今日市場短評

港股昨日大跌650點後,今日小幅反彈。盤中持續受半導體、電商股等拉昇,科指漲近2%,恆指曾漲近1%,隨後維持約百點漲幅。截至收盤,恆指收漲0.6%,終止三連跌。芯片股、教育股、醫藥股全天表現強勢,黃金股、煤炭股跌幅居前。個股方面,新股樂普生物略微收漲0.14%;美團曾帶動恆指上揚,收漲3.09%;正榮地產收漲8.22%,據悉已與央國企洽談項目股權轉讓;中國儒意收漲13.46%領跑短視頻概念股;俄鋁終止三連跌收漲13.04%;聯想集團績後收跌2.66%。

窩輪焦點

中芯國際(00981)

中芯認購證(18101)到期日:2022年4月槓桿:9.23倍

半導體板塊集體走強

消息面上,中芯國際發佈業績,2021年第四季度公司合併報表營業收入102.6億元(約16.2億美元),較上年同期增長53.8%,創歷史新高。第四季度營業利潤爲40.92億元,同比增長248.9%;歸屬於上市公司股東的淨利潤爲34.14億元,同比增長172.7%;歸屬於上市公司股東的扣除非經常性損益的淨利潤爲14.79億元,同比增長3553.6%。初步統計顯示,該公司去年全年總收入爲356.3億元、按年增長29%,淨利潤爲107.3億元、按年增長147.7%。

牛熊證焦點

美團(03690)

美團牛證(59089)到期日:2022年6月

回收價:165.88槓桿:10.55倍

官媒指引導外賣平臺減費不是命令

中國官媒《經濟日報》評論文章指出,內地近日14部門聯合出臺《關於促進服務業領域困難行業恢復發展的若幹政策》,43項紓困措施中,僅盯上「引導外賣等互聯網平臺企業進一步下調餐飲業商戶服務費標準」,反應有點過頭。此外,政策說的是「引導」,不是命令,旨在促進政府部門、大平臺、小商戶攜起手來,同舟共濟渡難關。 該評論文章指出,有關政策全文5,000多字,提及平臺經濟的僅有一兩句,其初衷不是要針對平臺經濟。事實上,在以中央財政、政府部門爲主體實施的紓困政策中,平臺企業成爲被寄予厚望的出力方,恰恰說明平臺企業在經濟社會中的重要地位得到認可,能聯動千千萬萬市場主體,未來大有可爲。下調服務費或會影響平臺經濟的估值邏輯,但不意味着平臺企業前景堪憂。眼下,困住服務業的不只是傭金、房租、人工等成本問題,還有消費意願不足的問題,而後者可能更關鍵。因爲當消費足夠強勁,商家就有能力化解各種成本,可如果人們不去消費,商家沒有收入,哪怕傭金從20%降到2%,商家還是撐不住。如果商家倒閉了,或者勉強支撐但收入很少,平臺定的傭金比例再高,也收不上來錢。從這個角度看,平臺企業與商戶、消費者的關係十分密切。

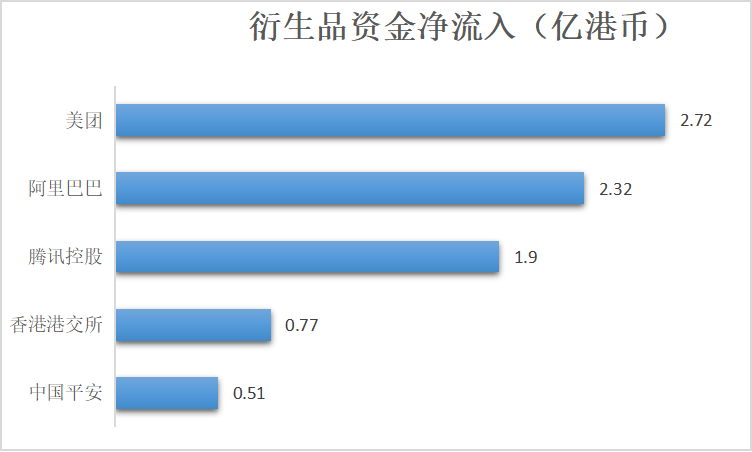

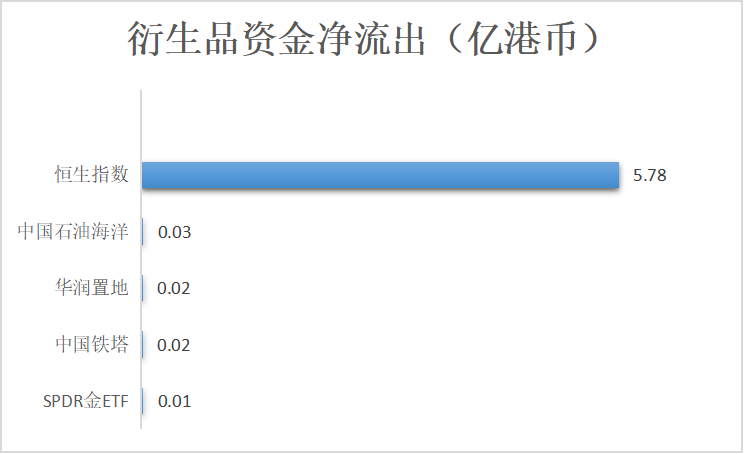

衍生品資金流入/流出