北水總結

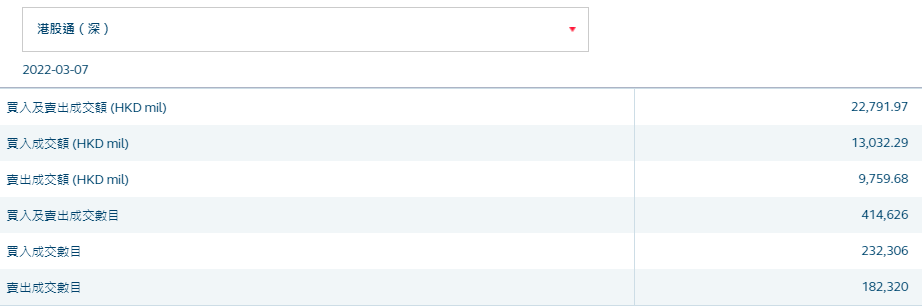

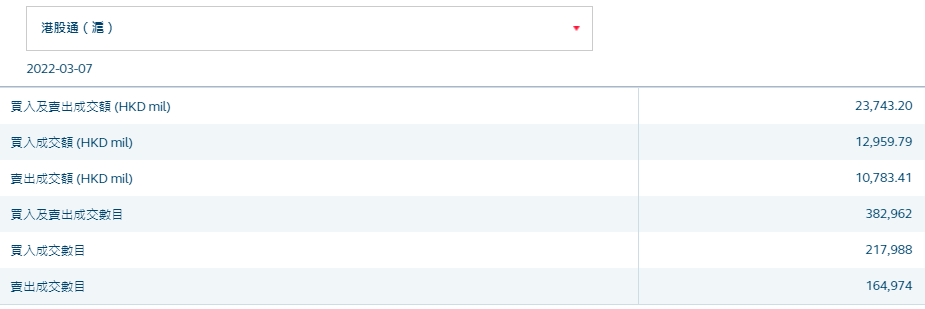

3月7日港股市場,北水成交淨買入54.49億,其中港股通(滬)成交淨買入21.76億港元,港股通(深)成交淨買入32.73億港元。

北水淨買入最多的個股是騰訊(00700)、美團-W(03690)、快手-W(01024)。北水淨賣出最多的個股是中海油(00883)、藥明生物(02269)、中國神華(01088)。

數據來源:盈立智投APP

十大成交活躍股

數據來源:港交所

個股點評

科網股繼續受內資追捧,騰訊(00700)、美團-W(03690)、快手-W(01024)分別獲淨買入20.09億、11.16億、4.98億港元。消息面上,國信證券近日發佈研報稱,互聯網行業的監管方向未變,但邊際有所改善。我們對全年互聯網行業表現觀點不變,政策邊際放鬆+業績改善,板塊有望實現反彈。3月互聯網行業即將密集發佈2021年年報,我們建議優先佈局年報業績優秀的互聯網龍頭公司快手、網易。同時,騰訊估值已處於歷史低位,爲隱含衆多優質向上期權的核心資產,建議逢低佈局。

保利協鑫能源(03800)獲淨買入3.98億港元。消息面上,保利協鑫能源近日表示,公司旗下江蘇中能兩萬噸FBR顆粒硅模塊化項目全部裝置均已進入生產狀態,標誌着公司顆粒硅年有效產能正式實現並達到三萬噸。保利協鑫相關負責人表示,預計今年底所有硅料產能將達到36萬噸。

中移動(00941)獲淨買入3.81億港元。消息面上,大摩此前表示,重申三家中資電訊營運商“增持”評級,2022年預測市盈率6.5-8倍,股息率7-9釐,屬吸引水平。瑞信則表示,預計中移動去年第四季收入及淨利潤將增長近5%,EBITDA料增長9.5%,收入及盈利預測略高於市場預期2%及4%,維持對公司“跑贏大市”評級,目標價由84.9港元輕微上調至85.6港元。

碧桂園服務(06098)獲淨買入7318萬港元。消息面上,碧桂園與招商銀行簽署150億元《地產併購融資戰略合作協議》。根據協議,招商銀行將授予碧桂園150億元併購融資額度,專用於碧桂園的地產併購業務,業務品種包括但不限於併購貸款、併購基金、資產證券化、以及基於併購相關業務需求所衍生的創新類融資產品。

中國神華(01088)遭淨賣出8077萬港元。消息面上,國家發改委副主任胡祖才3月7日在國新辦新聞發佈會上表示,做好能源保供穩價工作,保障能源安全。重點是做好煤炭保供穩價工作。下一步我們將全面實施好這項重大改革,確保改革措施落地見效。完善煤炭產供儲銷體系,提升供需調節能力,保障產能合理充裕,強化市場預期管理,引導煤炭價格在合理區間運行,完善煤、電價格傳導機制,確保安全穩定供應。

中海油(00883)今日盤中一度漲超5%創近兩年新高,部分北水資金逢高出逃,全天淨賣出額達2.63億港元。消息面上,據央視新聞報道,美國國務卿布林肯3月6日表示,美國正在與歐洲盟友合作,共同研究禁止進口俄羅斯石油的可能性,以進一步懲罰"俄羅斯入侵烏克蘭"的行爲。美、布原油期貨今日開盤一度大漲10%,均突破130美元/桶。

此外,小米集團-W(01810)、中國海外發展(00688)、中芯國際(00981)分別獲淨買入4.01億、1.45億、6200萬港元。而藥明生物(02269)遭淨賣出2.59億港元。

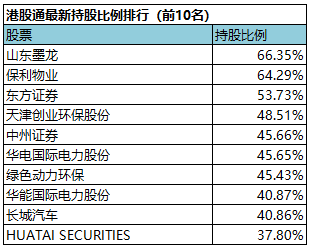

港股通最新持股比例排行

(港股通持股比例排行,交易所數據T+2日結算)