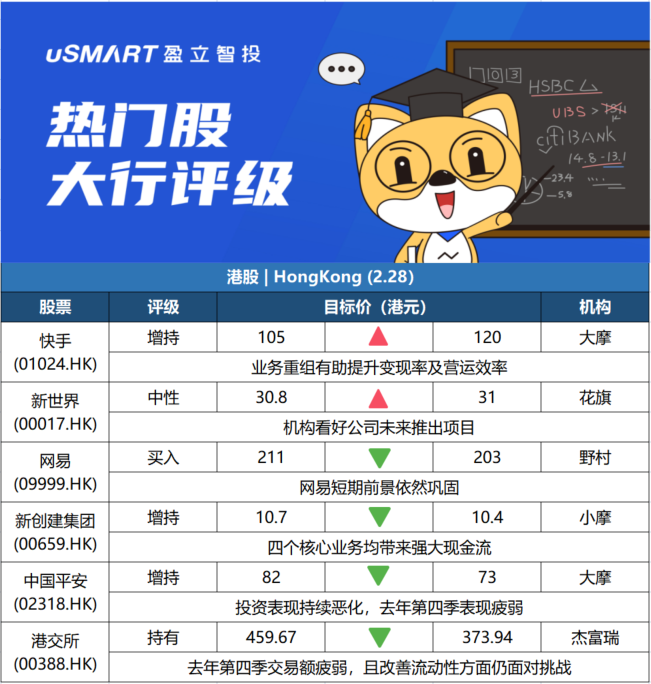

大行每日評級 | 短期前景然鞏固,野村予網易買入評級

摩根士丹利:升快手(01024.HK)評級至增持 目標價上調至120港元摩根士丹利發表研究報告指出,快手(01024.HK)過去六個月進行的業務重組,有助於提升變現率及營運效率,預期快手將繼續獲得更多市場份額,將投資評級提升至增持。快手股價年初至今累計上漲16%,反映出公司去年第四季及今年表現跑贏同業,預期2023年市場份額增長及盈利能力將繼續改善。該行又指認爲,市場對快手的預期已見底,預期下半年營運效率將提升,2022年至2023年收入前景向好。該行指,快手現價爲2022年及2023年預測市銷率的3.3倍及2.8倍,假設淨利潤率達到20%,預期2021至2023年收入年複合增長率達20%,估計中國市場業務今年第四季將可能實現盈虧平衡,將目標價由105港元上調至120港元。花旗:上調新世界(00017.HK)目標價至31港元 評級中性花旗發表報告指,新世界(00017.HK)未來於香港的住宅推出以啓德爲主,在該行對本港住宅前景看法負面下,預期集團的銷售會放緩,且毛利率低企。報告補充,更爲關注集團內地住宅業務(大灣區)會拖累估值,並認爲其負債率相對較高。不過,該行相信新世界未來推出的項目不錯,目標是於2021年至2025年的租金年均複合增長率約20%。花旗上調新世界股份目標價,由30.8港元輕微上調至31港元,評級維持中性,認爲集團承諾維持可持續的每股派息,與目前每股2.06元的派息水平相比,相信其超過6%的股息收益率可爲下行提供部分支持。

野村:下調網易(09999.HK)目標價203港元 評級買入野村發表報告指,網易(09999.HK)公佈另一穩健的季度業績,去年第四季線上遊戲收入按年上升30%,盈利按年增3倍,主要是受到低基數效應及穩固的遊戲收入增長所推動。該行維持對網易股份「買入」評級,目標價由211港元降至203港元,相當今年預測市盈率19倍,並維持今年盈利預測大致不變。野村表示,網易爲近期首選,認爲在宏觀挑戰下,大部分互聯網同行的業務前景會在今年上半年惡化,但指網易短期前景然鞏固。

摩根大通:下調新創建集團(00659.HK)目標價至10.4港元 評級增持摩根大通發表研究報告,指新創建(00659.HK)業務組合的積極資本循環,令盈利質量顯着改善,槓桿比率下降至13%,同時新創建仍在積極尋找機會出售非核心資產,以擴大其經常性收益和現金流。摩通認爲,公司92%應佔經營盈利中來自四個核心業務,均帶來強大現金流,目前股息7.9%收益率獲得很好的支持,尤其是在管理層承諾可持續和增長的每股分派下,摩通維持新創建「增持」評級,目標價由10.7港元下調至10.4港元。

摩根士丹利:下調中國平安(02318.HK)目標價至73港元 評級增持摩根士丹利認爲,中國平安(02318.HK)去年第四季銷售及毛利疲弱持續,下調其2021財年新業務價值23%(此前料跌2%),主要是因爲產品組合改變,將新業務價值毛利下調2個百分點。由於投資表現持續惡化,加上平安銀行去年第四季表現疲弱,該行將中國平安的稅後營運溢利增長預測由12%減至6%。摩根士丹利將中國平安目標價由82港元調低至73港元,維持「增持」評級。

傑富瑞:下調港交所(00388.HK)目標價至373.94港元 評級持有傑富瑞發表報告指,港交所(00388.HK)去年利潤爲125億元,低於市場預測的129億元,主要是受到去年第四季交易額疲弱影響。該行表示,由於俄羅斯與烏克蘭衝突,港交所股價於2月24日下跌了5.4%,但相信對集團的長遠營運影響有限,較大的下行壓力反而可能來自跌至長期趨勢的日均成交額。另外,港交所在吸引優質企業/投資者以改善流動性方面仍面對挑戰。富瑞下調港交所股份目標價,由459.67港元降至373.94港元,評級維持持有,並因應日均成交額下跌而調低集團今明兩年盈利預測。

Follow us

Find us on

Facebook,

Twitter ,

Instagram, and

YouTube or frequent updates on all things investing.Have a financial topic you would like to discuss? Head over to the

uSMART Community to share your thoughts and insights about the market! Click the picture below to download and explore uSMART app!

Disclaimers

uSmart Securities Limited (“uSmart”) is based on its internal research and public third party information in preparation of this article. Although uSmart uses its best endeavours to ensure the content of this article is accurate, uSmart does not guarantee the accuracy, timeliness or completeness of the information of this article and is not responsible for any views/opinions/comments in this article. Opinions, forecasts and estimations reflect uSmart’s assessment as of the date of this article and are subject to change. uSmart has no obligation to notify you or anyone of any such changes. You must make independent analysis and judgment on any matters involved in this article. uSmart and any directors, officers, employees or agents of uSmart will not be liable for any loss or damage suffered by any person in reliance on any representation or omission in the content of this article. The content of this article is for reference only. It does not constitute an offer, solicitation, recommendation, opinion or guarantee of any securities, financial products or instruments.The content of the article is for reference only and does not constitute any offer, solicitation, recommendation, opinion or guarantee of any securities, virtual assets, financial products or instruments. Regulatory authorities may restrict the trading of virtual asset-related ETFs to only investors who meet specified requirements.

Investment involves risks and the value and income from securities may rise or fall. Past performance is not indicative of future performance.