小摩由空翻多僅用兩個月

uSMART盈立智投 05-16 21:38

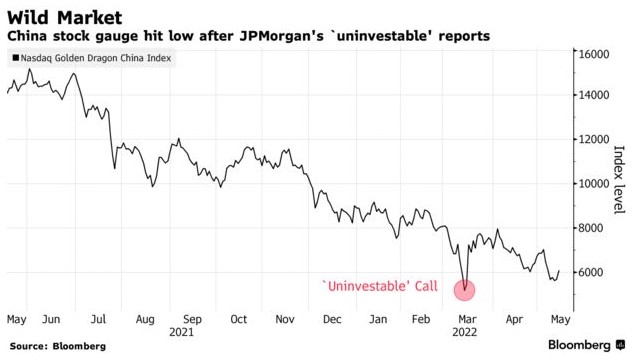

摩根大通今日集體上調阿裏巴巴(BABA.US)、騰訊(00700)、百度(BIDU.US)、美團(03690)等中國互聯網巨頭評級及目標價,而在3月14日摩根大通曾大幅下調以上股票目標價,該行稱這是這類股票“不可投資”一事的最新反轉。

在摩根大通3月份發佈報告的當天,納斯達克金龍中國指數觸及年內收盤低點。

小摩表示,該行在3月份的悲觀看法反映了一個三階段週期的第一個階段。該行分析師認爲第二階段——拋售減少、股價企穩——的到來早於預期。他們補充稱,風險偏好可能仍很低,成長型股票可能難以跑贏大盤。

摩根大通的分析師Andre Chang和Alex Yao指出,在最近的監管聲明的支持下,中國互聯網行業面臨的“重大不確定性”正在減弱。分析師預計,數字娛樂、本地服務和電子商務等“早期週期行業”將成爲“首批表現優異的行業”。該行表示,旅遊和廣告等週期較晚的垂直行業回升應該比周期較早的垂直行業滯後兩個季度。

以下是小摩對中國互聯網公司的最新評級及目標價:

Follow us

Find us on Facebook, Twitter , Instagram, and YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.