北水總結

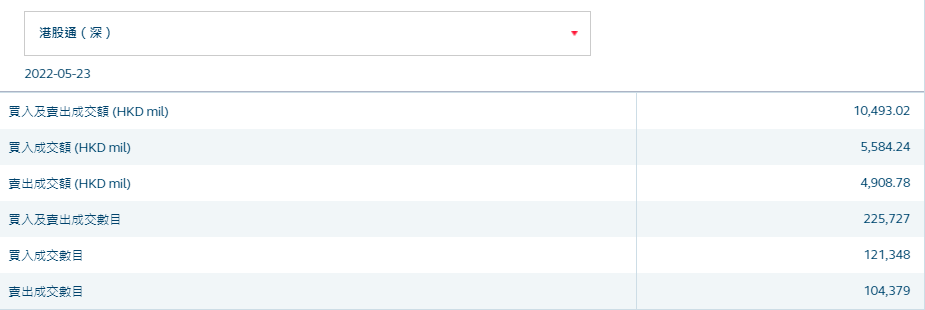

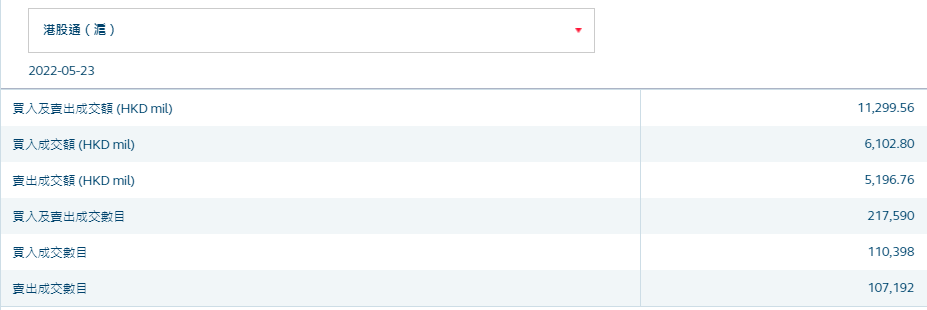

5月23日港股市場,北水成交淨買入15.81億,其中港股通(滬)成交淨買入9.06億港元,港股通(深)成交淨買入6.75億港元。

北水淨買入最多的個股是比亞迪股份(01211)、中海油(00883)、藥明生物(02269)。北水淨賣出最多的個股是騰訊(00700)、建設銀行(00939)、中芯國際(00981)。

數據來源:盈立智投APP

十大成交活躍股

數據來源:港交所

個股點評

比亞迪股份(01211)獲淨買入4.18億港元。消息面上。5月20日,比亞迪發佈CTB(電池車身一體化)技術及首款搭載CTB技術的產品“海豹”。瑞信表示,公司電池技術升級至CTB,進一步將電池集成到車身中,電池組的頂蓋構成車身的地板。這種融合簡化了車身結構和生產工藝,從而降低成本,提高安全性和更大的車輛空間。作爲比亞迪首款採用CTB技術的產品,預計“海豹”爲比亞迪的產品組合和利潤率將做出積極貢獻。

中海油(00883)再獲淨買入3.15億港元。消息面上,申萬宏源研報指出,受供需基本面以及地緣政治因素影響,國際油價持續走高,今年一季度布倫特原油現貨平均價格爲102.23美元/桶,同比上漲67.3%。中長期來看,全球供需的再平衡取決於OPEC和美國頁巖油。然而無論是從增產能力還是增產意願來看,供應端的增量都相對有限,中長期油價有望高位運行。

藥明生物(02269)獲淨買入2.22億港元。消息面上,針對近日“Vir公司與藥明生物終止協議”傳聞,藥明生物CEO陳智勝迴應稱:藥明生物當前退回了Vir新冠中和抗體的大中華區權益,但Vir所有CDMO項目沒有任何變化,還繼續在公司研發和生產;2020年新冠疫情爆發之時,藥明生物鑑於企業社會責任感,和Vir合作並獲得Vir新冠中和抗體的大中華區權益;目前,新冠疫情已經基本控制,所以公司退回了相關權益。

李寧(02331)獲淨買入2.14億港元。消息面上,大摩近日表示,雖然公司加大折扣,庫存堆積如山,但情況似乎可控。除非再次爆發重大疫情,否則需求應會恢復。該行指出,體育用品經銷商的經營壓力有所緩解,只要沒有再次爆發重大疫情,相信李寧及滔搏的股價將徘徊在3月15日的低位之上。該行認爲,李寧屬當中最安全復甦概念股,因其於目前低迷情況下擁有強勁的品牌動力及良好的庫存結構。

中國神華(01088)獲淨買入1.48億港元。消息面上,近日,國家發展改革委價格司組織重點煤炭和電力企業等召開專題會議,就如何界定動力煤等重點問題進行交流研討。國泰君安表示,此前市場預期爲,發改委對除了煉焦煤以外的長協煤/市場煤均進行限價,此次政策明確化工煤及高熱值煤不在限價範圍之內,限價範圍較市場預期有所收窄。政策主要針對於電煤尤其長協電煤的監管,而2021年已允許電價上調,煤炭電力企業盈利空間提升,政策管控下煤炭將長期維持高盈利。

騰訊(00700)遭淨賣出4億港元。消息面上,瑞信發表報告指,騰訊今年首季收入按年持平於1,360億元,較預期低4%,其中遊戲及雲業務表現均遜預期。至於經調整純利爲255億元,按年下跌23%,同樣低於預期。展望未來,該行稱集團遊戲業務中的本地遊戲趨穩,而海外遊戲則料可受惠於匯兌因素,預期今年業務可錄低單位數增長。至於廣告業務估計仍受到宏觀挑戰,及廣告商削減銷售和推廣開支影響。瑞信調低集團今明兩年每股盈測分別9%及10%。該行預期,騰訊盈利前景疲弱將拖累其股價表現。

此外,中國移動(00941)、快手-W(01024)、中國電信(00728)分別獲淨買入2.15億、9991萬、5043萬港元。而建設銀行(00939)、中芯國際(00981)、長城汽車(02333)分別遭淨賣出6541萬、3455萬、867萬港元。

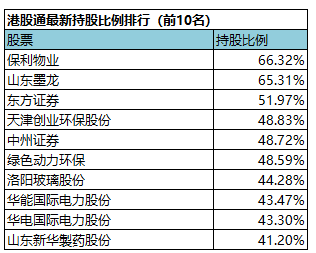

港股通最新持股比例排行

(港股通持股比例排行,交易所數據T+2日結算)