買特斯拉被套牢?期權幫你三年賺一倍

今年在美股持續弱勢、美聯儲不斷加息的情況下,股票行情極其震盪,不少投資者或多或少會有部分股票被套牢。股票虧錢後,投資者的選擇不只有等待,使用恰當的期權策略可以反敗爲勝。

適合當下市場狀況的期權策略叫Covered call,這種策略巴菲特和段永平都非常喜歡用,做法很簡單,在持有正股的時候賣空相應的看漲期權(call),也就是long stock + short call。

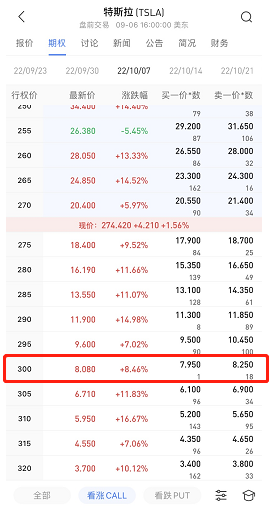

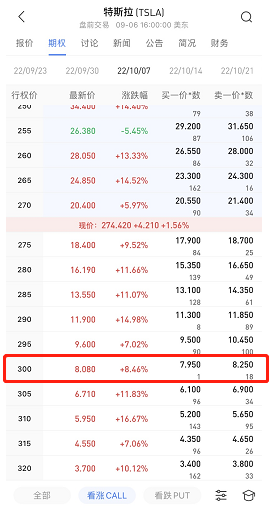

以特斯拉爲例,9月6日收盤,特斯拉每股價格爲274.42美元。投資者可以賣出一張目標價爲300美元,權利金爲808美元(每股爲8.08,一張合約包含100股),10月7日到期的看漲期權。

在到期日時有下列幾種情況:

1、到期日特斯拉股價在274-300美元區間

如果10月7日,特斯拉價格在300以下,期權合約順利到期,期權上投資者可以獲得808美元,除了期權帶來的利潤,股票帶來的利潤,投資者也可正常獲得,總收益爲股票收益加上期權收益。

短短一個月,不計特斯拉股票上的收益或虧損,期權上的回報率爲2.91%(持有100股成本爲274美元的特斯拉)。

假設在特斯拉股價不變,市場波動率不大幅變動的情況下,如果堅持每月賣出類似的看漲期權,堅持賣34.3個月,單靠期權可以賺回本來投資特斯拉的27400美元,收益率爲100%(實際操作中,需要每月股價波動,來選擇合適的期權,暴漲、暴跌情況下也需要進行策略調整)。

2、到期日特斯拉股價在300美金以上或者274美元以下

當到期日時,特斯拉的價格低於274美金,此時期權合約帶來的808美金仍可正常獲得。投資者在股票上因爲股價跌破成本274美元,需要承擔股票虧損。但相對於只買股票,期權的利潤可以給我們的股票虧損帶來一定的緩衝空間。

如果到期日時,特斯拉的價格高於300美金,比如爲310美元。此時期權合約的買方會要求行權。

因爲使用了期權策略,此時期權產生了淨虧損,每一百股股票,我們只能賺取2,508美元。股價漲超過盈虧平衡點308.8美元(目標價+每股權利金)的部分即爲期權帶來的淨虧損。在我們沒有賣出期權的情況下,漲到310美元,每一百股股票,我們能賺取2700美元(股價上漲收益+權利金)。

Covered call策略適合投資者認爲"長期看好持倉股票,不想賣出手上的股票,預期最近股票股價不會暴漲或暴跌"時使用。長期賣出合適的看漲期權,可以爲股票持倉帶來豐厚的收益,但要處理好股票暴漲時,期權對利潤限制的危害。

當股價在行權價以上,那麼股票隨時都有可能被對方行權買走。如果持有的股票是自己特別喜歡的股票,此時就可能會失去股票。當然,如果不想失去股票,也可以選擇把call買回來平倉。還可以在對方行權買走自己的股票之後,立刻從市場上買回來。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.