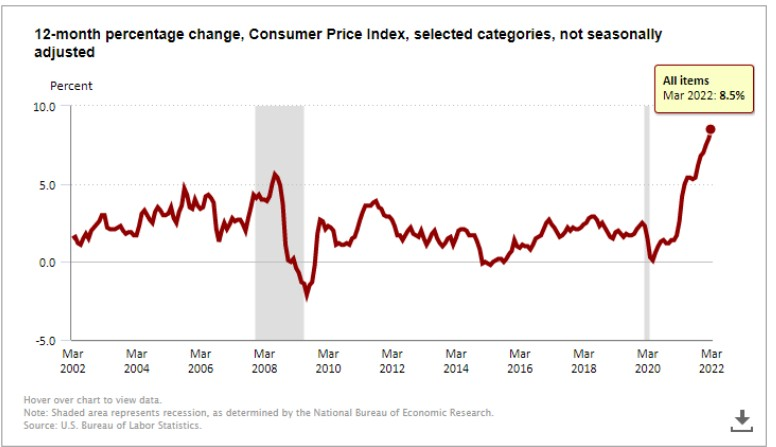

The rapid rise in US inflation is prompting the Federal Reserve to deleverage its $8.9 trillion balance sheet while sharply raising its benchmark interest rate to curb inflation, and economic data such as superimposed labor participation rates are lower than expected. there is still uncertainty about when US inflation will peak, and the market is beginning to worry about the possibility of stagflation or even recession in the United States. Under this pessimistic expectation, the three major indexes of US stocks are deep in the pullback area and may even enter a bear market.

The US CPI data to be released this week will be the focus of public attention. In short, if inflation continues to accelerate faster than expected, the market may put pressure on the Fed to raise interest rates sharply, while the easing of price pressure means that the Fed maintains a normal pace of interest rate hiking. and maintaining this neutral interest rate in the range of 2.50-3.00% by the end of 2022 may be sufficient, and US stocks may face a substantial reversal.

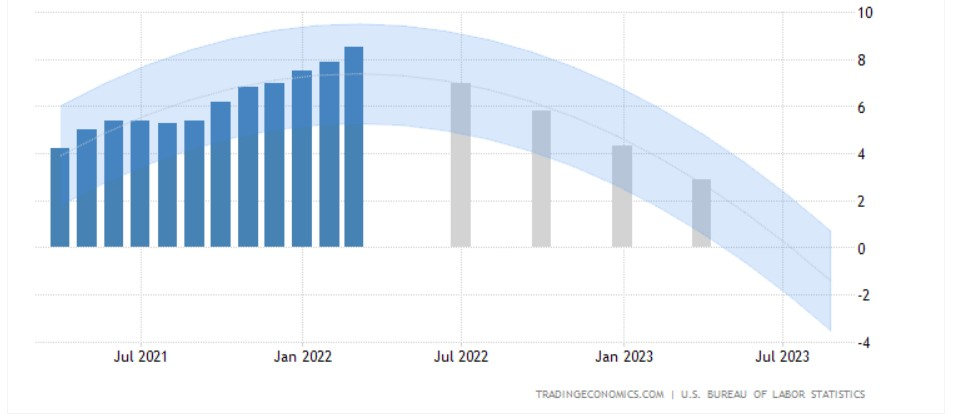

The April CPI data will be officially released before the opening of US stocks on Wednesday, and economists generally expect the US CPI data to fall to 8.1 per cent in April from 8.5 per cent last month. If in line with this expectation, it would be the first most market-significant decline in CPI since the COVID-19 epidemic in 2020. Trading Economics forecasts show that the March CPI data released in April will be the peak of inflation, and the CPI released in July is expected to fall to 7 per cent.

