對衝基金將再度狙擊美股!

在2022年的大部分時間裏,專業投機者在空頭和多頭方面都進行了積極的股票投注,高盛的客戶名義交易量升至1年新高,而大摩和瑞銀警告稱未來幾周將有更多CTA策略基金賣出。

高盛的主要經紀商數據顯示,對衝基金連續幾周增加了風險敞口,包括減持指數期貨等宏觀產品,同時增持個別公司的股票。按名義交易量計算,這是高盛在一年中最繁忙的一週。大摩也出現了同樣的趨勢,對衝基金客戶增持了科技和醫療保健等領域的股票,同時增加了針對交易所交易基金的空頭。

這些數據表明,資金管理人既熱衷於撿便宜,又對更廣泛的市場方向感到擔憂。至少有兩家華爾街公司警告稱,對衝基金預計將在未來幾周拋售數十億股票。

高盛分析師Vincent Lin認爲:"最新的舉動表明,基金經理越來越願意在微觀/獨特的情況下發動進攻,同時利用ETF/指數工具對衝β風險。"

本週二標普500指數在七天內第六次下跌。該指數徘徊在3,900點之上,這一水平在5月中旬曾作爲支撐,並在6月和7月短暫地作爲上行阻力。專家警告稱,如果跌破該門檻,將出現更多的賣盤。

美聯儲正在加強其鷹派立場,歐洲的能源危機正在肆虐,除了美國企業和一直在購買最新跌勢的日間交易商之外,風險投資已經變得尤爲匱乏。在過去的幾周裏,標普500指數已經回吐了於夏季復甦的一半以上的收益。根據大摩交易臺的數據,商品交易顧問等趨勢追隨者本週準備拋售300億美元的股票。瑞銀的另一項估計顯示,這一數額的拋售將在未來兩週發生。

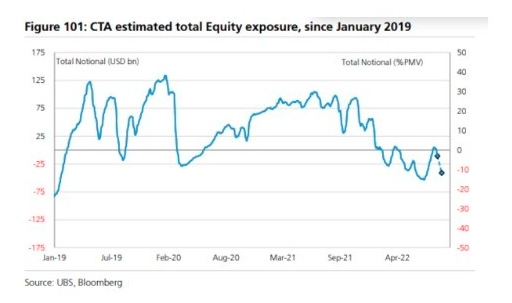

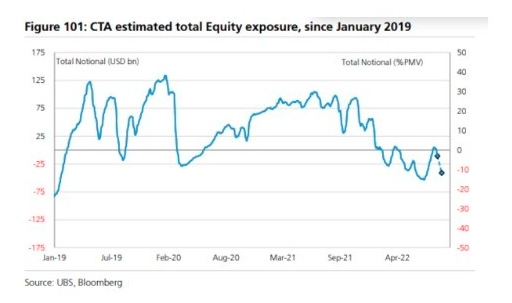

瑞銀估計,擁有3750億美元資產的對衝基金對市場產生了巨大影響,因爲在極端波動的一年裏,快錢正衝進又衝出股市。在標普500指數五十年來最糟糕的上半年,他們通過提高看跌的賭注使市場下跌;當股票從6月的谷底回升時,又大量解除空頭頭寸,促成了標普500指數今年的最大反彈。

瑞銀策略師Nicolas Le Roux指出:"CTA在7月/8月減少/關閉了對風險資產的空頭頭寸,但我們的模型預計他們將在9月再次轉爲看跌。最近美股的回調可能會在未來兩週面對一些來自CTA的賣壓。"

與量化交易員一樣,選股型對衝基金今年也削減了股票定位。高盛數據顯示,多頭/空頭對衝基金的淨槓桿(衡量該行業風險偏好的標準)考慮到了多頭與空頭的押注,在過去三年裏有98%的時間處於落後狀態。根據小摩的主要經紀人數據,自2017年以來,客戶的槓桿率一直處於底部1%的水平,這種謹慎的定位是對衝基金今年表現優於市場的原因之一。

然而,在小摩分析師John Schlegel看來,"如果我們正在走向更實質性的市場下跌/最終衰退,那麼定位可能有進一步跌破6月中旬低點的空間,CTA可能會進一步做空股票。"

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements. Any calculations or images in the article are for illustrative purposes only.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance. Please carefully consider your personal risk tolerance, and consult independent professional advice if necessary.