中金 | 港股政策加碼有助提振情緒

在十月到來前,海外中資股市場延續跌勢,已連續第五週整體下跌。10年美債利率大幅上升以及美元大幅升值引發全球範圍資產價格波動,也包括人民幣的走弱。人民幣兌美元週中一度突破7.2的2019年新低,進而影響了投資者風險偏好和資金流向。

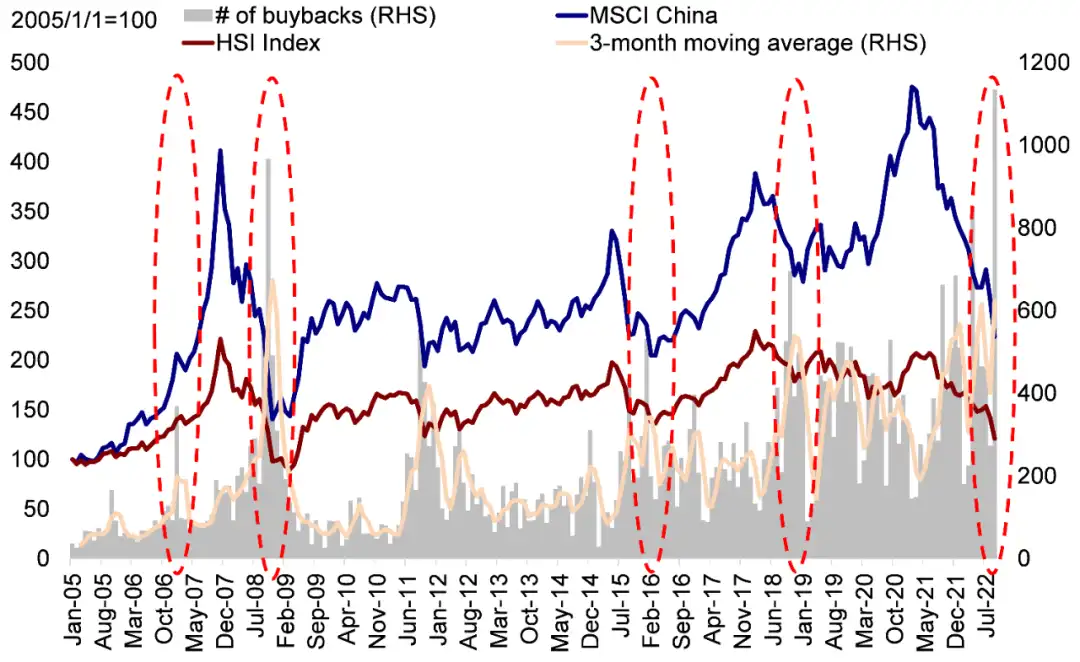

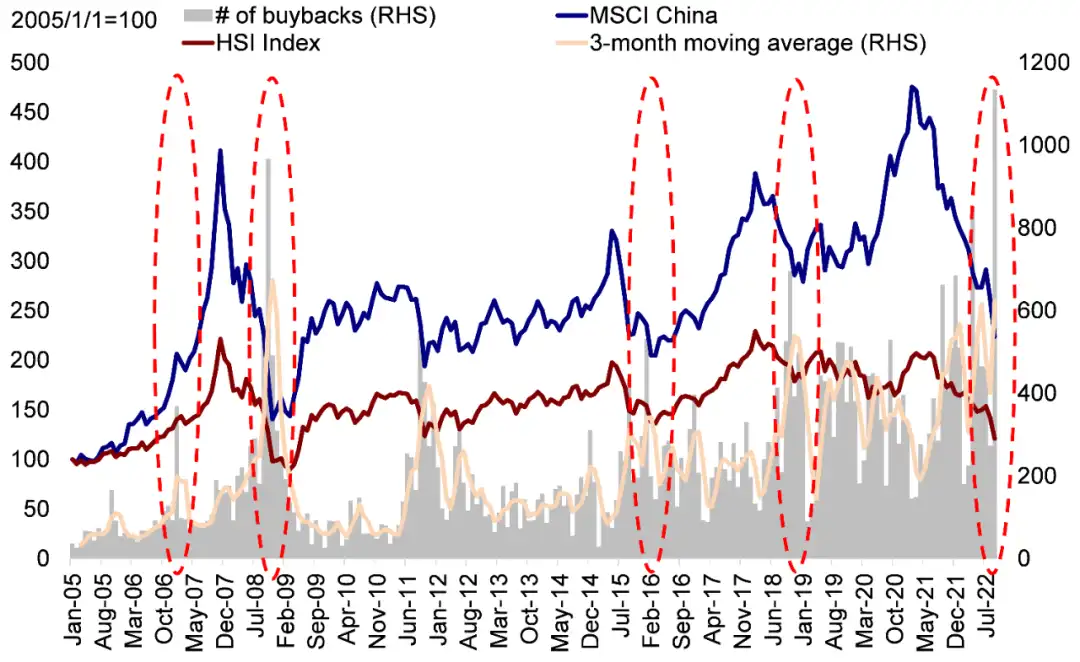

這一環境下,港股市場通常更容易受到外圍市場波動和人民幣貶值影響。因此,恆生指數在上週跌至2011年以來歷史低點,而恆生國企指數更是跌至2008年以來最低水平。不過值得一提的是,9月港股股票回購規模達到176億港元,刷新有史以來月度最高紀錄。歷史上來看,股票回購規模的大幅增長從中期來看通常是市場觸底的一個相對可靠依據。

外圍波動和全球金融條件收緊仍是上週海外中資股市場面臨的主要不利因素。在此前一週召開的FOMC 9月會議傳遞出美聯儲偏「鷹派」的政策立場後,美元匯率和10年期美債利率再度大幅走高。全球衰退憂慮和歐洲地緣政治局勢升級等外部不確定性可能仍然是整個4季度海外中資股市場面臨的主要波動源。

國內方面,近期公佈的經濟數據仍然表明有必要出臺進一步的穩增長政策提供支持。不過上週也不乏利好消息,其中包括多項重要政策以推動低迷的房地產市場修復。我們認爲這些政策措施顯現了政府在穩增長方面的意願和信號,有助於房地產市場逐步見底甚至溫和企穩。另外,隨着此前一週香港特區宣佈入境人員無需進行酒店強制隔離,我們預計赴港人數的大幅增長也有望推動香港旅遊和消費行業復甦。

往前看,隨着中國內地投資者本週迎來國慶長假,我們預計市場交投或將相對清淡,投資者可能等待會議的召開,並從中尋求更爲清晰的政策信號,因此未來幾周市場可能處於持續盤整中。在目前水平市場的上漲空間大於下跌風險。在此之前,以港元計價的高股息收益率個股對投資者而言可能是較好的選擇,可以提供下行保護和對衝人民幣貶值的負面影響。

另外,我們認爲優質成長個股(例如增長維持高景氣或者存在盈利反轉可能的板塊或標的)可能仍然是較好的選擇。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.