期權大單 | 亞馬遜又重挫,科技股風雨飄搖

uSMART盈立智投 10-28 17:40

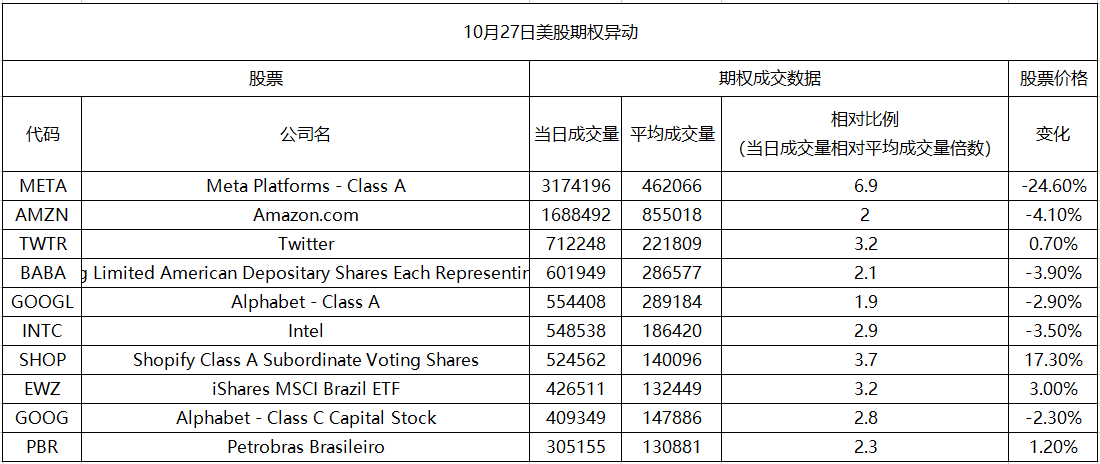

一、期權異動

10月27日,美股Meta、Amazon、Twitter等標的出現了期權成交量上的較大變化,分別爲日常成交量的6.9、2、3.2倍。

Meta週四暴跌24%,報97.94美元。消息方面:該公司週三發佈了令人失望的三季度收益(淨利潤同比暴降52%)以及疲弱的四季度預期。Meta還表示,元宇宙業務明年將繼續虧損更多的錢。三季報發佈後,多名分析師下調了Meta的評級。

蘋果週四跌超3%,報144.80美元。消息方面:蘋果三季度收入創新高但痛失兩位數增長,iPhone銷售略低於預期!

具體來看:三季度蘋果總收入創同期新高,超預期同比增長9%。CEO庫克稱,若不是美元走強,本該有兩位數增長。三季度iPhone銷售增近10%略低於預期,Mac收入猛增25%遠超預期,iPad收入超預期下降13%,服務收入增長超預期放緩至5%創增速新低。盤後蘋果股價震盪,先一度跌近5%,後轉漲。

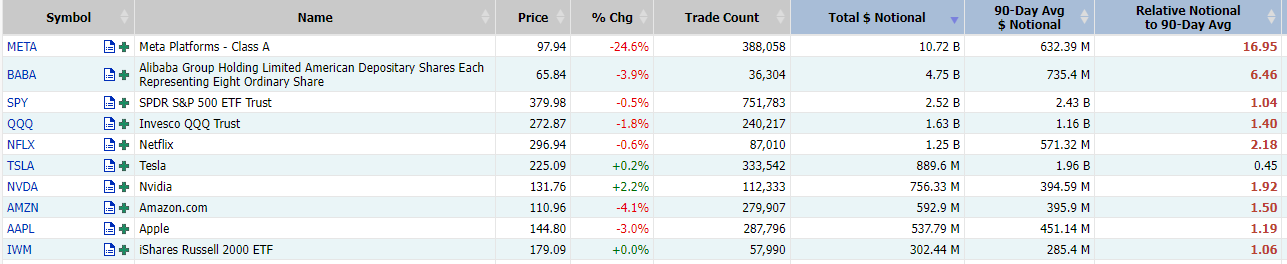

二、總成交量前10

美股週四收盤漲跌不一,標普500指數與納指均錄得連續第二個交易日下跌。截至收盤,納斯達克指數跌幅爲1.63%;道瓊斯指數漲幅爲0.61%;標普500指數跌幅爲0.61%。大型科技股全線收跌,Meta暴跌24.5%,亞馬遜跌超4%,蘋果跌超3%。此外,盤後公佈業績後,亞馬遜一度大跌21%,蘋果一度跌超5%;熱門中概股集體下行,嗶哩嗶哩跌超9%,阿裏巴巴跌逾4%。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.