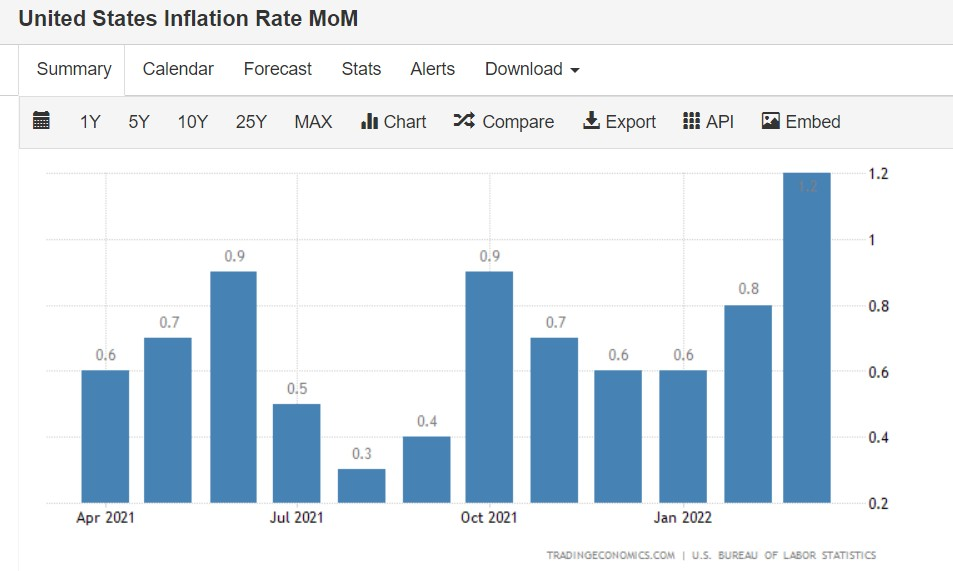

Chuck Jones, a senior analyst at Forbes, said that to meet the 8.1 per cent forecast, its monthly inflation figure (month-to-month) would have to fall from 2.3 per cent in January, 2.6 per cent in February and 3.8 per cent in March to no more than 1.25 per cent.

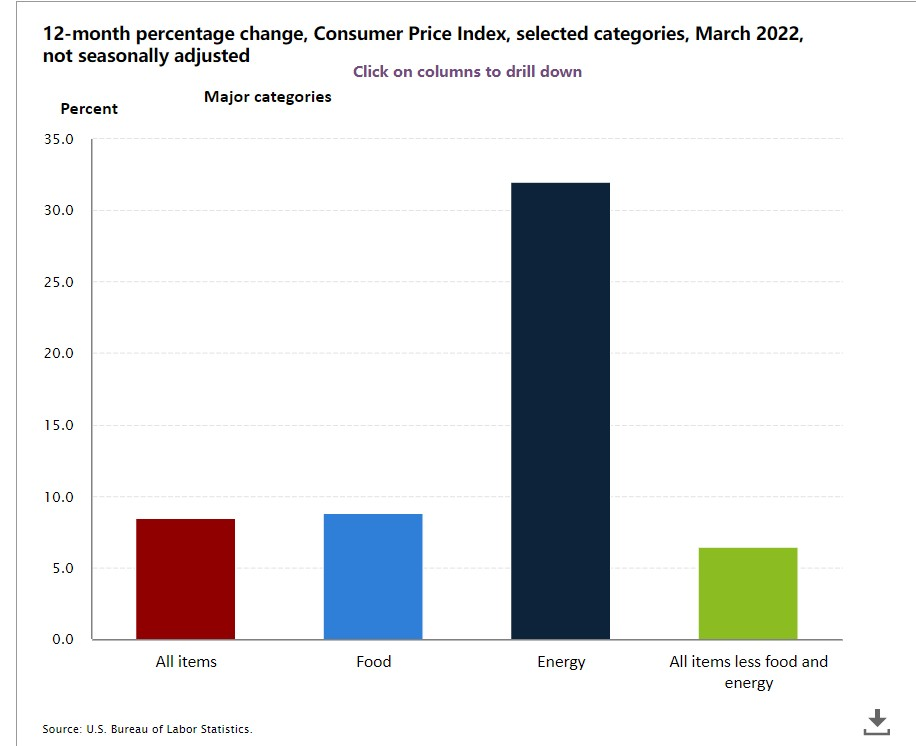

Overall energy prices rose about 32 per cent in March from a year earlier, according to the data. Jones expects gasoline and diesel grades to be roughly the same or even slightly lower in April compared with March, which will help drive down inflation, as they account for about 4 per cent of the weight of CPI data, yet they rose 48.2 per cent year-on-year in March. It is important to note, however, that natural gas prices are likely to rise sharply in April from a year earlier, which may partly offset slower increases in gasoline and diesel prices.

