美股業績指引不可信?

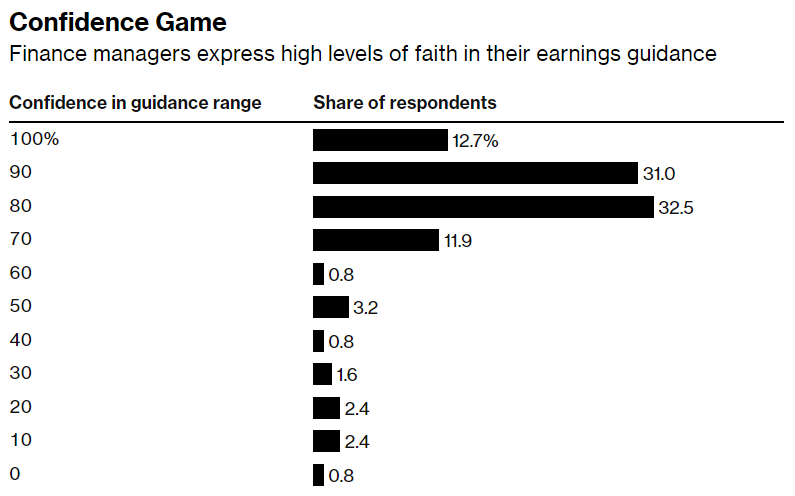

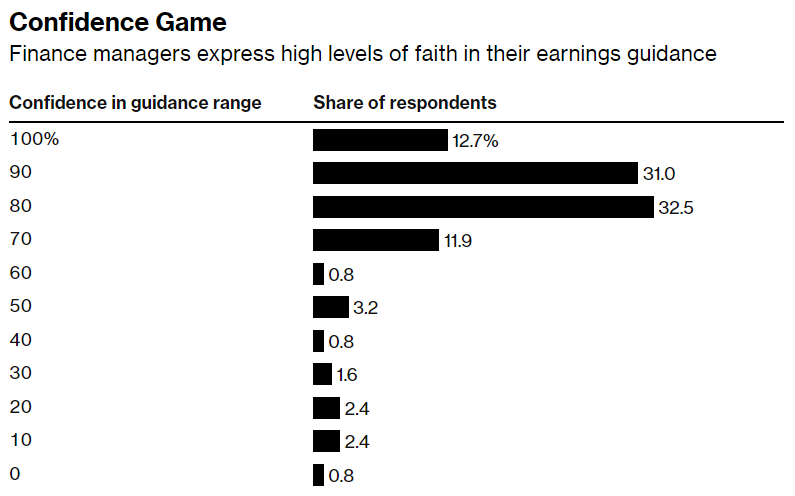

新研究顯示,多數人相信美股公司的收益將落在預期範圍內,但令人驚訝的是,70%的時候,公司收益指引是錯誤的。研究人員表示,超過四分之三的金融專業人士表示,他們公司的收益極有可能落在公司向投資者提供的指引範圍內,但這種情況很少發生。

該研究在2021年調查了357名上市公司的首席財務官、投資者關係專業人士和其他高管。論文發現,公司提供準確指引的比例約爲30%。他們不準確的預測反過來又影響了華爾街股票分析師給出的收益預期。這有助於解釋,根據彭博編制的標普500指數過去60個季度的數據,爲什麼只有非常低比例的公司的業績達到了分析師的預期。在2023年的第一個財政季度,標普500指數中的公司報告的收益與預期相符的比例略高於3%。

這項研究的作者之一的愛荷華大學蒂皮商學院會計學教授Paul Hribar稱:“實際上,經理人在預測盈利結果方面做得相對較差。當我們讓他們誠實地評估收益是否會低於他們的預期時,結果是他們遠遠高估結果了。過度自信可能是由於傲慢,但也有校準錯誤的原因。”

第一季度出現了不少誤判,有正面的,也有負面的。

以零售商塔吉特爲例,該公司第一季度每股收益預期超出指引上限15美分,但隨後又表示,今年的每股收益預期並沒有從此前的7.75美元至8.75美元的指引調整,不及市場預期。還有萬豪酒店(MAR.US)大幅下調了本季度的預期,隨後又將全年每股預期上調了約50美分,這得益於疫情後旅遊業的反彈。

即使在新冠肺炎帶來的波動和不確定性中,管理人員對預測未來業績的能力仍然保持着令人驚訝的樂觀。雖然約有一半的受訪公司不得不在疫情早期撤回一些指引意見,但大多數管理人員並沒有因此改變他們的總體指引政策。

研究人員還對一些財務經理進行了深入採訪,其中大多數人承認,他們發佈的預期過於保守,而他們自己對收益的預期則更爲樂觀,通常高於預期區間的中點。這有助於解釋爲什麼大多數收益“驚喜”都是超預期的——根據彭博社彙編的數據,歷史上約有75%的收益是超預期的。

Hribar稱:“經理們似乎願意說,‘遊戲就是這麼玩的。我們希望超出預期。’”

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.