期權大單 | 科技股全部暴雷,Meta跌成“重災區”

uSMART盈立智投 10-27 16:44

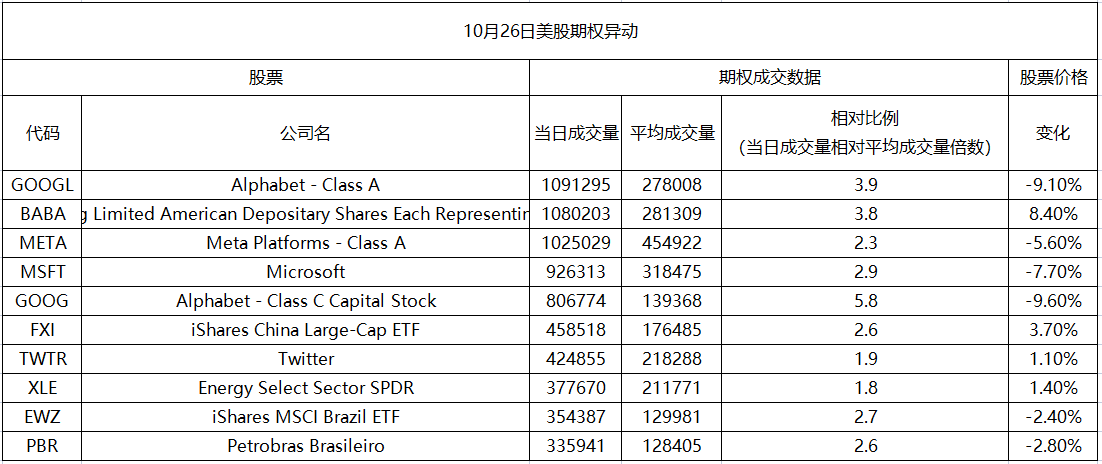

一、期權異動

10月26日,美股谷歌、阿裏巴巴、Meta等標的出現了期權成交量上的較大變化,分別爲日常成交量的3.9、3.8、2.3倍。

受財報暴雷影響,谷歌A週三大跌9%,報94.93美元。期權合約成交109.4萬張,看跌期權佔全部期權交易的47%。2022年10月28日到期行權價爲100美元的看漲期權的成交量特別高,成交量爲39,220張。這意味着在期權市場中,投資者押注該股在本週將會反彈。

Meta週三跌超5%,報129.82美元。期權合約成交104.6萬張,看漲期權佔全部期權交易的54%。查詢26日數據發現,Meta在十大看跌單隻股票排名也非常靠前。果不其然,Meta盤後發佈了財報:三季報全面遜於預期,指引不佳,元宇宙虧損擴大,預計支出大增。受此影響,Meta盤後更是暴跌超19%。

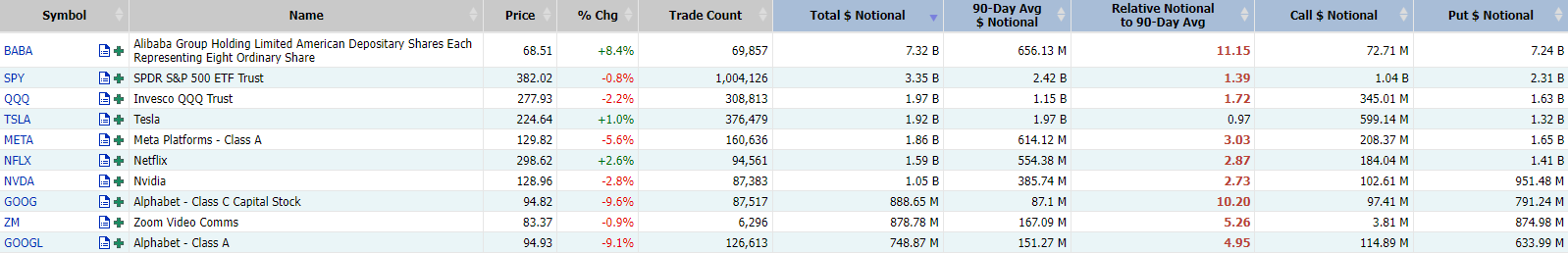

二、總成交量前10

科技股拖累標普500指數和納指雙雙下跌,結束了連續三天的上漲勢頭,道指勉強錄得上漲。Alphabet與微軟等科技巨頭財報欠佳,使市場擔心美國經濟衰退可能已經發生。高盛警告美股尚未觸底。投資者預計美聯儲鷹派立場可能軟化。截至收盤,納斯達克指數跌幅爲2.04%;道瓊斯指數漲幅爲0.01%;標普500指數跌幅爲0.74%。

大型科技股普遍下挫,谷歌跌超9%,創2020年3月以來單日最大跌幅;亞馬遜跌超4%,Meta跌超5%,盤後更是重挫19%,微軟跌超7%。英特爾旗下MobilEye美國IPO開盤首日收漲約38%,創2021年以來同等IPO規模的最大首日漲幅;熱門中概股逆市大漲,阿裏巴巴漲超8%,拼多多漲近12%。

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.