Therefore, in terms of CPI composition, oil and diesel prices flattened month-on-month or contributed to inflation in line with expectations, while natural gas prices will be the most difficult to predict. Food prices are likely to continue to rise against a backdrop of rising production, labour and transport costs. In addition, the labor shortage, and the consequent upward pressure on wages, is likely to be the focus of the market in the coming months.

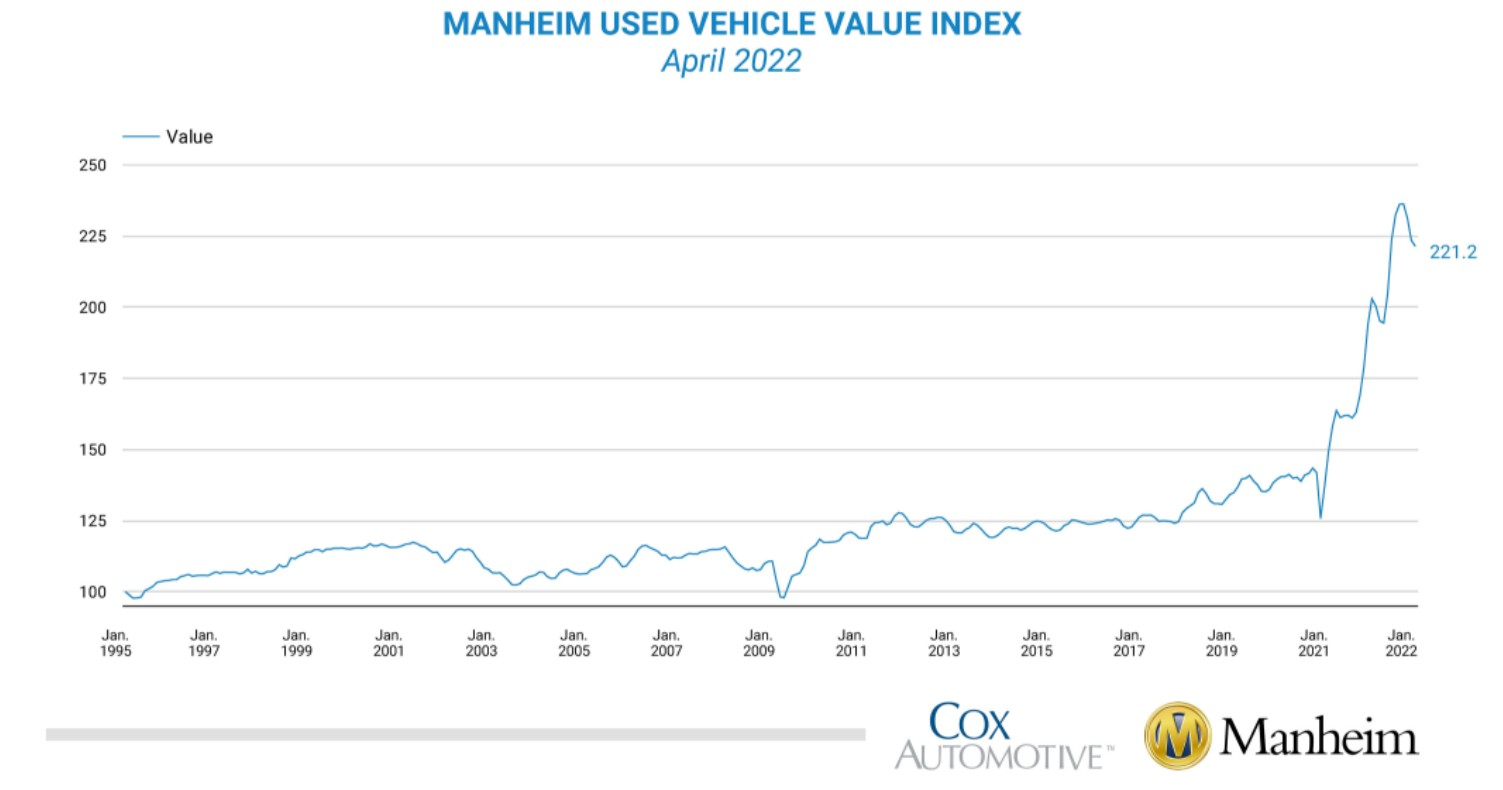

Most analysts say that with the exception of more volatile food and energy prices, there is a high probability that the price of used cars has peaked and that a fall in this category alone could cause the overall CPI index to fall by nearly 0.4 per cent. Manheim statistics of used car price forecast data show that used car prices will reach an important inflection point of decline.

Michael Pierce, a senior US economist at Capital Economics, once wrote in a report:

While we expect 8.5 per cent year-on-year growth in March to be the peak of CPI, CPI will remain uncomfortably high and then begin to fall more significantly in the second half of the year. We expect gasoline prices to fall less sharply in April, partly offset by the surge in natural gas prices, which will further push up electricity and utility prices. "

Which range will CPI fall into before the end of the year?

Is it possible that inflation will reach 3% in December? Chuck Jones, a senior analyst at Forbes, said that to reach this figure, it would require that prices remain flat for the rest of the year. In the past six months, inflation has risen sharply from 5.4 per cent to 8.5 per cent, up from 2.6 per cent a year ago (March 2021). From October to December last year, the value of CPI showed a downward trend for 3 consecutive months, while an upward trend from January to March.

Analyst Chuck Jones has built a mathematical model to calculate future Treasury yields, but the analyst says the model can also predict future inflation. According to the forecast data provided by Jones, if CPI does not show month-on-month growth for the rest of this year, the annual rate of CPI in December will reach 3.1%. The following is the annual rate of inflation forecast by Chuck Jones for the rest of the year (CPI does not show a growth trend).

However, Jones says the reality is that a quarter-on-month CPI is unlikely to be static for the rest of the year. As mentioned earlier, to bring inflation down to about 3 per cent, or a range of 3 to 4 per cent, the prices of various commodities such as gasoline, diesel, natural gas and used cars need to fall. Fortunately, Jones says, the price of used cars may have peaked.

