaglu, which may be one of the reasons why Eli Lilly's stock price performed slightly better than Novo Nordisk's .

It is reported that earlier this month, the medical and health data company Truveta published a paper in the Journal of the American Medical Association Internal Medicine stating that after integrating the electronic health record information of 18,386 obese patients in more than 30 health system databases in the United States, The researchers found that after 6 months of treatment, patients treated with tilpotide had lost 10.1% of their body weight, and patients treated with semaglutide had lost 5.8% of their body weight; after 12 months of treatment, these two figures were 15.3%, respectively. and 8.3%.

The superiority of tilpotide over semaglutide in weight loss may affect future patient drug selection and market dynamics. Although Novo Nordisk's Semaglutide relies on its first-mover advantage to significantly lead Eli Lilly's Tilpotide in global sales, some analysts pointed out that benefiting from lower prices, Tilpotide's sales growth may be will be faster than semaglutide. Wall Street analysts also have an average rating of "buy" on Eli Lilly; the average price target is $909.94, implying about 6% upside potential.

Roche (RHHBY.US)

Thomas Schinecker, CEO of Swiss pharmaceutical giant Roche, said on Thursday (July 25) local time that the weight-loss drug being developed by Roche will have a place in the market.

(Source: uSMART)

Roche last week announced early-stage trial data for its weight-loss drug CT-996, which showed that obese patients without type 2 diabetes could lose an average of 6.1% of their body weight within four weeks. Prior to this, Roche’s other weight loss drug CT-388 also achieved similar positive results. Trial data released in May showed that CT-388 could cause obese patients to lose an average of 18.8% of their weight within 24 weeks.

These two drugs are currently hot-selling GLP-1 (glucagon-like peptide-1)/GIP (glucose-dependent insulinotropic peptide) drugs. The difference is that CT-388 uses an injection form, which is more similar to that in the industry. Similar products are available from the two giants Novo Nordisk and Eli Lilly, while CT-996 is in oral form.

According to Schinecker, antibody drugs currently being developed by Roche could be used to combat the "yo-yo effect" of weight loss, both in obesity drug users and regular dieters.

The market potential for new weight-loss drugs is huge, and analysts estimate that the market size in this field is expected to reach US$200 billion by 2030.

Viking Therapeutics(VKTX.US)

On Thursday, July 25, the stock price of Viking Therapeutics, a clinical-stage biopharmaceutical company headquartered in San Diego, USA, rose as high as 38.7%, its best performance in five months, and finally closed up by more than 28%, reaching its highest level in the past two months since May 28. Monthly high.

(Source: uSMART)

This is mainly due to the acceleration of the development process of the weight loss drug injection VK2735 announced by Viking Therapeutics. After receiving a written reply from the US Food and Drug Administration FDA, it decided to advance it to the third and final phase of clinical trials.

Justin Zelin, an analyst at BTIG, pointed out that the decision to advance to phase III clinical trials early may shorten the development time of Viking Therapeutics' injectable weight loss drug by one year.

The market had previously estimated that the drug would be launched in 2029. In other words, drug substitutes that can compete directly with Novo Nordisk’s weight loss “miracle drugs” Ozempic and Wegovy, as well as Eli Lilly’s same “miracle drug” Zepbound, are one step closer to being officially launched.

More importantly, Viking Therapeutics' new drug plan will adjust the dosing burden to once a month, becoming the first company in the field of weight loss drugs to do so. It will be more cost-effective than the current once-a-week injections of the "weight loss duo" is attractive. Naz Rahman, an analyst at Maxim Group, a research and investment institution, said that VK2735 may be the best injection of its kind. The more convenient option of monthly injection may become a major competitive advantage. As we all know, patients cannot perfectly comply with weekly treatment.

VK2735 has the same mechanism of action as Eli Lilly and other "weight loss miracle drugs". They both use a new dual agonist of glucagon-like peptide 1 (GLP-1) and glucose-dependent insulin secretagogue (GIP) receptors. , to treat metabolic diseases such as diabetes, and produce gratifying weight loss effects by improving satiety and blood sugar indicators. Analysts such as Morgan Stanley predict that the global market for drugs known as GLP-1 treatments may reach $150 billion by 2030.

Some analysts said that the news that Viking Therapeutics is accelerating the development of injectable weight loss drugs has severely damaged the stock prices of competitors Eli Lilly and Novo Nordisk. On the one hand, this is because Viking’s drugs are developing both injectable and oral versions, and the administration time of injections is more convenient. Closer to “launch a potentially blockbuster drug.” Meanwhile, Eli Lilly and Novo Nordisk's weight-loss wonder drugs are facing supply shortages, "which means competitors have wiggle room to enter the market."

