透视港股通丨油价重挫 内资抛售中海油

北水总结

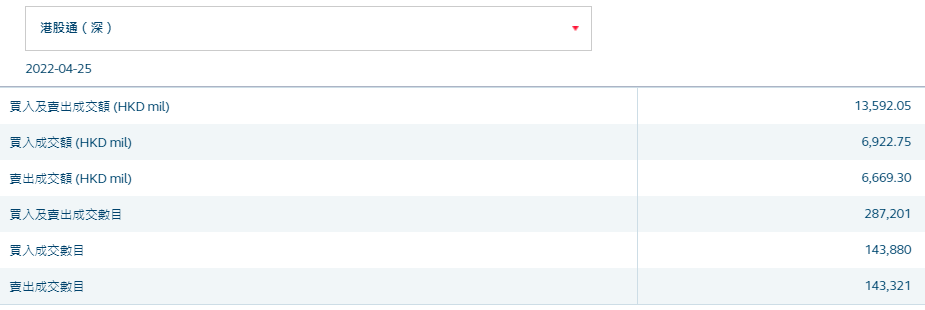

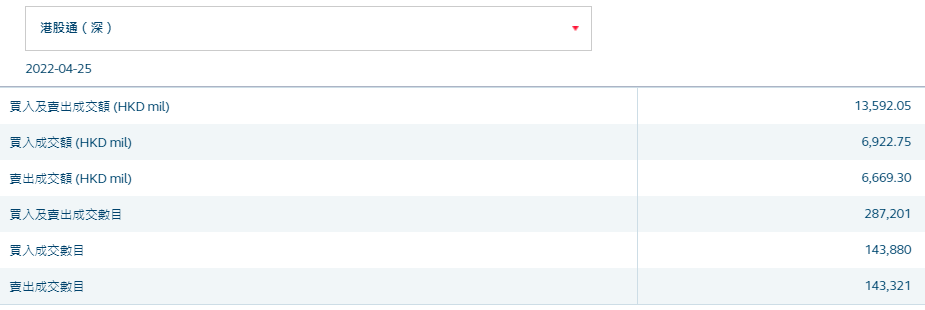

4月25日港股市场,北水成交净卖出2.97亿,其中港股通(沪)成交净卖出5.5亿港元,港股通(深)成交净买入2.53亿港元。

北水净买入最多的个股是美团-W(03690)、安踏体育(02020)、李宁(02331)。北水净卖出最多的个股是中海油(00883)、建设银行(00939)、腾讯(00700)。

数据来源:盈立智投APP

十大成交活跃股

数据来源:港交所

个股点评

美团-W(03690)获净买入6.28亿港元。消息面上,招商证券国际发布研报称,该然维持看好互联网行业今年下半年的前景,并预计行业基本面将在三季度迎来拐点。在近期的强劲逆风下,该行认为投资人应选择受到逆风影响较小、基本面坚挺、现金流较强的防御性标的,并在下半年逆风出现明显缓解后再考虑配置大幅低估的标的。值得注意的是,美团盘后发布公告称,建议授出一般授权以发行股份及购回股份﹑使适当时候更具灵活性地购回股份,购回股份最多为通过该决议案日期已发行股份总数的10%。

体育用品股继续受内资追捧,安踏体育(02020)、李宁(02331)分别获净买入3.25亿、2.11亿港元。消息面上,申万宏源发布研报称,疫情持续扰动线下零售,运动服饰表现相对更优。安踏品牌Q1流水增长10%-20%高段,Fila同增中单位数,比音勒芬、报喜鸟Q1业绩均领跑服装大盘、二季度虽受疫情及高基数双重压力,但行业中长期向好趋势不变,继续看好运动服饰高景气赛道。

招商银行(03968)获净买入1.85亿港元。消息面上,大和发表研究报告指,招商银行首季业绩非常强劲,整体财富管理业务收入按年持平,存款增长及净息差具韧性,在管理层变动方面,认为招行形成了完善的公司治理和业务营运机构,以实现长远发展,因此,招行凭借既定优势和持续创新,能够保持行业领先地位,该行认为招行已被过度抛售,维持其“买入”评级,目标价下调至65港元。值得一提的是,同属内银股的建设银行(00939)遭净卖出3.06亿港元。

药明生物(02269)遭净卖出8303万港元。消息面上,海外一线药厂新冠疫苗收入预期迎挑战,海外分析师调整辉瑞预期成为板块调整的重要事件。强生表示,由于全球供应过剩和需求不确定性,暂时不再提供新冠疫苗销售指引。而Cantor预计,2022年Q1,辉瑞Comirnaty的销售额大约只有10亿美元左右,与早前预期的20亿美元减半。

腾讯(00700)再遭净卖出2.36亿港元。消息面上,伽马数据发布《2022年1—3月游戏产业报告》。报告显示,2022Q1,中国游戏市场实际销售收入794.74亿元,环比增长10.08%,同比增长3.17%,低于2021年同期的同比增长率。2022Q1,中国移动游戏市场实际销售收入604.32亿元,环比增长9.28%,同比增长2.72%,低于2021年同期的同比增长率。

中海油(00883)遭净卖出6.08亿港元。消息面上,大摩近日发布研报,将今年的石油需求增长预期从每天340万桶下调至每天270万桶。在短期内,市场正在应对经济增长的低迷和美国大量释放石油战略储备的影响。还有业内人士表示,4月份中国对汽油、柴油和航空燃料的需求,预计将比去年同期下降20%,意味着每天减少约120万桶原油消费量。国际油价今日重挫,布伦特原油日内跌幅达5.0%,报100.84美元/桶;WTI原油日内跌幅达5.0%,报96.95美元/桶。

此外,快手-W(01024)获净买入1.11亿港元。而中国移动(00941)、中国电信(00728)、开拓药业-B(09939)分别遭净卖出2.23亿、2.03亿、1316万港元。

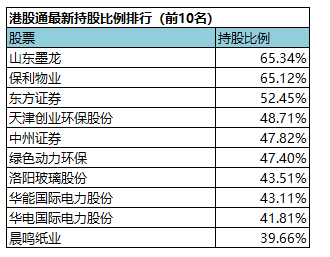

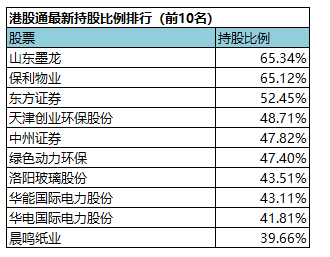

港股通最新持股比例排行

(港股通持股比例排行,交易所数据T+2日结算)

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.