The Capital Economics now expects inflation to be just below 4 per cent by the end of the year. Andrew Hunter, another senior US economist at Capital Economics, wrote:

"We don't expect CPI to fall to 3 per cent this year and may be slightly less than 4 per cent by the end of the year. Because we expect some important categories to start to decline for the rest of the year-energy and second-hand prices. In addition, price growth in other categories will slow as supply chains and labour shortages ease. "

According to Trading Economics, a well-known statistics and forecasting platform, US inflation will be around 1.9 per cent in 2023, which will bring inflation back to the Fed's target level. The platform commented:

According to Trading Economics's global macro model and a summary of analysts' expectations, US inflation is expected to reach 7 per cent by July. According to our econometric model, in the long run, inflation in the United States is expected to be around 1.9% by 2023. "

What are consumer inflation expectations?

Consumer inflation expectations have fallen from record highs, according to the latest survey data released by the New York Fed on Monday. Us consumer inflation expectations for the coming year fell in April, but perceptions of medium-term inflation and household spending expectations climbed to record highs, according to the latest data.

The latest survey data is bad news for the Fed, which is trying to stabilize consumer inflation expectations, and Fed officials may have underestimated consumers' pessimistic expectations about future spending pressures.

Median US consumer expectations for inflation in the coming year fell 0.3 percentage points to 6.3 per cent in April from the previous month, while three-year inflation expectations rose 0.2 percentage points to 3.9 per cent, according to survey data. Consumers still expect the high cost of living to persist. In the survey, consumers expect household spending to grow by 8% next year, an increase of 0.3 percentage points from a month ago.

According to the latest survey data from the University of Michigan, consumer expectations for one-year inflation remained at 5.4% in April, the same as in March and still at the highest level since 1981, while five-year inflation expectations were 3%. It was also the same as March's statistics.