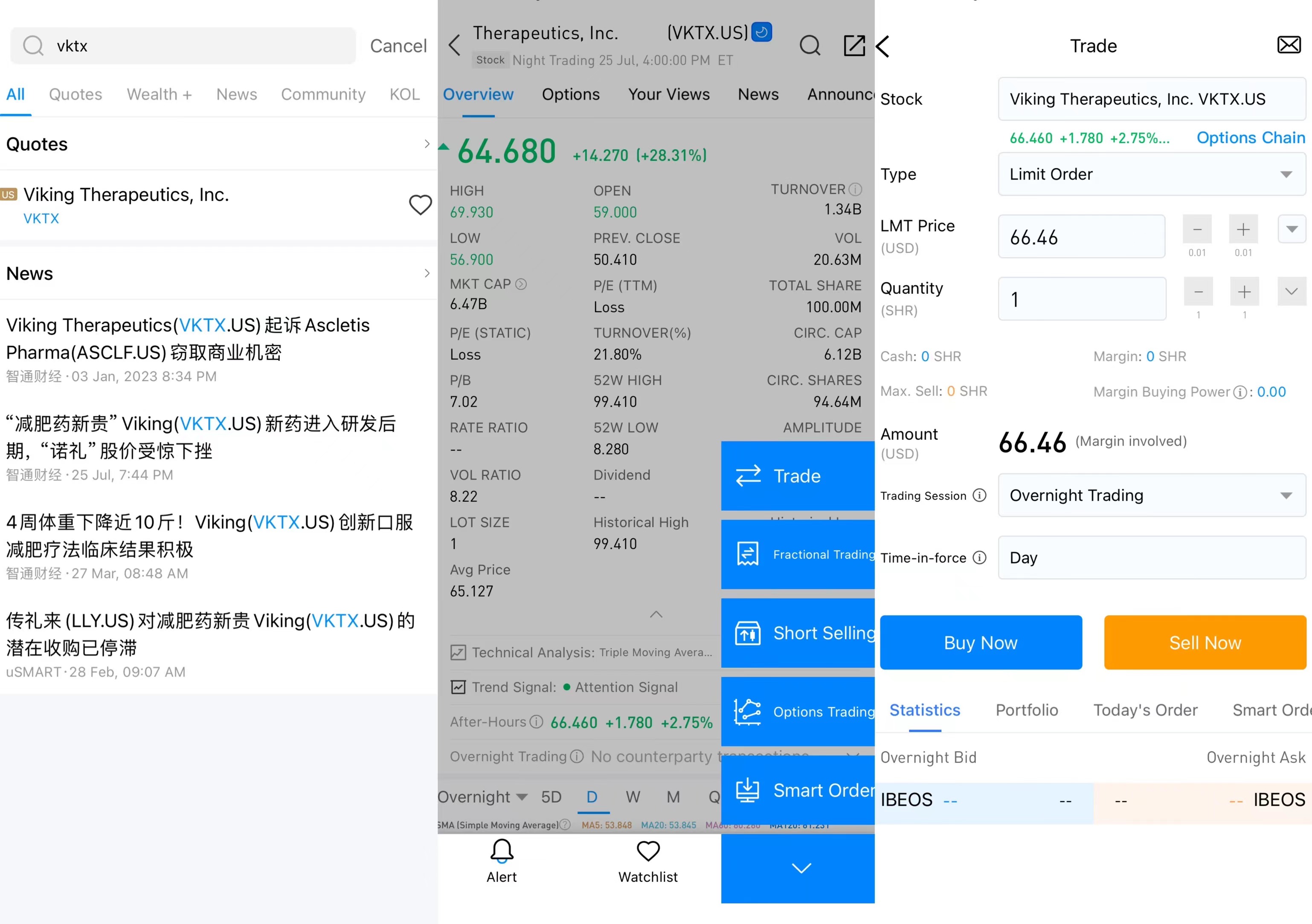

How to invest in US stocks on uSMART?After logging into uSMART HK APP, click "Search" from the upper right corner of the page, enter the US stock you want to buy, and enter the details page to learn about transaction details and historical trends. Click "Trade" in the lower right corner and select the "Buy/Sell" function. , finally fill in the transaction conditions and send the order; the picture operation instructions are as follows: